The test of the 1.1823 price coincided with the moment when the MACD indicator had just started to move down from the zero line, confirming the validity of the sell entry for the euro. As a result, the pair dropped by 50 pips.

The explosive growth of the Philadelphia Manufacturing Index triggered an instant surge in demand for the dollar and, as a result, a weakening in the euro's position. The optimistic data encouraged investors to actively buy the US currency, which was perceived as a sign of an improving US economy. In the near term, the dollar's strengthening trend is likely to persist, especially if positive economic reports continue coming out of the United States. Still, the long-term behavior of currency pairs depends on a much more complex set of factors, including the geopolitical situation, Fed actions, and inflation expectations.

Today, attention is focused on the release of the German Producer Price Index (PPI). If the actual figures come in below analysts' forecasts, this will most likely trigger a new wave of selling in the single European currency. Investors are closely monitoring the German economy, viewing it as a key indicator of overall European dynamics and as a gauge of inflation and future ECB interest rate policy. If the producer price index posts weak results, it will be seen as evidence of easing inflationary pressure, which in turn reduces the need for further ECB rate cuts. This could make the euro less attractive for investors.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

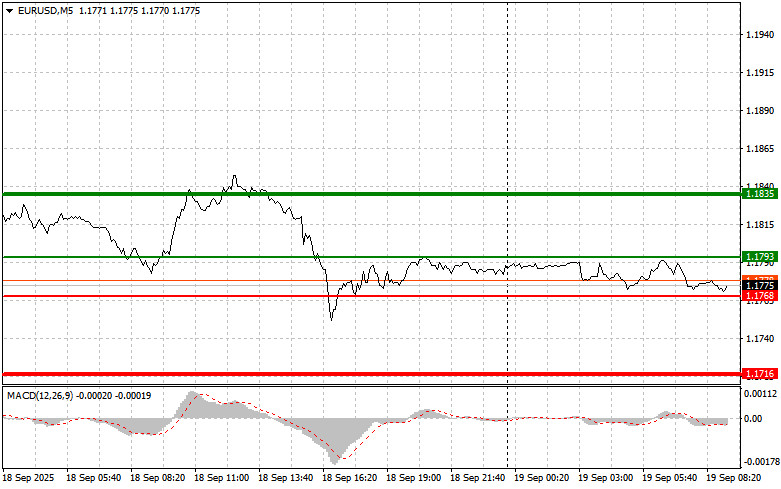

Scenario #1: Today, I plan to buy the euro at around 1.1793 (the green line on the chart), targeting a rise to 1.1835. At 1.1835, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30-35 pip move from the entry point. Betting on euro growth is possible only after strong fundamental data. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I'll also look to buy the euro if there are two consecutive tests of the 1.1768 price while the MACD is in oversold territory. This will limit the pair's downside potential and result in a reversal to the upside. Growth to the opposite levels of 1.1793 and 1.1835 can then be expected.

Scenario #1: I plan to sell the euro after it reaches 1.1768 (the red line on the chart). The target will be 1.1716, where I intend to exit and then immediately buy in the opposite direction (aiming for a 20-25 pip bounce from the level). Downward pressure on the pair will return if the data disappoints. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario #2: I'll also look to sell the euro if there are two consecutive tests of the 1.1793 price while the MACD is in the overbought zone. This will limit the pair's upward potential and result in a downward reversal. A move down to the opposite levels of 1.1768 and 1.1716 can then be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

فوری رابطے