The euro and the pound resumed their decline immediately after confidence in the U.S. reaching trade agreements with key partners increased in the market.

Following signing a trade agreement with the United Kingdom, Donald Trump's subsequent soft-spoken comments about the prospects of similar deals with China and Europe had a notable impact on currency markets. Traders interpreted these statements as a signal of potential easing in U.S. trade policy, which led to a strengthening of the U.S. dollar and a decline in several risk assets.

The optimism sparked by potential trade concessions enhanced the dollar's appeal as a relatively safe asset amid decreasing geopolitical tensions. This factor, combined with the likelihood of avoiding a recession in the U.S. economy, pushed the dollar higher against major world currencies.

At the same time, the euro came under pressure as the European Central Bank plans to continue actively cutting interest rates. The British central bank appears to be on a similar path, having lowered its rates by a quarter of a percentage point yesterday.

As for today's eurozone data, we only have figures on Italy's industrial production, which are of little market interest. Also scheduled are speeches by Bank of England Governor Andrew Bailey and Monetary Policy Committee member Huw Pill. The tone of their comments may temporarily support the pound, but it is unlikely this effect will be long-lasting. Their rhetoric will likely remain moderate and balanced, given the challenging economic environment in the UK.

If the data matches economists' expectations, the best approach would be to follow a Mean Reversion strategy. If the data significantly exceeds or falls short of expectations, it would be best to apply a Momentum strategy.

Buying on a breakout above 1.1257 may lead to euro growth toward the 1.1312 and 1.1376 areas.

Selling on a breakout below 1.1203 may lead to a decline in the euro toward the 1.1150 and 1.1097 areas.

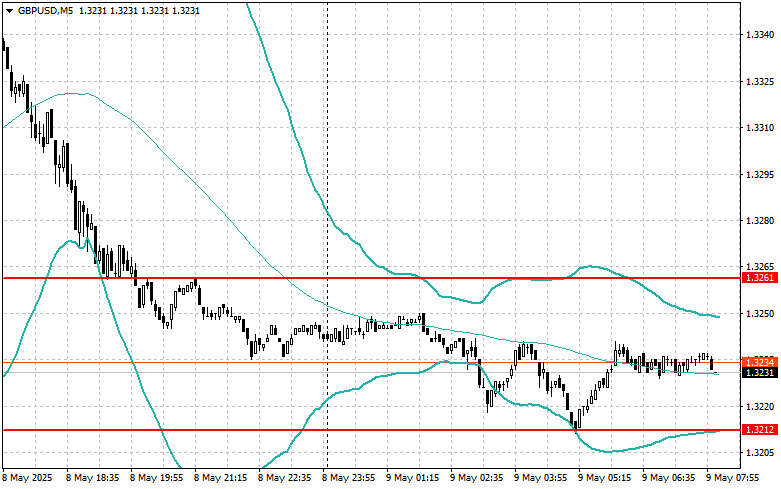

Buying on a breakout above 1.3251 may lead to pound growth toward the 1.3283 and 1.3312 areas.

Selling on a breakout below 1.3212 may lead to a decline in the pound toward the 1.3170 and 1.3126 areas.

Buying on a breakout above 145.81 may lead to dollar growth toward the 146.18 and 146.49 areas.

Selling on a breakout below 145.46 may lead to dollar sell-offs toward the 145.16 and 144.85 areas.

I will look to sell after a failed breakout above 1.1245 followed by a return below this level.

I will look to buy after a failed breakout below 1.1198 followed by a return above this level.

I will look to sell after a failed breakout above 1.3261 followed by a return below this level.

I will look to buy after a failed breakout below 1.3212 followed by a return above this level.

I will look to sell after a failed breakout above 0.6424 followed by a return below this level.

I will look to buy after a failed breakout below 0.6395 followed by a return above this level.

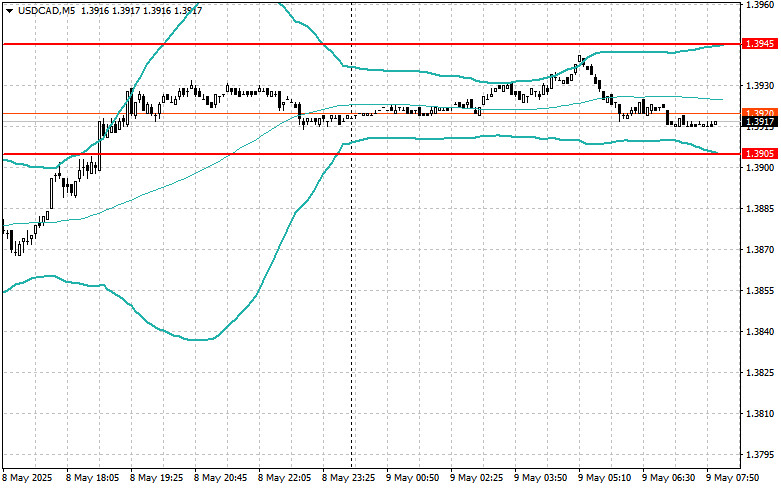

I will look to sell after a failed breakout above 1.3945 followed by a return below this level.

I will look to buy after a failed breakout below 1.3905 followed by a return above this level.

SZYBKIE LINKI