There were no tests of the levels I marked in the first half of the day.

European credit activity statistics had little significant impact on the euro during the first half of the day. Despite a slight improvement in some indicators, the overall picture remains relatively clear. Corporate lending shows signs of stabilization, likely linked to concerns about future economic growth and the current geopolitical situation. Meanwhile, consumer lending remains resilient, particularly in the mortgage segment. Low interest rates and a booming real estate market are stimulating housing demand, thereby supporting credit activity. However, this dynamic may prove unsustainable in the long term if interest rates rise and real estate prices fall.

During the U.S. session, data on Job Openings and Labor Turnover (JOLTS) and the Consumer Confidence Index are expected. Investors and analysts closely monitor these indicators, as they can provide valuable insights into the state of the U.S. economy and potential monetary policy directions of the Federal Reserve. The JOLTS job openings figure reflects labor demand, and its growth could indicate economic strengthening, supporting the dollar.

The Consumer Confidence Index, on the other hand, reflects consumers' views on the current and future economic situation. A decline is forecasted, which could suggest lower spending and slower economic growth — negative for the dollar.

For today's intraday strategy, I will rely mainly on the execution of Scenario #1 and Scenario #2.

Buy Signal

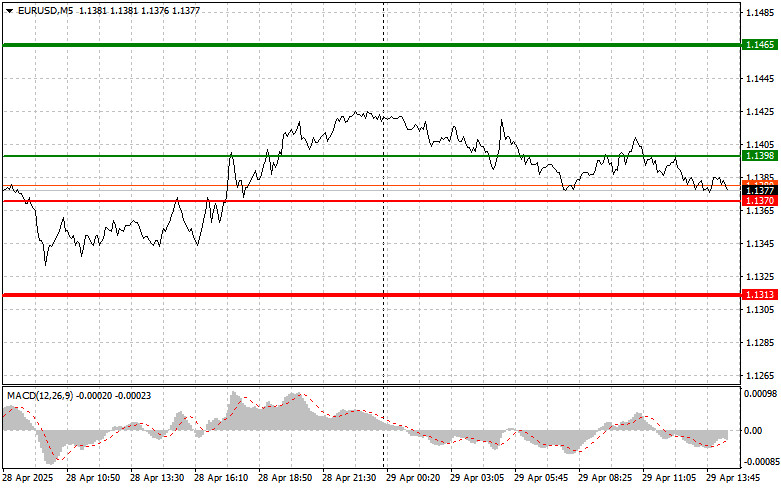

Scenario #1: Today, I plan to buy the euro upon reaching the entry point around 1.1398 (green line on the chart), targeting a rise to 1.1465. At the 1.1465 level, I plan to exit the market and open a sell position in the opposite direction, expecting a 30–35 point move from the entry point. The euro's growth can be expected either following the trend or after weak U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1370 price level, at a time when the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a market reversal upwards. Growth towards the opposite levels of 1.1398 and 1.1465 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1370 level (red line on the chart). The target will be 1.1313, where I plan to exit the market and immediately open a buy position in the opposite direction, aiming for a 20–25 point move from the level. Pressure on the pair may return if buyers show no activity near the daily high. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1398 price level, at a time when the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a market reversal downwards. A decline toward the opposite levels of 1.1370 and 1.1313 can be expected.

What's on the Chart:

Important

Beginner traders on the Forex market must be very cautious when making market entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid being caught in sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you do not practice proper money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Spontaneously making trading decisions based on the current market situation is fundamentally a losing strategy for an intraday trader.