EUR/USD and GBP/USD instruments have been practically immobilized this week, with very few events that could change the current situation. One such event was the FOMC minutes released on Wednesday evening. Let me remind you: the Federal Reserve meeting minutes are documents containing information about the mood of Fed governors and the course of the meeting. As the latest minutes showed, only two governors voted for a rate cut — Christopher Waller and Michelle Bowman. I have already written about this "sweet couple" many times. Waller is still eyeing Jerome Powell's chair, while Michelle Bowman, appointed by Donald Trump, is very reluctant to follow the path of Adriana Kugler and Lisa Cook.

I have written about Kugler several times already. The FOMC governor unexpectedly resigned on August 8, although her term of office was due to expire only in January 2026. No official explanation was provided. It was only recently revealed that Kugler had decided to return to teaching. Honestly, I don't believe Kugler chose to leave the Fed Board of Governors as soon as Trump began aggressively pushing for monetary easing. As the saying goes, "there's no smoke without fire."

On Wednesday, it became known that Trump is bringing accusations against another FOMC governor, Cook. More precisely, the accusations were made not by Trump himself, but by Bill Pulte, head of the Federal Housing Finance Agency, while Trump merely wrote on his TruthSocial account that Cook should resign immediately. It is easy to guess that Trump appointed Mr. Pulte, a Republican. And Cook is one of those voting against Fed rate cuts.

From this, a clear trend can be seen. Trump has set his mind on removing all unwanted policymakers from the FOMC, but legally, he cannot fire them, just as he cannot fire Jerome Powell. But if accusations are leveled against every "hawk," they may resign on their own.

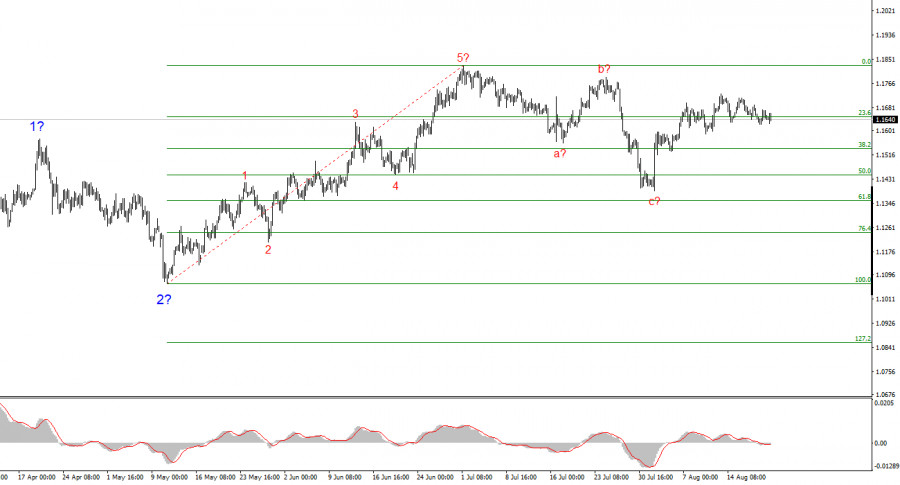

Based on the analysis of EUR/USD, I conclude that the instrument continues to build a bullish segment of the trend. The wave layout still entirely depends on the news background linked to Trump's decisions and U.S. foreign policy. The targets of the trend segment may extend up to the 1.25 level. Accordingly, I continue to consider buying with targets around 1.1875, which corresponds to 161.8% Fibonacci, and higher. I assume that wave 4 is complete. Therefore, now is still a good time to buy.

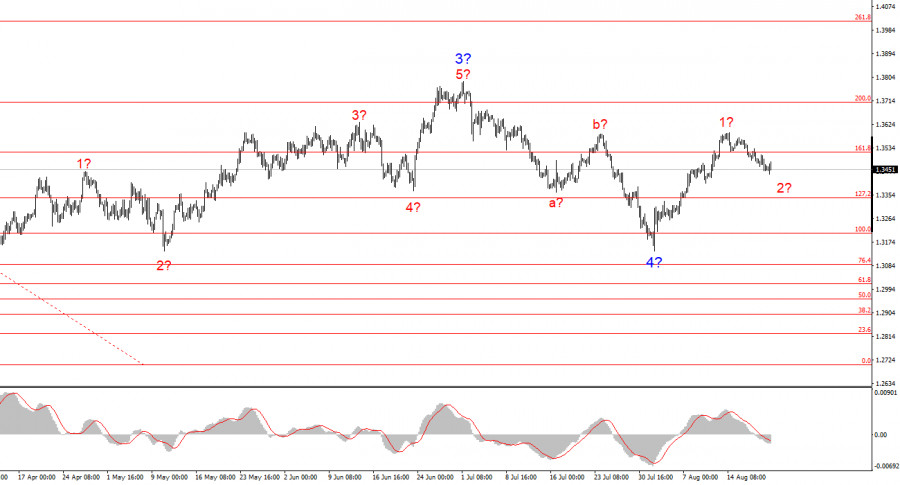

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Trump, the markets may face many more shocks and reversals, which could seriously affect the wave pattern, but at present, the working scenario remains intact. The targets of the bullish trend segment are now located around 1.4017. At this point, I assume that the downward wave 4 is complete. Wave 2 within wave 5 is also nearing completion. Therefore, I recommend buying with a target of 1.4017.

SZYBKIE LINKI