The EUR/USD currency pair rose slowly but steadily on Wednesday and Thursday. On Wednesday, the macroeconomic background did not support the rise of the European currency; however, the bulls made an effort and pushed the pair up by several dozen pips. On Thursday, the macroeconomic background was completely absent, yet the euro appreciated by another couple of dozen pips. Thus, the euro is growing, albeit with great difficulty. The question is, how long will such a struggle for growth continue?

We continue to expect only growth for the EUR/USD pair in the medium term, but the market has been in a total flat pattern for the past five months. Therefore, the number one task is to wait for the flat to end. A couple of weeks ago, the price dropped twice to the lower boundary of the sideways channel at 1.1400-1.1830, allowing for long positions to be opened. However, at the same time, no clear buy signal emerged, such as a retest of the 1.1400 level or a liquidity sweep at that level. The euro is rising now, but the basics of technical analysis tell us that as long as the last high has not been broken, the downward trend cannot be considered finished. Therefore, the current growth of the euro may be the beginning of a long and strong upward movement, or it could be just another "noise" within the sideways channel on the daily timeframe.

Our expectations remain unchanged—only the decline of the U.S. dollar. It should be remembered that 2026 is approaching, and this year the Federal Reserve may conduct monetary easing in isolation, as the European Central Bank has already completed its easing cycle, and the Bank of England is unlikely to significantly lower the key rate next year. The UK needs to address the high inflation issue before lowering rates. The latest report signaled a slowdown in inflation, but this is only for one month, not a trend. Thus, the Fed will likely cut its rates much more aggressively than the ECB or the BoE. Furthermore, given that Jerome Powell will step down next year and a new head will be appointed by Trump to take his place, monetary easing may occur much more rapidly than many expect now.

In the last two months, the market has desperately ignored all "bearish" factors for the dollar. However, we want to emphasize that this will not last forever. The market remains in a flat pattern, which explains the lack of reaction to many fundamental events. Nonetheless, we believe that the market will not forget about these events. The flat is a time for forming new positions. Therefore, market makers are preparing for a new trend. Frankly, it is difficult for us to envision a bullish dollar trend under the current circumstances in the U.S.

On the 4-hour timeframe, the pair remains above the moving average, which allows for expectations of further upward movement. From our perspective, it is advisable not to disregard the current buying opportunities, as we may be witnessing the beginning of a new phase of the global upward trend.

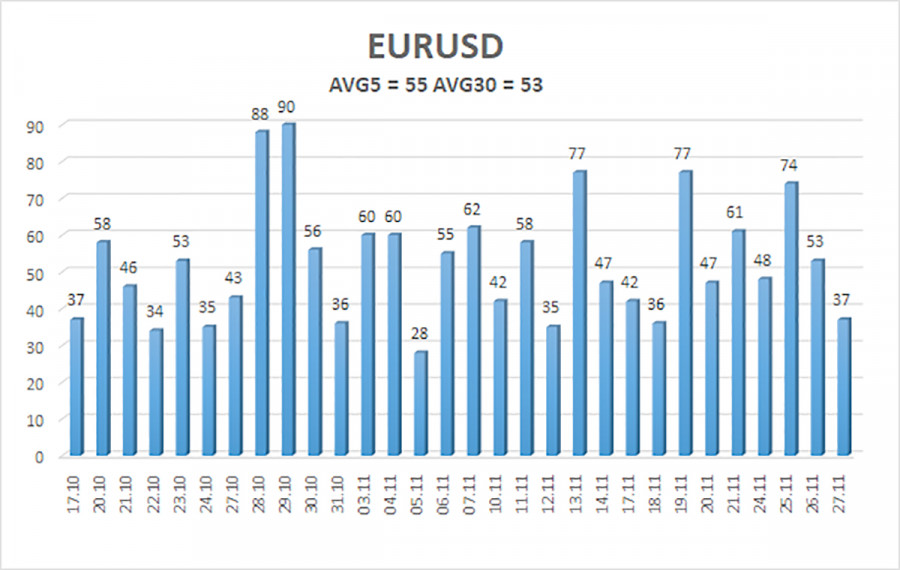

The average volatility of the EUR/USD currency pair over the last five trading days as of November 28 is 55 pips, which is considered "average." We expect the pair to trade between 1.1542 and 1.1652 on Friday. The upper linear regression channel is directed downwards, signaling a downward trend, but in fact, the flat continues on the daily timeframe. The CCI indicator entered the oversold zone twice in October, which may trigger a new phase of the upward trend in 2025.

The EUR/USD pair remains below the moving average, but the upward trend persists across all higher timeframes, while the daily timeframe has been flat for several months. The global fundamental background continues to exert a strong influence on the U.S. dollar. Recently, the dollar has been rising, but the reasons for this movement may be purely technical. Given the price is below the moving average, small short positions targeting 1.1505 can be considered on technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

QUICK LINKS