The last shall be first. Signs of a deteriorating U.S. economy and uncertainty due to the shutdown prompted investors to diversify their portfolios. At the beginning of November, they reduced their exposure to technology companies. Rumors of a soon-to-be-resumed government operation brought everything back to normal. The stocks of the Magnificent Seven recorded their best performance since May. As a result, the S&P 500 has risen from the ashes.

Just like the Federal Reserve, investors operated in a fog due to a lack of information. The end of the shutdown will allow the release of U.S. economic data and, based on that information, help predict the central bank's future moves. History shows that when the government was shut down in 2013, employment data surfaced a couple of days after resuming operations.

Concerns about the overvaluation of technology stocks and low returns from investments in artificial intelligence have become a thing of the past. The market has once again bought the dip. Furthermore, Wall Street experts are highly optimistic. For instance, Morgan Stanley believes that reliable corporate earnings will give momentum to the stock market in 2026. As data on the state of the U.S. economy is released, uncertainty regarding the fate of the Fed's rate will gradually dissipate.

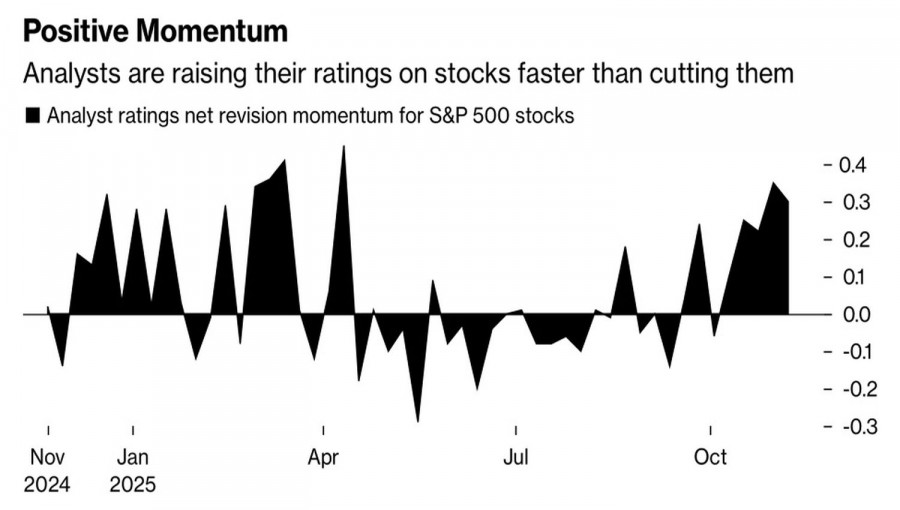

Indeed, in the third quarter, earnings of S&P 500 issuers grew by 14.6%, well above expectations. Morgan Stanley points to the continuous upward revision of forecasts by Wall Street experts as a bullish factor. The difference between optimists and pessimists has reached its highest level since April.

One of the "bulls" is UBS Group, which expects the S&P 500 to reach a record high of 7,500 by mid-2026. This implies an 11% rally from current levels. According to the firm, technological giants will continue to generate solid profits and lead other issuers in the broad stock index.

It seems that the period of fear dominance in the U.S. stock market has come to an end. Greed has returned. At the same time, strong data about the U.S. economy will positively impact the S&P 500 due to expectations of earnings growth. Weak statistics will also stimulate a rally in the broad stock index due to an increased likelihood of the Fed easing monetary policy.

"Bulls" find themselves in a win-win situation amid the divergent, or K-shaped, U.S. economy. The gap between wealthy Americans who own stocks and the poor without securities is widening. Meanwhile, the Fed's safety net assists both categories.

Technically, on the daily chart of the S&P 500, buyers easily played the pin bar and opened the trading session with a gap upwards. All moving averages remain behind, indicating the seriousness of the bulls' intentions. Long positions established from 6731 should be held and expanded. Target levels are set at 7000 and 7140.