The worst quarter since 2011, the worst month since Bloomberg began tracking bitcoin in 2010. In June, the cryptocurrency leader lost 41% of its value, and in April-June at 58%. The numbers are colossal, but if you remember the high correlation of the token with the US stock market and the saddest first half of the year since 1970 for American stock indices, you can calm down a bit and take a breath. The most important thing is that Bitcoin survived, and there, you see, we will wait for recovery.

Quarterly dynamics of BTCUSD

I have repeatedly emphasized that the main reason for the gigantic decline in the capitalization of cryptocurrencies from $3 trillion in November to less than $900 billion was the Fed's change of mind. The central bank began to move away from monetary stimulus, which saved the US economy from recession and allowed stock indices to reach historic highs. As a result, the S&P 500 fell into a bear market territory, and BTCUSD quotes fell to their lowest levels since December 2020.

The fall of the token was facilitated by a number of negative news in the field of the crypto industry. The collapse of the stablecoin TerraUSD, the suspension of accepting funds by the lender Celsius Network, the insolvency of the cryptocurrency hedge fund Three Arrows Capital, the refusal of the US Securities and Exchange Commission to convert Grayscale Bitcoin Trust to an exchange-traded fund, and other negative things worsened the mood of bitcoin fans. Large players are leaving the market, and the crowd is following them.

At the same time, history shows that you should not sprinkle ashes on your head. Five times, in 1932, 1939, 1940, 1962, and 1970, the S&P 500 fell 15% or less in the first half of the year, but regained ground in the second half, rising by an average of 24% by the end of the year. Just like then, investor pessimism was on the rise. Now, 72% of Deutsche Bank respondents expect a further fall in the stock index, and 90% believe a recession in the US economy until 2023. At present, against the backdrop of an impending downturn, a V-shaped recovery in the stock market looks unlikely, but if the Fed starts to put on the brakes, it will not bring the federal funds rate to the 3.5% expected by CME derivatives, the situation will change radically.

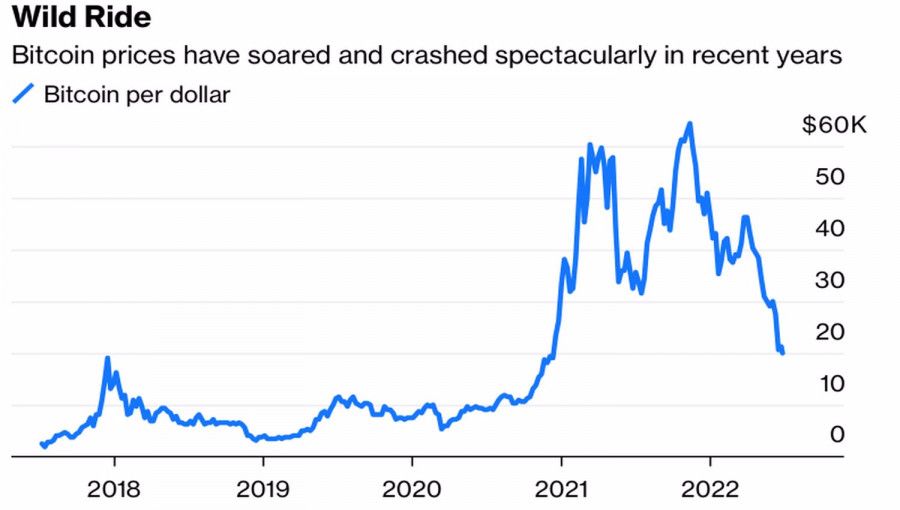

No one knows what the growth of bitcoin will be. If after a 50% drop from April and July 2021, prices quickly recovered to a new peak, then after the collapse that started in December 2017, the token took more than two years to return to stable growth.

Bitcoin dynamics

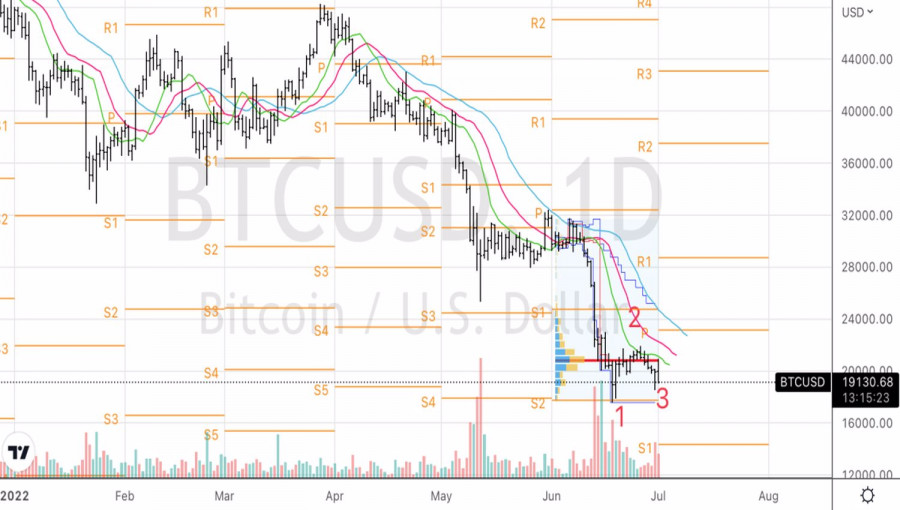

Even though pessimism currently prevails and goes off scale, optimists have not disappeared from the market either. Deutsche Bank expects BTCUSD to rally towards 28,000 by the end of 2022 as the US stock market gradually recovers. Fundstrat considers bitcoin to be a cyclical asset that bottoms out every 90 weeks. If so, then the bottom is not far off.

Technically, a 1-2-3 reversal pattern can be formed on the BTCUSD daily chart. In this regard, breaks of fair value at 20,800 and local peak at 22,000 can be used for purchases.

SZYBKIE LINKI