(Reuters) – Výrobce zdravotnického vybavení Revvity se v pondělí připojil k větším společnostem s varováním ohledně dopadu cel uvalených administrativou amerického prezidenta Donalda Trumpa, ale udržel svůj výhled ročního zisku.

Akcie společnosti, které letos dosud poklesly o 14,2 %, vzrostly v dopoledním obchodování o 1,8 %.

Revvity očekává, že cla uvalená na Čínu budou mít dopad ve výši 135 milionů dolarů, plánuje však úsporná opatření a očekává, že bude těžit ze slabšího dolaru, protože více než polovinu svých tržeb generuje mimo USA.

Plánuje také úpravy ve své výrobní struktuře a jedná s alternativními dodavateli.

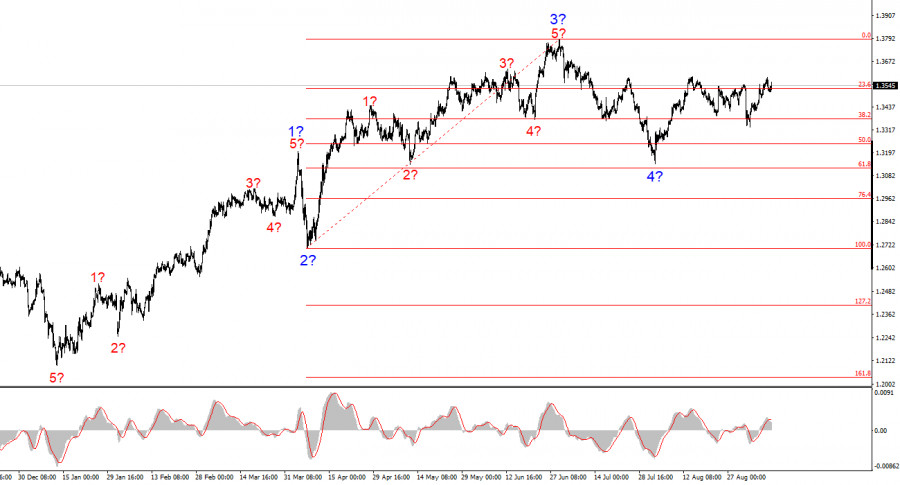

The wave pattern for GBP/USD continues to point to the formation of a bullish impulsive wave structure. The wave picture is almost identical to that of EUR/USD, since the only "culprit" remains the dollar. Demand for the dollar is falling across the market (in the medium term), which is why many instruments show almost the same dynamics. At this stage, wave 4 is likely complete. If so, the rise of the instrument will continue within the framework of impulsive wave 5. Wave 4 could take on a five-wave form, but this is not the most likely scenario.

It should be remembered that much on the currency market now depends on Donald Trump's policies—not only trade-related ones. From time to time, positive news comes from the U.S., but the market constantly factors in complete economic uncertainty, Trump's contradictory decisions and statements, and the White House's hostile and protectionist stance. Global tensions remain high, and the U.S. economy continues to face difficulties. The GBP/USD exchange rate fell by only 20 basis points on Tuesday, and on Wednesday gained the same 20 points. Yesterday, the key Nonfarm Payrolls report was released, which pleased absolutely no one—least of all the Fed. If the U.S. central bank under Jerome Powell was hoping for at least some positive signals from the labor market, that hope was in vain. The labor market continues to "cool," and how much longer it will do so under the pressure of Donald Trump's protectionist policies is unknown.

The wave pattern remains clear and does not allow for alternative scenarios. We saw a clear three-wave correction, after which an impulsive five-wave trend segment should follow.

Donald Trump continues to demand that the Fed cut interest rates, but Powell and his colleagues no longer have the option to resist Trump's calls, as they are bound to fulfill both of their mandates: full employment and price stability. The labor market is deteriorating month by month, forcing the regulator to resume a monetary easing cycle to stimulate job creation. Not because Trump wants it, but because the Fed has no other choice.

No matter how one views the news background, finding anything positive for the U.S. currency is extremely difficult. Based on this, I continue to expect higher GBP/USD quotes. I would remind readers that there are situations when the news background contradicts the wave picture. At present, however, everything aligns almost perfectly. The pound is rising slowly, but why should it—or its buyers—rush? The pound holds all the cards, while the dollar has only low-value ones. And since this is not a poker game, those cards bring no benefit to the U.S. currency.

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish impulsive trend segment. Under Donald Trump, the markets may face many more shocks and reversals that could significantly affect the wave picture, but for now the main scenario remains intact. The targets of the upward trend segment are now located near 1.4017. At present, I assume that the construction of corrective wave 2 within wave 5 has been completed. Therefore, I still recommend buying with a target of 1.4017.

Key principles of my analysis:

SZYBKIE LINKI