Společnost Federal Agricultural Mortgage A (NYSE: AGMa) oznámila za první čtvrtletí zisk na akcii ve výši 4,19 USD, což je o 0,05 USD více, než odhadovali analytici (4,14 USD). Tržby za čtvrtletí dosáhly 96,79 mil. USD, zatímco konsensus odhadoval 94,02 mil. USD.

Cena akcií společnosti Federal Agricultural Mortgage A uzavřela na 133,00 USD. Za poslední 3 měsíce poklesla o 12,32 % a za posledních 12 měsíců o 4,65 %.

Společnost Federal Agricultural Mortgage A zaznamenala v posledních 90 dnech pozitivní revize EPS a negativní revize EPS.

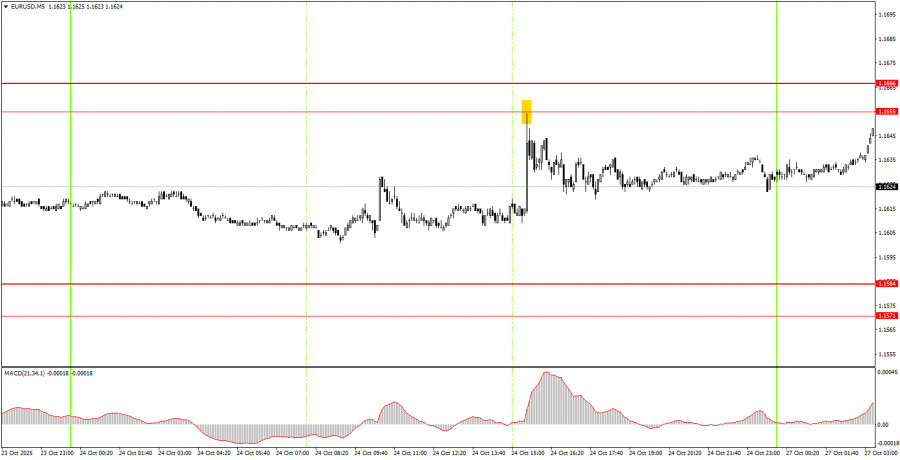

The EUR/USD currency pair exhibited little trend on Friday. During the day, macroeconomic reports were published in the Eurozone, Germany, and the U.S. that should have supported trading decisions. However, instead of experiencing significant movements, we witnessed minimal volatility. The European currency had a good opportunity to rise again, but if the market refuses to buy it and remains generally reluctant to trade, no movement will occur regardless of the fundamental and macroeconomic context. Essentially, we saw only a market reaction to the U.S. inflation report, which was significant. The Consumer Price Index (CPI) rose more slowly than analysts expected, standing at only 3%. This report increases the likelihood of several Federal Reserve rate cuts at upcoming meetings. However, the market's reaction lasted only 5 minutes, resulting in a 40-pip drop for the dollar. This was virtually the only movement throughout the day.

On the 5-minute timeframe, one trading signal was formed during Friday's session, which is not surprising given the current volatility. After the U.S. inflation report was released, the price jumped to 1.1655, then pulled back with minimal deviation. Novice traders could have acted upon this sell signal, but for understandable reasons, the decline was weak.

On the hourly timeframe, the EUR/USD pair shows some signs of a potential upward trend. The descending trendline has been breached, and the overall fundamental and macroeconomic backdrop remains unfavorable for the U.S. dollar. Therefore, we anticipate the resumption of the upward trend in 2025. However, the sideways trend on the daily timeframe persists, resulting in low volatility and illogical movements on lower timeframes.

On Monday, the EUR/USD pair may move in any direction, likely again with minimal volatility. New trading signals can be expected in the area of 1.1571-1.1584 or the range of 1.1655-1.1666.

On the 5-minute timeframe, levels to consider include: 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527, 1.1571-1.1584, 1.1655-1.1666, 1.1745-1.1754, 1.1808, 1.1851, 1.1908, 1.1970-1.1988. On Monday, there are no significant or interesting events scheduled in either the U.S. or the Eurozone, so volatility may drop to virtually zero again. Note that even the eight more significant reports released last Friday did not provoke any volatility.

Support and Resistance Levels: These levels serve as targets when opening buy or sell positions. Take Profit levels can be placed around these areas.

Red Lines: These represent channels or trend lines that illustrate the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): This consists of a histogram and a signal line; it is a supplementary indicator that can also be used as a source of signals.

Important speeches and reports (always included in the news calendar) can significantly impact the movement of currency pairs. Therefore, during their release times, it is crucial to trade with caution or exit the market to avoid sharp reversals against previous movements.

Beginner traders in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and effective money management are essential for long-term success in trading.

ລິ້ງດ່ວນ