Praha – Vláda dnes schválila způsob financování stavby dvou nových jaderných bloků v Dukovanech. Stát od polostátní společnosti ČEZ převezme 80 procent podílu její dceřiné firmy Elektrárna Dukovany II, která má projekt na starosti. Finální dohodu s korejskou KHNP chce vláda podepsat za týden 7. května. Na tiskové konferenci po dnešním jednání vlády to uvedl premiér Petr Fiala (ODS).

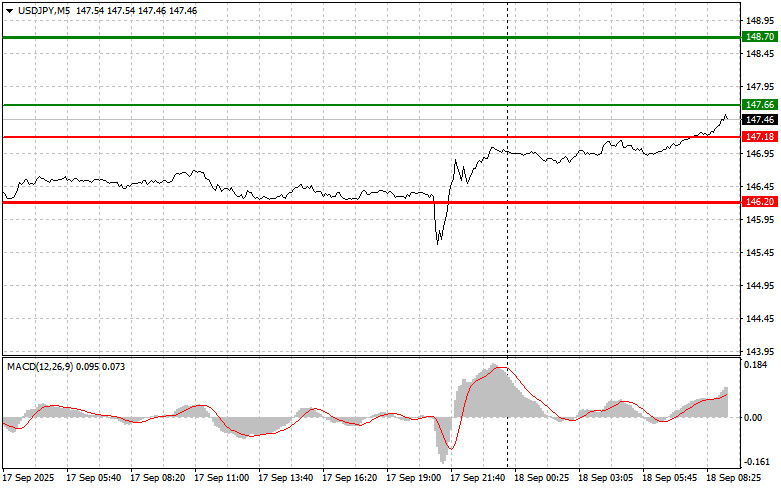

The test of 146.17 occurred when the MACD indicator had just started moving downward from the zero line, confirming the correct entry point for selling the dollar. As a result, the pair fell by more than 40 pips.

Yesterday's Fed decision to cut rates led to a temporary strengthening of the yen, but then demand for the dollar returned. The initial market reaction to the Fed's rate cut was predictable: the yen, traditionally seen as a safe-haven asset, strengthened. The key factor behind the subsequent reversal was the absence of clear signals from the Fed regarding future monetary policy. Traders hoping for stronger statements about continued easing did not receive them. In addition, Japan's own macroeconomic indicators and the Bank of Japan's policy continue to play an important role in yen dynamics.

This morning, a weak report on machinery and equipment orders was released. The figure dropped sharply by 4.6%, weakening the yen against the U.S. dollar. This came as an unpleasant surprise for Japan's economy, which is already facing difficulties such as stagnant domestic demand and increased competition from other Asian countries. Analysts attribute the decline in orders to several factors: global economic uncertainty due to trade wars and geopolitical risks, as well as weak domestic demand caused by declining consumer confidence.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today if the entry point around 147.66 (green line on the chart) is reached, targeting 148.70 (thicker green line). At 148.70, I intend to exit longs and immediately open shorts in the opposite direction, aiming for a 30–35 pip pullback. It is best to return to buying the pair on corrections and significant dips in USD/JPY. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY if the price tests 147.18 twice in a row while the MACD is in oversold territory. This will limit downside potential and trigger an upward reversal—expected targets: 147.66 and 148.70.

Scenario #1: I plan to sell USD/JPY only after breaking below 147.18 (red line on the chart), which should lead to a rapid decline. The key target for sellers will be 146.20, where I intend to exit shorts and immediately open longs in the opposite direction, aiming for a 20–25 pip rebound. It is always better to sell from higher levels. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY if the price tests 147.66 twice in a row while the MACD is in overbought territory. This will cap the upside potential and trigger a reversal downward—expected targets: 147.18 and 146.20.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

SZYBKIE LINKI