While Wall Street experts puzzle over how the US dollar will react to the nearest Fed's interest rate decision, and the ECB contemplates the future of European inflation, the EUR/USD pair is drifting back and forth within a narrow trading range. Traders are hesitant to jump the gun, reasonably assuming that the Fed's decisions at the end of 2024 could serve as a springboard for the entire forex market, at least through the first quarter of 2025.

According to ECB Chief Economist Philip Lane, the path of inflation in the eurozone remains uncertain. Rising wages, increased corporate profits, and geopolitical tensions could push up energy prices and freight costs, driving the CPI higher. Conversely, a prolonged blow to consumer and business confidence could push inflation down. Tariffs and trade wars could further muddy the waters.

In such conditions, the European Central Bank must remain highly flexible and impartial. Judging by its latest forecasts, the ECB is poised to expect a slowdown in inflation rather than acceleration. This outlook paves the way for further deposit rate cuts and puts pressure on the euro.

ECB's inflation and GDP forecasts

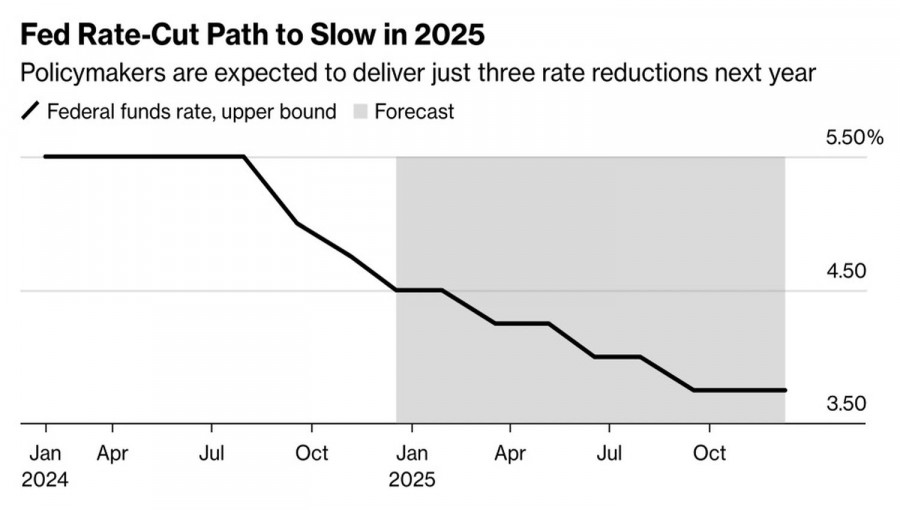

However, investors are currently more interested in how EUR/USD will react to the outcome of the December FOMC meeting. A 25-basis-point cut to the federal funds rate is expected, bringing it to 4.5%. Additionally, the FOMC's updated projections for 2025 may indicate three monetary easing steps, down from four projected in September.

According to Danske Bank, this could strengthen the euro against the US dollar, as it would signal the Fed's continued intention to ease monetary policy next year.

In contrast, Bank of America predicts a downward move for EUR/USD, describing the December Fed decision as a "hawkish cut." Any hints from Jerome Powell about a January pause or the Fed's concerns over inflation could justify selling the main currency pair.

Forecast for US funds rate

Curiously, the bond market disagrees with derivatives and expects the updated FOMC forecasts to include the same number of easing moves for 2025 as in previous projections. If so, EUR/USD could likely correct back into its downtrend.

Thus, the wide range of opinions on the Fed's December verdict keeps traders away from the main currency pair, at least until the updated FOMC rate forecasts are released.

Technical analysis

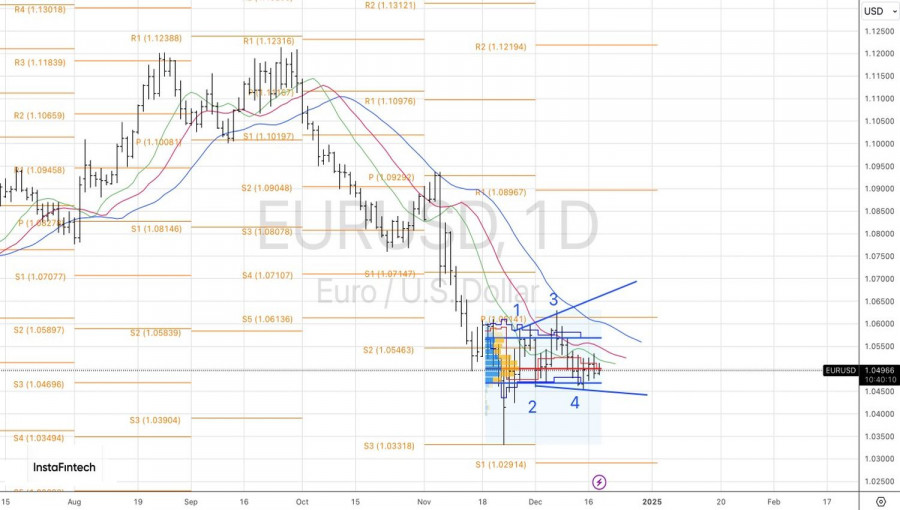

On the daily chart, EUR/USD is consolidating within a narrow range of 1.0475 to 1.0535. A break below the lower border could resume the downtrend—unless the bulls defend the 1.0455 support and trigger a reversal pattern, such as an Expanding Wedge.

Conversely, a successful breach of the 1.0535 resistance could increase the risk of a pullback and provide grounds for initiating long positions.

QUICK LINKS