Startup Mistral AI ve středu představil firemní verzi svého chatbota Le Chat. CEO Arthur Mensch uvedl, že firma za posledních 100 dní ztrojnásobila tržby, zejména díky poptávce mimo USA.

Open source verzi Le Chat spustila společnost v únoru. Firemní verze nyní umí propojení s Microsoft SharePoint a Google Drive.

„Za posledních 100 dní jsme ztrojnásobili byznys, zejména v Evropě a mimo USA,“ řekl Mensch novinářům v Paříži. Růst zaznamenali ale i v USA.

Startup má aktuálně hodnotu 6 miliard USD. Přesné tržby nezveřejňuje, ale podle odborného tisku činily v loňském roce 30 milionů USD.

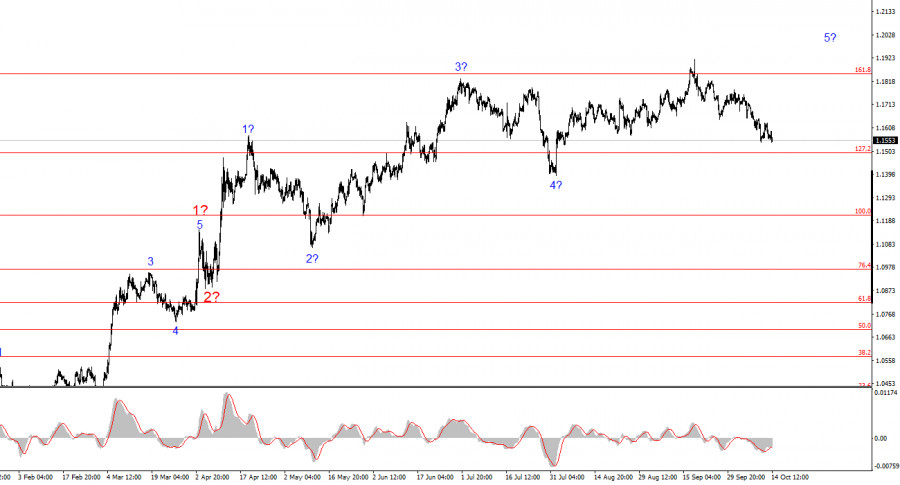

The wave pattern on the 4-hour chart for EUR/USD has changed. It is still too early to conclude that the upward trend segment has ended, but the recent decline in the euro has required an adjustment of the wave count. We now see a series of three-wave structures a–b–c, which may be part of the larger wave 4 within the overall uptrend. In this case, wave 4 has taken on an unusually extended form, but the wave pattern as a whole remains coherent.

The formation of the upward trend segment continues, while the news background mostly supports currencies other than the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Federal Reserve also persists. The market's dovish expectations regarding the Fed rate are growing. Meanwhile, the U.S. government shutdown continues. The market has given a rather low assessment of the results of Trump's first 7–8 months in office, even though economic growth in the second quarter reached nearly 4%.

In my opinion, the formation of the upward trend segment is not yet complete. Its potential targets extend up to the 1.25 area. Based on this, the euro may continue to decline for some time, even without any clear reasons for it (as seen over the past two weeks). However, the wave structure will remain consistent.

The EUR/USD pair declined by several dozen more points on Tuesday and could lose much more by the end of the day — even without relevant news. Lately, the pair has been trading entirely under the influence of a corrective wave pattern.

Until recently, I did not believe that the market would continue to increase demand for the dollar given the current news background — but you live and learn. Even if the trend segment that began on July 1 is not wave 4, we are still observing the formation of a sequence of three-wave structures. Therefore, we should in any case expect the current structure to complete. At present, it is in the process of forming wave c, which could even end below the August 1 low at 1.1391.

Based on this analysis, it can be concluded that the euro may easily lose another 150–200 points in value. The market is clearly taking advantage of the absence of U.S. economic data to benefit the dollar — no statistics, no problems. Once the shutdown ends and all delayed reports are released, it is possible that the formation of the upward trend will resume. For now, my readers can only watch events unfold. Personally, I still do not consider selling, as this would go against the current news background. Even though the political crisis in France has already been resolved, the euro continues to decline.

Based on the EUR/USD analysis, I conclude that the pair continues to form an upward trend segment. The wave structure still depends heavily on the news background related to Trump's decisions and the foreign and domestic policies of the new White House administration. The targets for the current trend segment may extend up to the 1.25 level. At present, we appear to be witnessing the formation of corrective wave 4, which is nearing completion but has taken on a complex and extended form. Therefore, in the near term, I still consider buying positions only. By year-end, I expect the euro to rise to 1.2245, corresponding to 200.0% on the Fibonacci scale.

On a smaller scale, the entire upward segment is clearly visible. The wave structure is not perfectly standard, as the corrective waves differ in size — for example, the larger wave 2 is smaller than the inner wave 2 within wave 3. However, this also happens. I would like to remind readers that it is best to identify clear and readable structures on charts rather than trying to label every single wave. The current upward structure raises few doubts.

Main Principles of My Analysis

فوری رابطے