Členové odborů v jednotce Electric Boat společnosti General Dynamics (NYSE:GD) hlasovali pro schválení stávky, uvedla v úterý odborová organizace United Auto Workers.

Tento krok přichází uprostřed probíhajícího pracovního sporu po vypršení smlouvy členů v Electric Boat, která je součástí segmentu námořních systémů obranného dodavatele, jenž montuje ponorky s jaderným pohonem pro americké námořnictvo, 4. dubna.

Odborový svaz zastupuje více než 2 400 námořních konstruktérů, kteří v této jednotce navrhují ponorky a bojují za získání úpravy životních nákladů (COLA), aby udrželi krok s inflací, spolu s dostupnou zdravotní péčí.

Členové odborů rovněž usilují o obnovení důchodů, neboť tvrdí, že společnost General Dynamics prosazuje zvýšení týdenních nákladů na zdravotní pojištění o 52 % až 161 %.

Společnost General Dynamics získala od Pentagonu významné zakázky na stavbu ponorek třídy Virginia pro námořnictvo, ale má několikaleté zpoždění za plánem kvůli nedostatku kvalifikované pracovní síly, problémům s konstrukcí a problémům v dodavatelském řetězci, které jsou důsledkem pandemie.

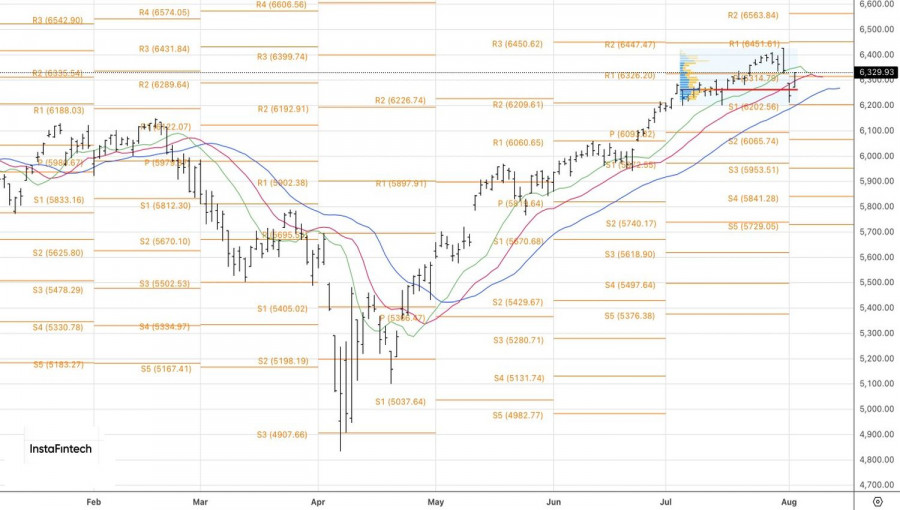

FOMO in action! People are too impatient to wait for a deeper pullback. Major stock indices jumped more than 1% after a sharp drop triggered by weak U.S. employment data for July. Investors did what they've been doing for most of the year – they bought the dip. The fear of missing out outweighed concerns about the fate of the U.S. economy. After all, there's the Federal Reserve, which will throw it a lifeline.

Investor greed has made Morgan Stanley, Deutsche Bank, and Evercore look foolish. After the S&P 500 retreated from record highs, these firms warned of a 10–15% correction in the broad stock index. In their view, tariffs will begin to impact corporate earnings negatively, most likely as early as Q3. In Q2, 82% of 336 reporting companies beat earnings estimates. In Q1, the figure was 78%.

Leading the charge is the Magnificent Seven, whose profits surged 26% in April–June. The remaining 493 S&P 500 companies posted a modest 4% earnings increase.

The recovery in the broad stock index is happening despite weak insider activity. In July, insiders purchased shares in just 151 related companies — the lowest figure since 2018.

Despite warning of a pullback in the S&P 500, Morgan Stanley still recommends buying the dips. State Street calls investor pessimism over weak employment data from May to July short-sighted, arguing that unemployment at 4.2% still signals a resilient labor market.

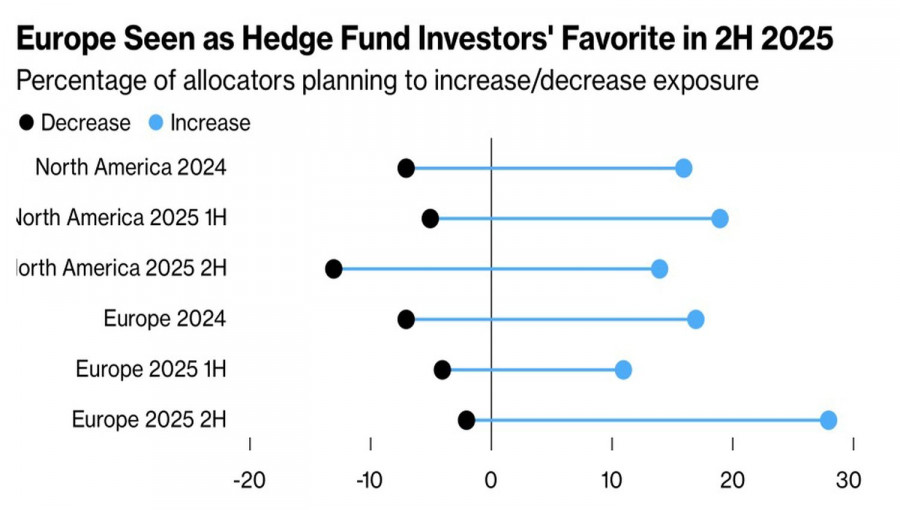

Buying the dip has become the hallmark of retail investors in 2025. Big players prefer to use S&P 500 rallies to diversify into non-U.S. equities. According to a Goldman Sachs survey, 28% of hedge funds plan to increase their holdings in European stocks, while only 2% intend to reduce them. The survey included 333 investors managing more than 1 trillion dollars.

The rebound in the S&P 500 reflects growing market expectations of the Fed resuming its monetary easing cycle. Derivatives markets have raised the odds of a federal funds rate cut in September to 92%. However, this optimism is based on disappointing data. Moreover, the Fed appears to be lagging behind, which could ultimately weigh on equities.

Technically, on the daily chart, bulls are trying to regain control of the S&P 500. They managed to push prices above the fair value at 6265. However, failure to consolidate above the pivot level of 6315 would signal buyer weakness and provide a reason to sell.

QUICK LINKS