Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Monday Trade Review:

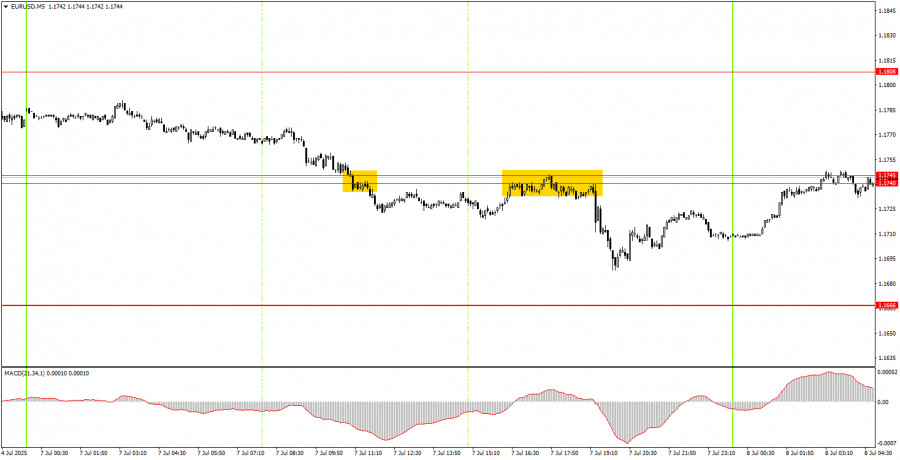

EUR/USD, 1H Chart

On Monday, the EUR/USD pair traded with a downward bias, and the U.S. dollar posted a fairly strong gain. As we've mentioned before, even under Donald Trump, the dollar can't decline every single day—periodic corrections are to be expected. However, any sudden rise in the dollar tends to be viewed with skepticism and caution.

Yesterday, the Eurozone released a fairly neutral retail sales report, while Germany published strong industrial production data. Therefore, the macroeconomic backdrop should have supported euro growth rather than a decline. There were no particularly impactful fundamental events. Trump continued issuing threats and imposing or raising tariffs, and Elon Musk announced the creation of the "American Party." These headlines were unlikely to serve as grounds for dollar strengthening. Thus, we tend to view the current market movement as a technical correction, which is unlikely to be strong or long-lasting.

On the 5-minute timeframe, two trading signals were formed on Monday. During the European session, the price broke through the 1.1740–1.1745 level, and during the U.S. session, it rebounded from that same area from below. These two sell signals mirrored each other, so novice traders could have entered only one trade. By the end of the day, the pair moved about 25–30 points downward—enough to secure a profit.

On the hourly timeframe, the EUR/USD pair maintains an upward trend, despite breaking the ascending trendline. The fact that Donald Trump remains president is still enough to cause periodic declines in the dollar. Of course, the dollar will occasionally correct upward, but overall, the fundamental backdrop makes strong dollar growth highly unlikely. Last week, the U.S. had macroeconomic support, but it didn't help the dollar. This week, the price may continue to decline slightly, but a break above the descending trendline would signal renewed growth.

On Tuesday, EUR/USD may remain flat or trade with low volatility. No major events are scheduled for the second trading day of the week.

On the 5-minute timeframe, watch the following levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1561–1.1571, 1.1609, 1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

On Tuesday, there will be no macroeconomic background in either the Eurozone or the U.S. However, yesterday Donald Trump announced a tariff hike to 25% for Japan and South Korea—as expected.

Reminder for Beginners:Not every trade can be profitable. Developing a clear strategy and following money management principles are key to long-term success in forex trading.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.