Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

The EUR/USD currency pair experienced upward movement for approximately half of Wednesday. The latest "surge" in the euro was particularly "impressive," although it was likely just another fall in the dollar. The euro and the pound remain mere bystanders in this Trump-led performance—only the dollar changes in price and attractiveness. Yesterday, the market spent half the day selling off the US currency amid slowing US inflation. In essence, the drop in inflation is just a formal pretext to sell the dollar. The Federal Reserve, in any case, expects consumer prices to accelerate. In April, Trump's tariffs didn't have time to affect US prices, as many retailers had prepared in advance by stockpiling goods and choosing not to raise prices immediately. Therefore, inflation will accelerate eventually, and the Fed will not lower the key rate anytime soon. Nonetheless, the market seized the opportunity to get rid of the dollar — and did so wholeheartedly. The downtrend remains intact but is relatively weak. The dollar still finds it extremely difficult to appreciate.

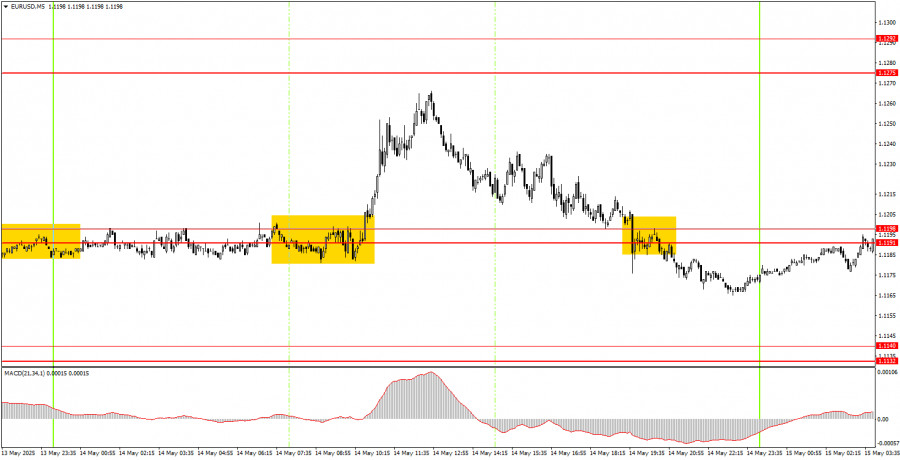

On the 5-minute time frame Wednesday, two trading signals were formed. First, the pair struggled to break away from the 1.1191–1.1198 area, rising about 50 pips. Unfortunately, the price did not reach the nearest target level of 1.1275, so any profit on the trade could only be secured by closing it manually. The next signal formed around the same area was quite weak. The sell signal came too late, but would not have resulted in a loss.

On the hourly time frame, the EUR/USD pair has finally started something resembling a downtrend. Overall, market sentiment remains extremely negative toward the US dollar. However, Trump has taken steps toward de-escalating the trade conflict he initiated himself, which means the dollar could strengthen in the near term. The extent of dollar growth will depend on how many agreements can actually be signed.

On Thursday, the EUR/USD pair will trade based on technical factors, although the macroeconomic background may have a moderate influence throughout the day. Numerous reports will be presented, but none of them are considered critically important.

On the 5-minute time frame, consider the following levels: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1275–1.1292, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. In the Eurozone, GDP and industrial production reports are scheduled for release on Thursday. These are not the critical data points, especially the second estimate of Q1 GDP. Retail sales, the Producer Price Index, and jobless claims will be published in the US. The first two may slightly influence market sentiment.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.