(Reuters) – Čínský technologický gigant Alibaba (NYSE:BABA) Group v úterý představil Qwen 3, vylepšenou verzi svého vlajkového modelu umělé inteligence, který přináší nové hybridní schopnosti uvažování.

Uvedení na trh přichází v době, kdy se v čínském sektoru umělé inteligence zostřuje konkurence, podnícená průlomovým úspěchem místní startupové společnosti DeepSeek z počátku tohoto roku, která tvrdí, že vyvinula vysoce výkonné modely s nižšími náklady než její západní konkurenti.

Čínský lídr v oblasti vyhledávání Baidu (NASDAQ:BIDU) se v pátek připojil k závodu ve zbrojení v oblasti umělé inteligence uvedením modelů Ernie 4.5 Turbo a Ernie X1 Turbo zaměřených na uvažování.

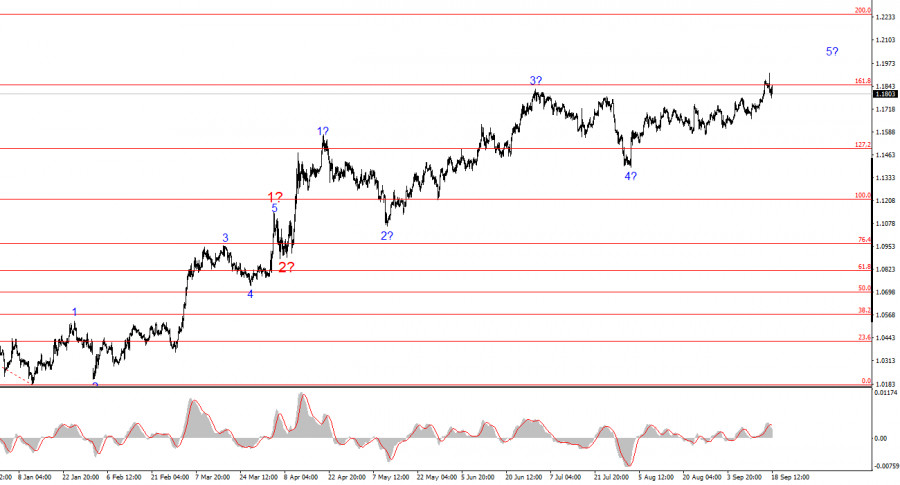

The wave structure on the 4-hour chart for EUR/USD has remained unchanged for several months, which is very encouraging. Even when corrective waves form, the integrity of the structure is preserved. This makes accurate forecasting possible. I should remind you that wave counts rarely look textbook-perfect. Right now, however, they look very good.

The construction of the upward trend section continues, while the news background mostly supports everything but the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. The market's dovish expectations regarding Fed policy are growing. Market participants rate the results of Trump's first six to seven months very poorly, despite second-quarter economic growth of 3%.

At this stage, it can be assumed that the construction of impulse wave 5 is ongoing, with potential targets reaching as high as the 1.25 level. Within this wave, the structure is fairly complex due to the sideways movement observed over the past month. Still, waves 1 and 2 can be distinguished, leading me to believe that the instrument is now in wave 3 of 5.

The EUR/USD rate declined slightly on Wednesday and Thursday, which can be seen as an illogical move. On Wednesday evening, the outcome of the Fed's sixth meeting of the year was announced. Market expectations were entirely dovish. Everyone is now convinced of at least two rounds of monetary easing before year-end. However, given the last four labor market reports and the dubious growth of the U.S. economy in Q2, market participants are now expecting more from the regulator—specifically, two more rounds in addition to Wednesday's.

As expected, the FOMC unanimously approved easing, but as I noted yesterday, such a decision does not automatically make the Committee dovish. Most Fed governors lean toward two or three easing rounds this year, including September's. Another cut is "planned" for next year, but clearly the "dot plot" should not be called a plan. Wednesday's decision was one the Fed had no choice but to take. But there is a big difference between cutting rates several times and cutting them at every meeting until they reach a level that satisfies Trump.

Wednesday's vote reflected how future Fed meetings will proceed. Mr. Miran, who has been a governor for all of two days, will vote for 50-basis-point cuts at every meeting, Waller and Bowman will push for 25, and everyone else will decide based on economic data. Three doves are not enough to keep lowering rates beyond the currently expected two to three rounds.

Based on this EUR/USD analysis, I conclude that the pair continues to build an upward trend section. The wave structure remains entirely dependent on the news background linked to Trump's decisions and the domestic and foreign policies of the new White House administration. Targets for the current trend may extend up to the 1.25 level. Since the news background remains unchanged, I continue to hold long positions, despite the completion of the first target near 1.1875, which corresponds to 161.8% Fibonacci. By year-end, I expect the euro to rise toward 1.2245, equal to 200.0% Fibonacci.

On a smaller scale, the entire upward section is visible. The wave count is not perfectly standard since corrective waves vary in size. For example, the larger wave 2 is smaller than the inner wave 2 in 3. But such cases do occur. I remind you that it is best to identify clear structures on the chart rather than tie yourself to every wave. At present, the bullish structure raises virtually no doubts.

Key Principles of My Analysis:

ລິ້ງດ່ວນ