The euro continued to lose ground against the dollar, while the pound remained trading within a sideways channel. Pressure on the Japanese yen significantly increased following news of a contraction in the Japanese economy in the third quarter of this year.

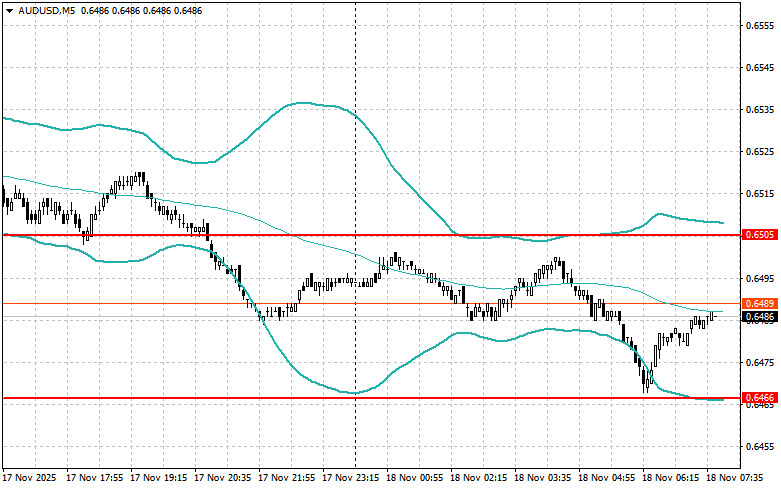

Strong data on the growth of the Empire Manufacturing Index in the U.S. and statements from Federal Reserve representatives regarding cautious interest rate cuts helped the U.S. dollar strengthen against several risk assets yesterday. Traders continued to reassess their expectations for further U.S. rate cuts. In the short term, the dollar's dynamics will likely continue to depend on U.S. economic data and the Fed's rhetoric. If the data remains strong and the Fed maintains a cautious approach to rate cuts, the dollar may continue to strengthen.

Unfortunately, there are no reports from the Eurozone scheduled for the first half of the day today, so strong volatility in the EUR/USD pair is unlikely. This means that traders focused on short-term fluctuations are unlikely to find significant trading opportunities. Trading volumes are also likely to remain low as major institutional investors prefer to wait for the release of more significant economic data. In such conditions, where determining factors are absent, technical analysis comes to the forefront. Support and resistance levels established in previous trading sessions become key reference points.

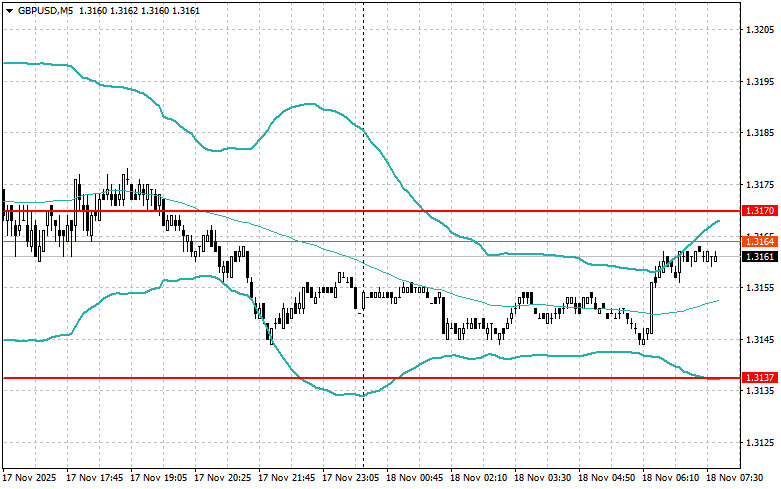

As for the British pound, there are also no data releases for the UK in the first half of the day. Given the lack of macroeconomic news, the market's attention will be entirely focused on Huw Pill's speech. His comments on current inflation, prospects for monetary policy, and the overall state of the British economy may influence the British pound's quotations and investor sentiment. The market will closely monitor signals from the Bank of England regarding potential future actions. Any hints of a more "wait-and-see" stance, suggesting that rates will remain unchanged to combat inflation, could strengthen the pound. Conversely, more "dovish" signals of potential future rate cuts may pressure the British currency.

If the data align with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data turns out to be significantly higher or lower than economists' expectations, the Momentum strategy would be the best approach.

QUICK LINKS