The GBP/USD currency pair was practically immobilized on Friday and Monday. Volatility was low, and the calendar of macroeconomic and fundamental events remained empty. We assumed that negotiations between the presidents of the U.S. and Russia in Alaska could provoke a strong market reaction, but virtually no concrete information made it into the media. Both sides announced "progress," and Donald Trump, in his own social network, has already stated several times that Ukraine and Russia could reach a ceasefire and peace talks in the very near future.

Formally, the dollar has two possible scenarios. Either it will continue to fall if a truce between Ukraine and Russia is signed, or the market will ignore this factor, reasoning that the dollar has already weakened enough in 2025. In any case, the reduction of geopolitical tension is a bearish factor for the U.S. currency. Therefore, at best, the dollar will not fall even further than it already has.

It is also worth noting that around this same time, EU leaders, Trump, and Volodymyr Zelensky are holding a meeting in Washington. According to rumors, the Ukrainian president will be offered a ceasefire proposal that he must accept. Let us recall that Trump is eager to end the conflict between Ukraine and Russia to secure the Nobel Peace Prize, which will be announced in October. We, in principle, do not care about Trump's motives for reconciling Russia and Ukraine, but few would deny that ending the war is a positive development.

However, EU leaders believe that peace should be "fair," ideally in the form that Europe envisions. Recall that the comfortable and phlegmatic European Union fears Russia and seriously considers the possibility that Moscow could start a military conflict in the future on its territory. Since no one in Europe wants to fight, it is preferable that Ukraine continues to do so, thereby distracting Moscow's attention away from Europe itself. Undoubtedly, this is flawed logic, but many political analysts hold this view. Therefore, it is extremely difficult to predict what agreement, if any, will be reached by top officials in Washington.

On Friday, Jerome Powell will speak at the Jackson Hole symposium, and many experts consider this the "event of the week." We disagree with such a definition and believe this event is similar to the U.S.–Russia–Ukraine negotiations: it will either bring new problems for the dollar, or it will bring nothing at all. What can Jerome Powell say if already half of the FOMC is prepared to vote for several rate cuts? Either his rhetoric will remain unchanged (leaving nothing to react to), or he too will shift toward a more dovish tone (which is negative for the dollar).

Thus, the new week can bring the dollar only new disappointments. Even if Powell does not change his tone now, he will change it in the future. Or he will be replaced well before May 2026. Unfortunately, the outcome regarding the Federal Reserve's key rate is already nearly predetermined.

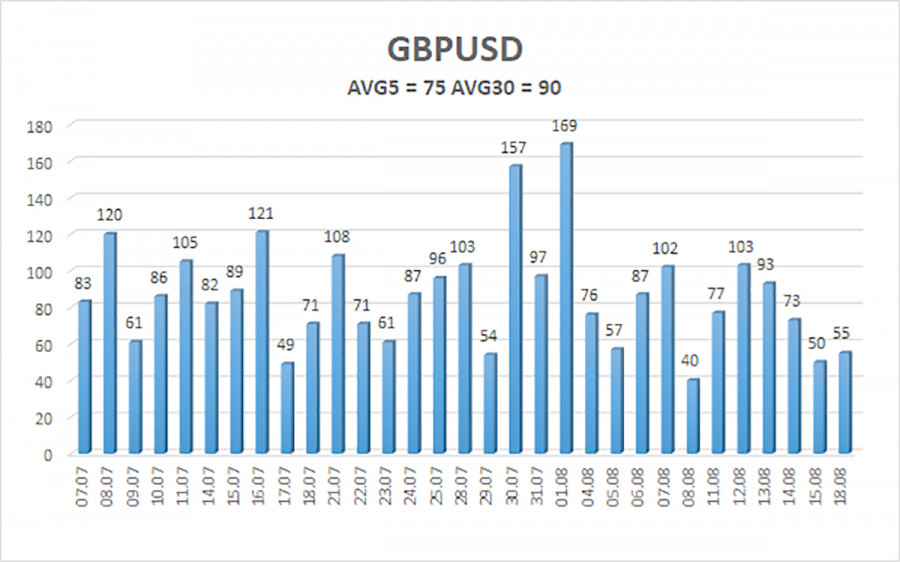

The average volatility of the GBP/USD pair over the past five trading days stands at 75 pips. For the pound/dollar pair, this value is considered "moderate." On Tuesday, August 15, we therefore expect movement within the range limited by the levels of 1.3443 and 1.3593. The long-term linear regression channel points upward, indicating a clear uptrend. The CCI indicator entered the oversold zone twice, signaling the resumption of the upward trend. Several bullish divergences were also formed before the new growth cycle began.

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

The GBP/USD currency pair has completed another cycle of downward correction. In the medium term, Trump's policy is likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3593 and 1.3672 remain much more relevant when the price is positioned above the moving average. If the price is below the moving average line, small shorts with targets at 1.3443 and 1.3428 can be considered on purely technical grounds. From time to time, the U.S. currency shows corrections, but for trend-based strengthening, it needs real signs of an end to the global trade war.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

SZYBKIE LINKI