Japonský úřad pro hospodářskou soutěž v úterý vydal společnosti Google příkaz k zastavení činnosti a upuštění od ní kvůli praktikám narušujícím hospodářskou soutěž, což je první podobné opatření proti americkému technologickému gigantu.

Google nutil výrobce chytrých telefonů upřednostňovat jeho služby, uvedla Japonská komise pro spravedlivý obchod (JFTC). Vyhledávací gigant musí jmenovat třetí stranu, která bude monitorovat a podávat zprávy dozorovému orgánu.

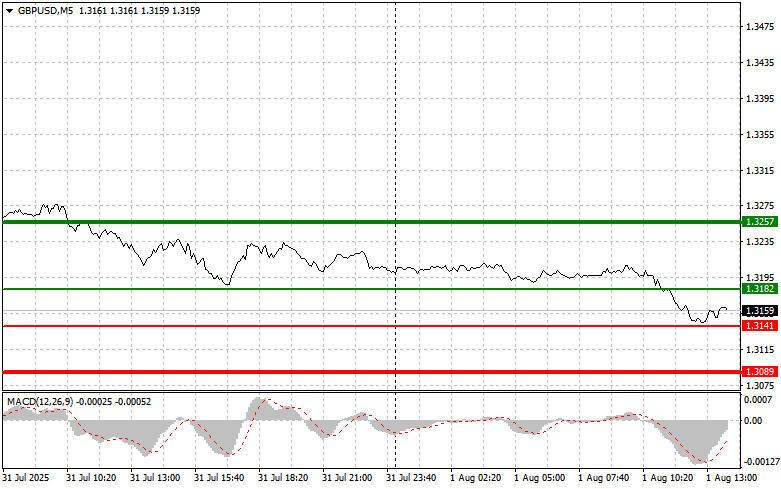

Trade Analysis and Recommendations for the British Pound

The test of the 1.3191 level coincided with the MACD indicator just beginning to move down from the zero mark, confirming a valid entry point for selling the pound, which led to a drop of over 40 points.

Weak UK manufacturing PMI data added pressure on the pound, triggering another decline. Investors, concerned about slowing economic growth and potential recession, continued to actively sell the British currency, leading to a cascade of sell-offs. The current statistics are not the only factor driving sentiment—future expectations are equally important. Anticipated deterioration in the economic outlook, tied to U.S. tariffs and global risks, is exacerbating the market's negative sentiment.

Key U.S. economic indicators are scheduled for release this afternoon, including nonfarm payrolls, the unemployment rate, and changes in average hourly earnings. Of particular importance is the change in employment, as it reflects the pace of job creation. A strong increase in employment may signal a resilient economy, while weak data could raise concerns about slower growth and prompt the Federal Reserve to consider easing monetary policy—likely putting pressure on the dollar.

Also crucial is the analysis of the ISM manufacturing PMI and the University of Michigan Consumer Sentiment Index. Positive readings from these indicators could lead to broad-based selling of the pound.

As for the intraday strategy, I will mainly rely on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today upon reaching the 1.3182 entry point (green line on the chart), targeting growth toward 1.3257 (thicker green line on the chart). At 1.3257, I will exit long positions and open short positions in the opposite direction, anticipating a pullback of 30–35 points. A pound rally today would likely only occur if U.S. data is weak. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3141 level while the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. Growth toward the opposite levels of 1.3182 and 1.3257 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below 1.3141 (red line on the chart), which would likely trigger a rapid decline. The key target for sellers will be the 1.3089 level, where I will exit short positions and immediately consider buying in the opposite direction, aiming for a 20–25 point rebound. Sellers are ready to act at the first opportunity. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to fall.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3182 level while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a reversal to the downside. A decline toward the opposite levels of 1.3141 and 1.3089 can be expected.

Chart Key:

Important Note: Beginner Forex traders must make market entry decisions with extreme caution. It's best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss protection, you can lose your entire deposit quickly, especially when trading large volumes without proper money management.

And remember, successful trading requires a clear plan like the one outlined above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

SZYBKIE LINKI