Trade Review and Trading Tips for the British Pound

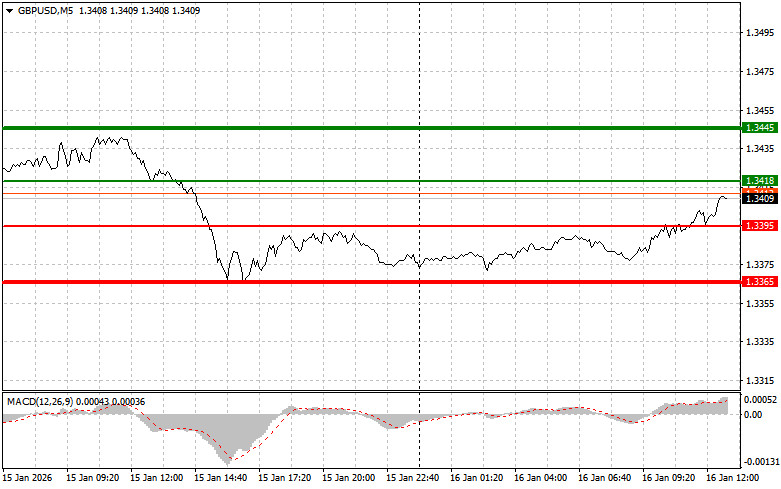

The test of the 1.3393 price level occurred at a moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the pound. As a result, the pair rose by only 15 points.

The absence of UK data helped the pound stage a correction. Uncertainty, often perceived as a negative factor for investment, this time worked in favor of the British currency. Investors, lacking statistical data to rely on, preferred to take a wait-and-see approach, which slowed the pound's further decline. This was also supported by an overall improvement in sentiment in global markets, where lower volatility and moderate optimism supported risk assets.

In the second half of the day, careful analysis of upcoming data will allow traders to assess the current state of the U.S. economy and adjust their strategies accordingly. Industrial production, as an important indicator, will show activity in the real sector and its dynamics. Growth in this indicator usually signals rising demand, new orders, and, as a result, a positive impact on the economy as a whole. Particular attention will be paid to the manufacturing sector, as it is a key driver of economic growth. An increase in manufacturing output points to improved competitiveness of U.S. goods and services, which in turn may strengthen the dollar's position on the global stage.

Speeches by FOMC members Michelle Bowman and Philip N. Jefferson will also remain in focus. Their comments on the current economic situation, inflation, and plans for future monetary policy will have a significant impact on market expectations and, consequently, on the dollar's exchange rate. Cautious rhetoric from Fed officials, signaling readiness for a pause in the monetary easing cycle, could support the dollar.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today when the entry point around 1.3418 is reached (green line on the chart), with a target of growth toward the 1.3445 level (the thicker green line on the chart). Around 1.3445, I plan to exit long positions and open short positions in the opposite direction (aiming for a move of 30–35 points in the opposite direction from that level). Pound appreciation today can be expected only after dovish comments from Fed officials.Important! Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3395 level while the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a bullish market reversal. A rise toward the opposite levels of 1.3418 and 1.3445 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after a breakout below the 1.3395 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 1.3365 level, where I plan to exit short positions and immediately open long positions in the opposite direction (aiming for a move of 20–25 points in the opposite direction from that level). Pressure on the pound may return today in the event of strong U.S. data.Important! Before selling, make sure that the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3418 level while the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a bearish market reversal. A decline toward the opposite levels of 1.3395 and 1.3365 can be expected.

What's on the Chart:

Important. Beginner Forex traders must be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit—especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

PAUTAN SEGERA