On Thursday, the EUR/USD pair traded sideways. The outcome of the ECB meeting had virtually no impact on market sentiment—and the meeting itself turned out to be uneventful. As a result, the EUR/USD pair continues to trade within the range of 1.1712 to 1.1802, without breaking through either level. Today, a rebound from either of these levels would signal a move in the opposite direction toward the other boundary of the range.

The wave pattern on the hourly chart remains straightforward and clear. The last completed downward wave failed to break the previous low, while the most recent upward wave surpassed the prior high. Therefore, despite the extended correction, the current trend remains bullish. The lack of real progress in the U.S. trade negotiations, the low likelihood of concluding trade agreements with most countries, and the imposition of new tariffs continue to weigh heavily on bearish prospects.

On Thursday, the ECB held its fifth policy meeting of the year but made no changes to its monetary policy. As a reminder, the ECB had cut interest rates at each of its four previous meetings this year. However, inflation in the eurozone has slowed into the desired range, and the ECB remains highly concerned about the outcome of trade negotiations between the U.S. and the EU. If a deal cannot be reached, Donald Trump is expected to impose higher tariffs, prompting the EU to respond in kind, potentially driving up inflation. For this reason, continuing to ease policy without an agreement is risky. At the same time, any tariffs would weigh on the already sluggish European economy. If a deal is reached, the economy may feel some relief, and inflation may remain at its current levels. In that case, the ECB may consider further easing. As such, future policy decisions will depend on the outcome of talks between Washington and Brussels.

On the 4-hour chart, the pair reversed in favor of the euro and consolidated above the 1.1680 level. Previously, the euro had closed below the ascending trend channel. I still refrain from concluding that a bearish trend has begun. In my view, the hourly chart is currently more informative. The pair exited the trend channel not due to strong bearish pressure but due to a prolonged correction. The upward movement may continue toward the 161.8% Fibonacci level at 1.1854.

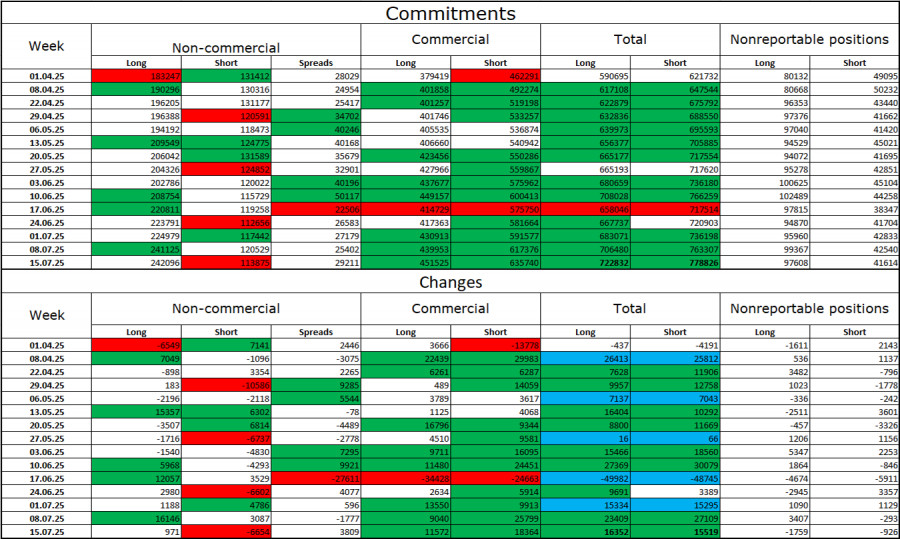

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders opened 971 new long positions and closed 6,654 short positions. Sentiment among the "Non-commercial" category remains bullish, largely thanks to Donald Trump, and continues to strengthen. Speculators now hold a total of 242,000 long positions and just 113,000 short contracts—a more than twofold gap. Also noteworthy is the number of green cells in the table above, indicating strong accumulation of euro positions. In most cases, interest in the euro continues to grow, meaning sentiment toward the dollar is weakening.

For 23 consecutive weeks, large traders have been reducing short positions while increasing longs. The divergence in monetary policy between the ECB and the Fed remains significant, but Donald Trump's policies are viewed as a more influential factor, as they could trigger a recession in the U.S. economy and a host of other structural, long-term problems for America.

News Calendar for the U.S. and the Eurozone:

The economic calendar for July 25 includes two entries. The overall influence of the news background on market sentiment this Friday may be limited.

EUR/USD Forecast and Trading Tips:

Selling the pair today is possible in case of a rebound from the 1.1802 level on the hourly chart, targeting 1.1712—or in the event of a break below 1.1712, targeting 1.1645. Buying opportunities were available on a rebound from 1.1574, a close above 1.1645, or a close above 1.1712 with a target of 1.1802. Today, long positions can still be held with targets of 1.1802 and 1.1888 until a sell signal emerges. I recommend moving Stop Loss orders closer to current price levels.

Fibonacci grids are drawn from 1.1574 to 1.1066 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.

TAUTAN CEPAT