Analysis of Trades and Trading Tips for the British Pound

The price test at 1.3463 occurred at a time when the MACD indicator had moved significantly below the zero mark, which limited the downward potential of the pair.

Pound buyers failed to offer anything significant at the end of last week in the GBP/USD pair. The negative dynamics of the pound were reinforced by several factors, among them — investor caution ahead of key economic publications from the UK and ongoing uncertainty about the prospects for continued growth in the British economy.

Today, there are no UK economic releases; however, speeches are expected from Bank of England Monetary Policy Committee member Huw Pill and Bank of England Governor Andrew Bailey. Statements from policymakers are unlikely to lend much support to the pound, which remains in a rather fragile position due to ongoing concerns about the UK's economic outlook. Markets will likely watch the tone of these speeches closely for any signs of potential future interest rate cuts. Investors are also eager to hear how the Bank of England assesses the current inflation situation and risks of recession. Any hints at a more dovish stance could put pressure on the pound.

As for my intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Scenarios

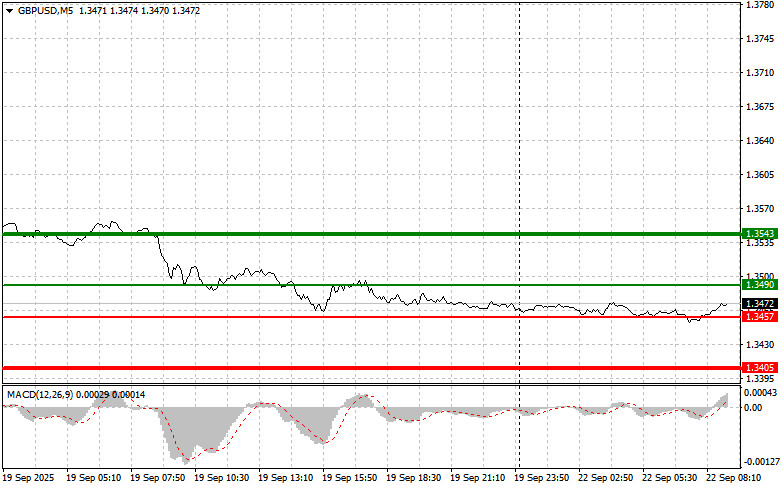

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3490 (green line on the chart) with a target growth to the level of 1.3543 (thicker green line on the chart). Around 1.3543, I intend to exit long positions and open short positions in the opposite direction (expecting a move of 30–35 points in the opposite direction from that level). A strong upward move in the pound can only be expected if BoE officials take a hawkish stance. Important! Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3457 price level at a time when the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a market reversal upward. Growth to target levels of 1.3490 and 1.3543 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after a break below the 1.3457 level (red line on the chart), which will lead to a rapid decline in the pair. Sellers' key target will be the 1.3405 level, where I plan to exit short positions and open long positions in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pound sellers will show their presence if UK economic data turns out weak. Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3490 price level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline to target levels of 1.3457 and 1.3405 can be expected.

What's on the chart:

Important: Beginner forex traders should be very cautious when making decisions to enter the market. It is best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price movements. If you choose to trade during news events, always use stop-loss orders to minimize losses. Without stop-loss orders, you risk losing your entire deposit very quickly, especially if you do not use money management and trade in large volumes.

And remember: for successful trading, it is essential to have a well-defined trading plan — such as the one I've presented above. Making spontaneous trading decisions based on current market situations is an inherently losing strategy for an intraday trader.