Canada's economy is slowing down. The latest car sales report showed a 3.2% m/m decline in July, marking the fourth consecutive monthly drop following a spike in March when consumers rushed to make purchases before the introduction of tariffs. Meanwhile, in the U.S., car sales rose by 7.1% m/m in July.

The Bank of Canada is expected to keep its key interest rate at 2.75% until the end of the year. At first glance, given that the Federal Reserve may cut rates in September and possibly again in November and December, the resulting yield differential should favor the Canadian dollar and potentially allow it to resume strengthening. However, since the issue of tariffs remains unresolved, such assumptions remain purely speculative. The introduction of higher tariffs will inevitably lead to a reassessment of risks—and, consequently, a reassessment of the Bank of Canada's policy.

The Fed, based on Jerome Powell's position, is preparing for the threat of rising inflation driven by the new tariff policy. The situation is further complicated by incoming data this week that clearly indicate a slowdown in U.S. consumer demand. The Fed is increasingly forced to navigate between conflicting trends—rising inflation necessitates tighter monetary policy, while weakening demand and a slowing economy call for easing.

As a result, by the time of the September meeting, the Fed may find itself in a position where no good option exists. The White House is actively pushing for rate cuts, and this demand is clearly justified. Beyond the disappointing NonFarm Payrolls, several other indicators confirm the slowdown trend—such as a weaker ISM Services reading, falling employment indices in ISM reports, rising inflation expectations from the University of Michigan alongside a drop in consumer sentiment, and more. However, if July's consumer inflation data (due on August 12) shows an increase, the probability of a Fed rate cut will fall again, escalating the standoff between the Fed and the Trump administration—with unpredictable consequences.

This new wave of uncertainty may slow the rise of USD/CAD despite ongoing tariff risks, but overall, the trend remains bullish.

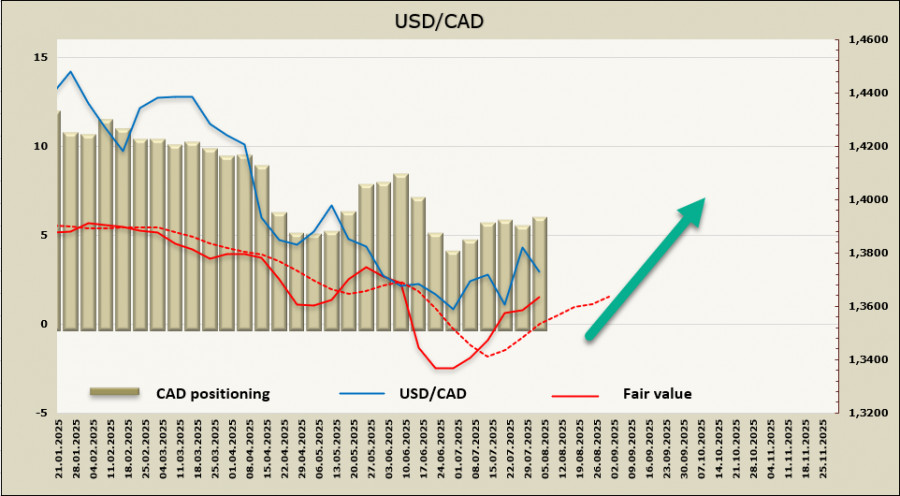

The net short position on CAD slightly increased to -5.3 billion dollars over the reporting week. Speculative positioning remains bearish, and the fair value model suggests further growth.

In the previous report, we expected a confident rise in USD/CAD, but a poor employment report altered Fed rate expectations and triggered a dollar sell-off. We assume this factor has already been priced in, and after a brief consolidation, the pair will resume its upward movement. Support is located at 1.3660/60, and a decline below this level is unlikely. For now, growth is capped by the resistance zone at 1.3910/30, and breaking through it would require new drivers.