The test of the 1.1679 price level occurred when the MACD indicator was starting to move up from the zero line, confirming a correct entry point to buy the euro and resulting in a gain of over 25 pips.

As the data showed, there was no sharp jump in US inflation in July of this year since the personal consumption expenditure index matched economists' expectations. This gives the Federal Reserve some room to maneuver, especially considering its recent signals about a possible first rate cut this year. Nevertheless, it's essential to note that inflation remains above the target, and the central bank will likely continue to monitor economic indicators closely. And even though the situation with US interest rates remains muddled and unpredictable, there are currently no major disagreements within the Fed regarding the decisions being made.

Today will bring the publication of two key economic indicators watched closely by experts: the Eurozone's manufacturing PMI and the unemployment rate. Regarding the PMI, most economists predict a slight decline compared to last month. This dynamic may signal some slowdown in industrial development. At the same time, if the actual value exceeds the forecast, it could inspire investors and support the euro.

The unemployment rate, in turn, serves as a barometer for labor market health. It is expected to remain unchanged compared to last month; however, any unexpected fluctuations could impact the European Central Bank's monetary policy decisions. A decrease in unemployment could prompt the ECB to maintain its wait-and-see monetary policy stance more firmly, while an increase might motivate the central bank to adopt a more dovish stance.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

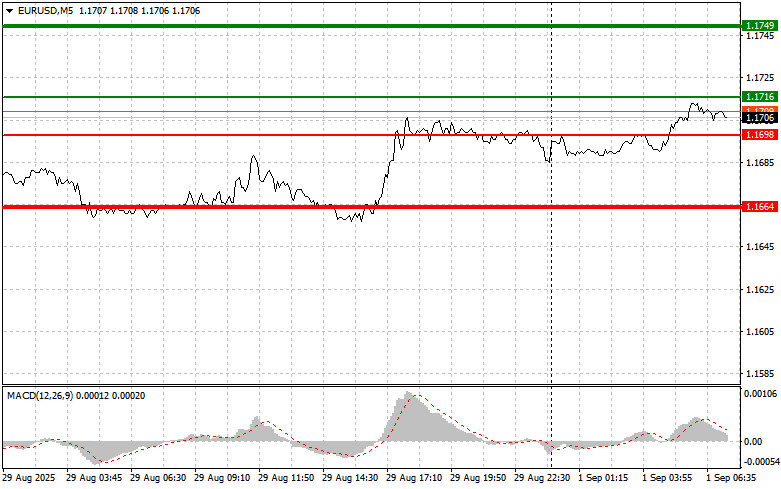

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

فوری رابطے