On Thursday, the EUR/USD pair continued its upward movement and consolidated above the 100.0% Fibonacci retracement level at 1.1574. However, during the night, a sharp reversal occurred in favor of the U.S. dollar, with a break below this level, and the decline is currently continuing toward the 76.4% Fibonacci level at 1.1574. The news background has had a strong influence on market sentiment over the past two days, and high volatility is likely to persist today.

The wave pattern on the hourly chart remains clear. The last completed downward wave did not break the previous low, while the most recent upward wave easily surpassed the previous peak. This confirms the continuation of the current "bullish" trend. Recent news about increased tariffs on steel and aluminum forced bears to retreat once again, and the lack of real progress in U.S.–China negotiations keeps them from launching new attacks. A bearish trend may only be considered if the pair consolidates below the 1.1374–1.1380 zone.

On Thursday, Donald Trump announced his intention to raise tariffs on all countries currently engaged in trade talks with the U.S. This move has been announced but not yet implemented. It appears to be another pressure tactic on nations that, according to Trump, should either ease restrictions on American goods or indirectly pay more into the U.S. budget through American consumers. Trump claims that negotiations are proceeding too slowly and is threatening to raise tariffs as a result.

It's worth recalling that two months ago, Trump declared a 90-day "tariff truce" during which import tariffs would remain in place but be reduced to a minimum of 10%. With about a month left until that deadline, no trade agreements have been signed yet. Only the UK has reached a tentative agreement, but it hasn't been officially signed. Thus, the trade war continues to escalate, giving bulls new reasons to enter the market every other day.

On the 4-hour chart, the pair previously reached and consolidated above the 127.2% Fibonacci level at 1.1495, suggesting that the euro's growth could continue toward the next target at 1.1680. The ascending channel clearly indicates the continuation of the bullish trend. A break below 1.1495 could trigger a reversal in favor of the U.S. dollar, leading to a decline toward the lower boundary of the channel. No emerging divergences are currently visible on any indicators.

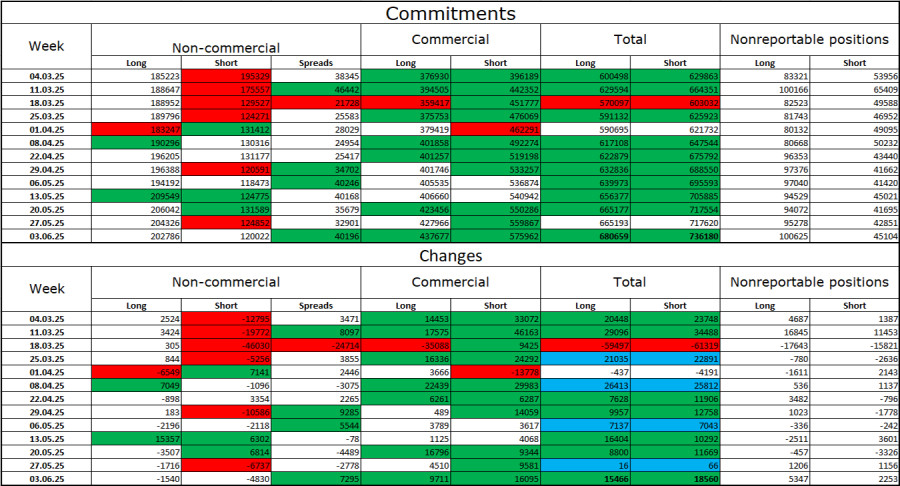

Commitments of Traders (COT) Report

During the latest reporting week, professional traders closed 1,540 long contracts and 4,830 short contracts. The sentiment of the "Non-commercial" group remains bullish, largely due to Donald Trump. The total number of long positions held by speculators now stands at 203,000, while short positions are at 120,000 — and the gap (with rare exceptions) continues to widen. This suggests strong demand for the euro and little interest in the dollar. The overall situation remains unchanged.

For eighteen consecutive weeks, large traders have been reducing their short positions and increasing long ones. While the policy divergence between the ECB and the Fed is already significant, Donald Trump's political stance has become an even more decisive factor for traders, as it could lead to a U.S. recession and other long-term structural problems.

News Calendar for the U.S. and the Eurozone:

The June 14 economic calendar contains three secondary events. Therefore, the news background's influence on market sentiment is expected to be weak or nonexistent. Traders already have enough news to justify continued selling of the U.S. dollar, without needing to pay attention to German inflation or Eurozone industrial production.

EUR/USD Forecast and Trading Tips:

Selling the pair was possible after a close below 1.1574 on the hourly chart, with a target of 1.1454. I previously recommended buying after a rebound from the 1.1374–1.1380 zone with targets at 1.1454 and 1.1574 — both of which have been achieved. New long positions may be considered on a rebound from 1.1454 or after a close above 1.1574.

Fibonacci levels are plotted from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.