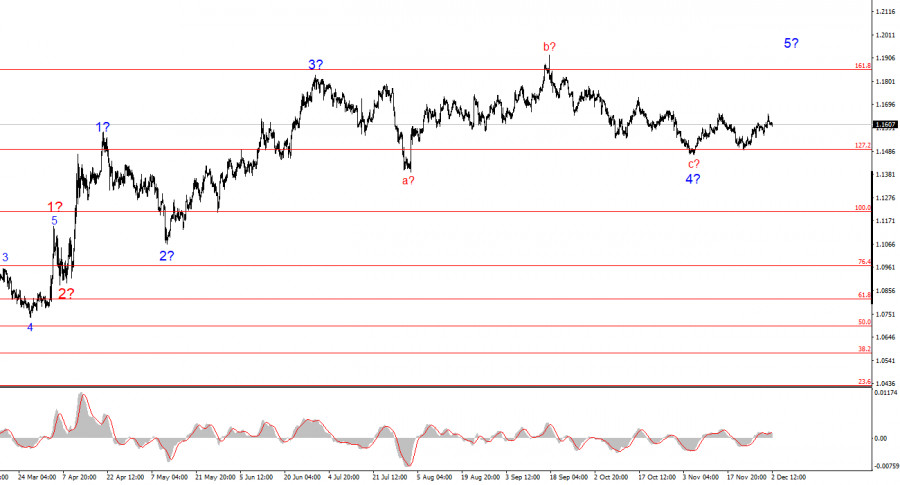

The wave pattern on the 4-hour chart for EUR/USD has transformed, but overall it remains quite clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure since July 1 has become significantly more complex and extended. In my view, the instrument has completed the formation of corrective wave 4, which took on a very unconventional form. Inside this wave, we observe solely corrective structures, so there is no doubt about the corrective nature of the decline.

In my opinion, the construction of the upward trend segment is not over, and its targets extend all the way up to the 1.25 level. The a-b-c-d-e wave series looks complete; therefore, in the coming weeks, I expect the formation of a new upward set of waves. We have seen the presumed waves 1 and 2, and the instrument is currently in the process of building wave 3 or c. I expected the second wave to finish in the 38.2%–61.8% Fibonacci level of the first wave, but the quotes fell to 76.4%. Over the past few days, everything has been unfolding according to plan.

The EUR/USD exchange rate remained almost unchanged during Tuesday by the start of the U.S. trading session. About half the day passed, but all the most interesting and important reports and events had already occurred. Overnight, Federal Reserve Chair Jerome Powell unexpectedly delivered a speech; however, this time he did not touch on monetary policy issues. A few hours ago, reports on unemployment and inflation were released in the Eurozone, but once again, reports from a single region contradicted each other.

Inflation in the Eurozone rose to 2.2% year-over-year. I cannot say this is a high value, nor that the ECB should sound the alarm. 2.2% is very close to the ECB's target, and everyone understands that inflation cannot be exactly 2% every month. Therefore, there is nothing alarming about a slight acceleration in price growth. But at the same time, the market did not expect an increase, and the ECB—by even half a step—moves slightly closer to raising interest rates. Naturally, this half-step means little, since the probability of tightening remains minimal and will stay that way until inflation reaches at least 2.5–2.6%.

Meanwhile, the unemployment rate rose to 6.4%, which the market also did not expect. Naturally, higher unemployment is negative for the European economy and the euro. However, the first report (inflation) was positive for the euro, and overall the market concluded that the euro does not deserve either selling or buying at this point.

Based on the EUR/USD analysis, I conclude that the instrument continues building an upward trend segment. For several months the market has taken a pause, but Donald Trump's policies and the Federal Reserve remain strong factors that may weaken the U.S. dollar in the future. The targets for the current trend segment may extend up to the 1.25 level. At this time, the formation of an upward wave sequence may continue. I expect that from current levels, the formation of the third wave in this sequence will continue, which may be either c or 3. For now, I remain in long positions with targets in the 1.1670–1.1720 range.

On a smaller scale, the entire upward trend segment is visible. The wave pattern is not the most standard, as the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 in wave 3. But this also happens. I remind you that it is best to isolate clear structures on charts rather than forcefully tie every move to a specific wave. Right now, the upward structure leaves no doubt.

Key principles of my analysis: