Centrální banka Filipín oznámila pokles hrubých devizových rezerv země na 104,6 miliardy dolarů ke konci dubna, oproti 106,7 miliardy dolarů z předchozího měsíce. Tato informace byla zveřejněna ve středu na základě předběžných dat.

Navzdory tomuto poklesu banka ujistila, že současná úroveň devizových rezerv i nadále poskytuje silnou externí likviditní rezervu. Tato rezerva odpovídá 7,2 měsíce dovozu zboží a plateb za služby a primární důchody, uvedla banka ve svém prohlášení.

Several macroeconomic releases are scheduled for Tuesday. In Germany, the final estimate of September inflation will be published. It should be noted that the second reading is almost always a formality. Additionally, ZEW economic sentiment indices for Germany and the Eurozone will be released. While these are considered important indicators, we do not expect a strong market reaction.

In the United Kingdom, the most interesting and significant reports will be released: unemployment, jobless claims, and wage growth figures. If the data are neutral and in line with forecasts, traders are unlikely to react. However, any surprising or extreme values could trigger significant movement.

There are several fundamental events planned for today, but the primary focus is on Jerome Powell's speech. In recent weeks, we have heard from many representatives of the Federal Reserve, Bank of England, and European Central Bank— and learned nothing new. As a result, most speeches by central bank officials no longer have a significant influence on the currency markets.

Powell himself has spoken several times recently, and his rhetoric has remained unchanged. There is no reason to expect a more "dovish" or "hawkish" tone from the Fed Chair, especially given the current situation in the U.S., where macroeconomic data are not being published due to the government shutdown. Without data, the Federal Reserve is unable to assess inflation trends, labor market conditions, or unemployment levels — prerequisites for adjusting its monetary policy stance.

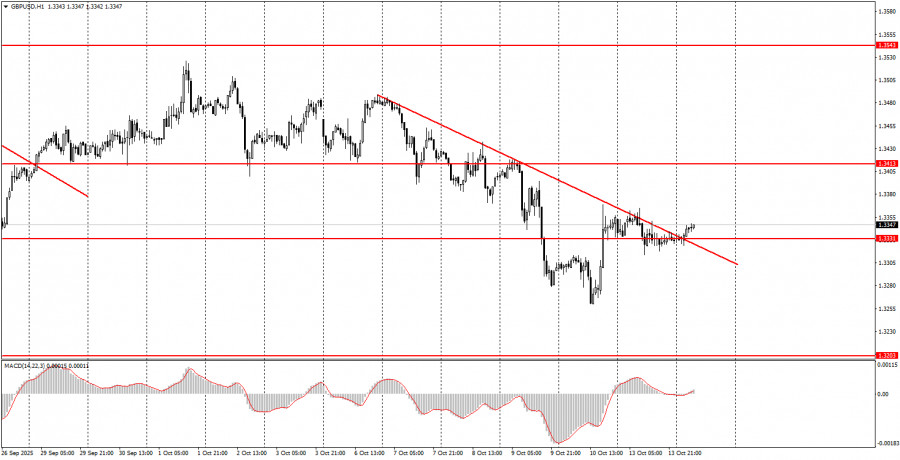

During the second trading day of the week, both currency pairs may continue to move chaotically and irrationally. For now, we are predominantly observing a decline in both EUR/USD and GBP/USD, for which logical explanations are hard to find.

Today, the euro may start a new upward movement toward the 1.1655–1.1666 area if it consolidates above the 1.1571–1.1584 zone. The British pound may continue rising after confirming a breakout above the trendline and the 1.3329–1.3331 area, targeting the 1.3413–1.3421 resistance level.

Important speeches and reports (always listed in the economic calendar) can strongly affect the movement of a currency pair. Therefore, during such events, it is recommended to trade with maximum caution or exit the market altogether to avoid sharp price reversals.

Beginner traders should remember that not every trade will be profitable. Developing a strict trading strategy and proper money management are key to long-term success in forex trading.