The wave structure remains clear. The last completed downward wave broke the previous low, while the new upward wave has yet to surpass the previous high. Thus, a "bearish" trend is ongoing, with no signs of its conclusion. For signs of a trend reversal, the euro would need to confidently rise above 1.0460 and close above it.

The informational background on Tuesday was the bulls' hope to break the "bearish" structure. After German inflation rose more than expected, many traders anticipated a stronger rise in European inflation. Overnight and early Tuesday, new purchases of the euro began. However, the European Union's Consumer Price Index (CPI) rose in line with forecasts to 2.4% year-over-year, which prevented the bulls from continuing their attacks.

The "bearish" trend remains intact, but there are still several reports later this week that could support the bulls in their attempt to establish an uptrend. For now, it is crucial for the bulls to defend the 1.0336–1.0346 support zone. Failure to do so would almost certainly lead to a decline back to 1.0255. Near this level, further euro depreciation seems more likely than a new rally. As such, I remain "bearish" as I see no changes to the graphical outlook.

On the 4-hour chart, the pair made two rejections from the 127.2% Fibonacci retracement level at 1.0436, reversing in favor of the U.S. dollar and starting a new decline toward 1.0332 and 1.0225. The downward trend channel clearly reflects current market sentiment, and until the pair consolidates above it, I do not expect significant euro growth. The RSI indicator is showing signs of a potential "bearish" divergence.

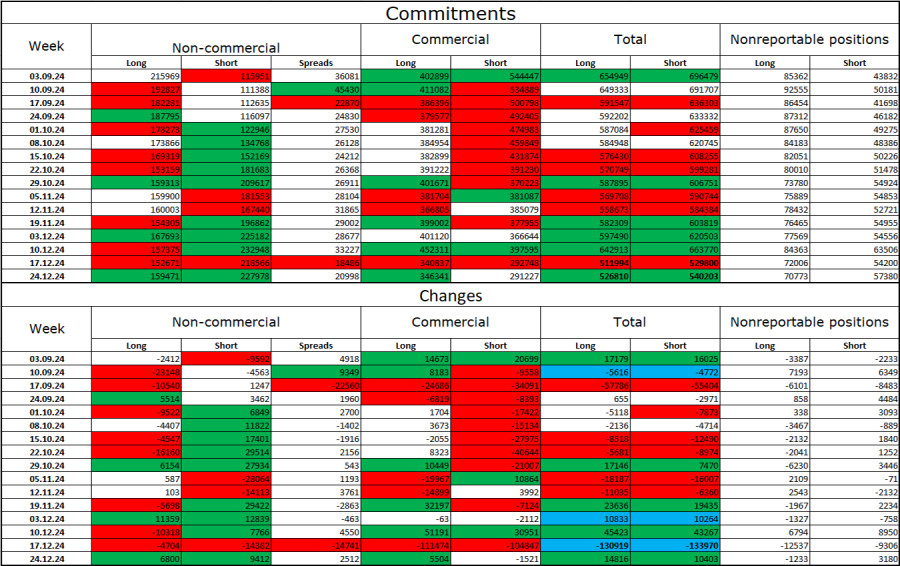

In the latest reporting week, speculators added 6,800 long positions and 9,412 short positions. The sentiment among "Non-commercial" traders remains "bearish" and is intensifying, signaling further potential declines in the pair. Total long positions held by speculators now stand at 159,000, while short positions are at 228,000.

For 15 consecutive weeks, major players have been reducing their holdings of the euro, reflecting an unambiguous "bearish" trend. Occasionally, bulls dominate during certain weeks, but these are exceptions rather than the rule. The key factor supporting the dollar—expectations of FOMC monetary policy easing—has already been priced in. Without new reasons to sell the dollar, its continued growth remains more probable. Technical analysis also indicates the persistence of a long-term "bearish" trend, suggesting an extended decline in the EUR/USD pair.

On January 8, the economic calendar features four events, each with moderate or weak market influence. The overall impact of the news background on market sentiment is expected to be mild.

Sales of the pair could be initiated on a rejection from the 1.0405–1.0420 zone on the hourly chart, targeting 1.0336–1.0346 and 1.0255. The first target has been achieved. New sales are advisable upon consolidation below 1.0336–1.0346. Purchases were possible on a rebound from 1.0255, targeting the 1.0336–1.0346 zone. Both this target and the next at 1.0405–1.0420 have been achieved. Further purchases will be possible on a rebound from the 1.0336–1.0346 zone.

Fibonacci retracement levels:

QUICK LINKS