The Pound Posted Strong Growth, Updating Monthly Highs, While the Euro Did Not Show the Same Strong Confidence

Yesterday, traders shifted their focus to new statements concerning trade negotiations and the geopolitical situation, which, to some extent, positively impacted risk assets. Many market participants expect progress in resolving the military conflict in Ukraine and concluding a trade deal between the United States and China. However, it should be noted that the euro's growth has been restrained. The absence of strong drivers and the ongoing uncertainty in the global economy prevent the European currency from demonstrating a more confident rise. The European Central Bank's actions to lower interest rates also exert pressure.

Today, the data expected include the German GfK Consumer Climate Indicator, private sector credit growth in the Eurozone, and changes in the M3 money supply aggregate. These indicators are undoubtedly important for assessing the current state of the Eurozone economy and its development prospects. The German Consumer Climate Index is traditionally seen as a leading indicator of consumer sentiment and, consequently, potential spending.

An increase in private sector lending in the Eurozone may indicate rising investment activity and consumer demand, which would positively impact economic growth. However, excessively rapid credit expansion could lead to credit bubbles and heightened financial risks.

Changes in the M3 money supply are a key indicator of the European Central Bank's monetary policy. Growth in M3 may suggest increased liquidity in the economy, which could stimulate economic growth and risk triggering inflation.

As for the pound, no statistical data is scheduled for the UK today, so the focus will shift to a speech by Sir David Ramsden, the Bank of England's Deputy Governor for Markets and Banking. His remarks could shed light on the current sentiment within the regulator regarding inflation and future monetary policy.

If the data aligns with economists' expectations, acting based on a Mean Reversion strategy is better. If the data significantly exceeds or falls short of expectations, it is preferable to use a Momentum strategy.

Buying on a breakout above 1.1417 may lead to a rise toward 1.1445 and 1.1487;

Selling on a breakout below 1.1375 may lead to a fall toward 1.1320 and 1.1267.

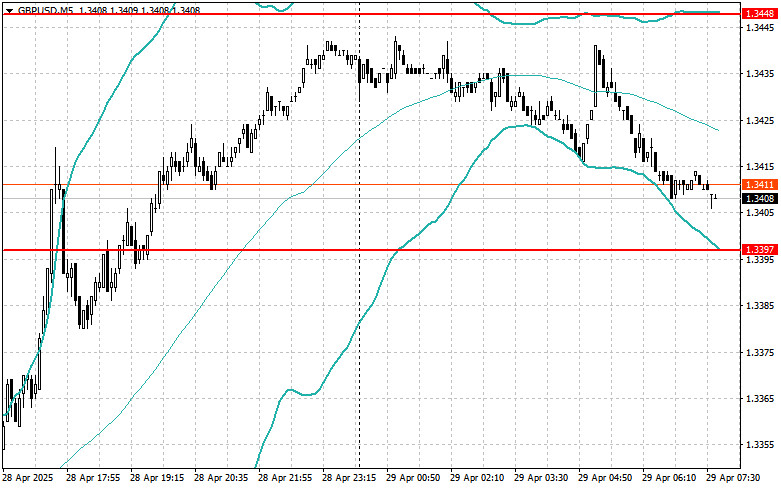

Buying on a breakout above 1.3420 may lead to a rise toward 1.3465 and 1.3510;

Selling on a breakout below 1.3375 may lead to a fall toward 1.3333 and 1.3282.

Buying on a breakout above 142.70 may lead to a rise toward 143.30 and 143.71;

Selling on a breakout below 142.30 may lead to a decline toward 141.86 and 141.34.

Look for selling opportunities after a failed breakout above 1.1424 and a return below this level;

Look for buying opportunities after a failed breakout below 1.1375 and a return above this level.

Look for selling opportunities after a failed breakout above 1.3448 and a return below this level;

Look for buying opportunities after a failed breakout below 1.3397 and a return above this level.

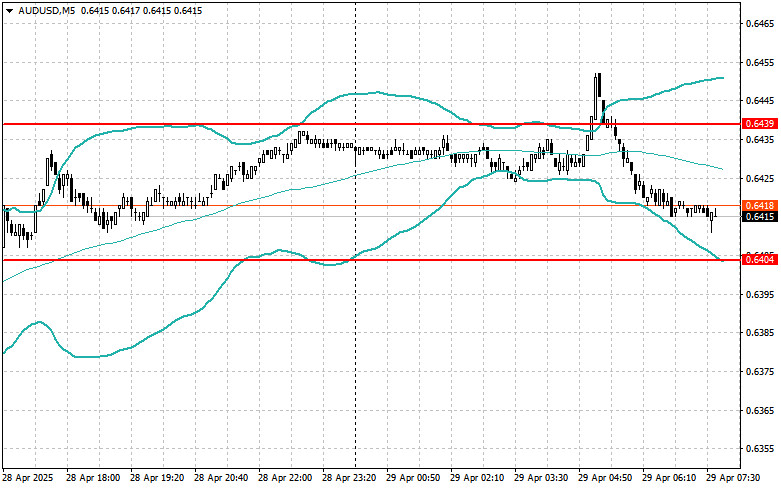

Look for selling opportunities after a failed breakout above 0.6439 and a return below this level;

Look for buying opportunities after a failed breakout below 0.6404 and a return above this level.

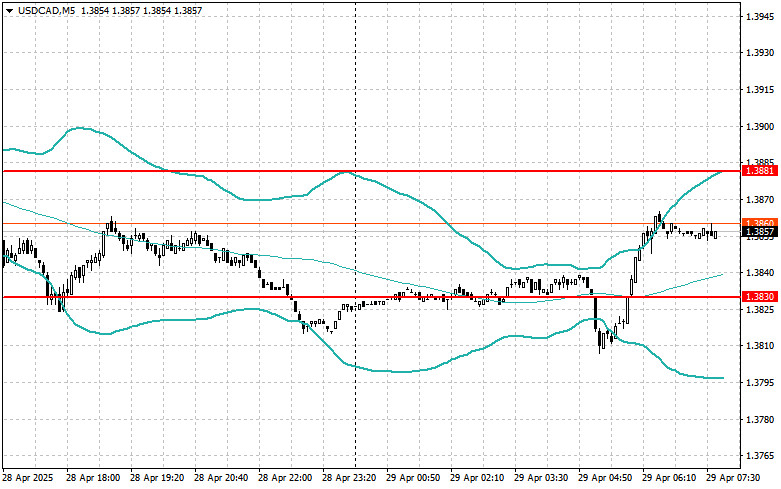

Look for selling opportunities after a failed breakout above 1.3881 and a return below this level;

Look for buying opportunities after a failed breakout below 1.3830 and a return above this level.

فوری رابطے