China has decided to tighten export conditions for rare earth metals starting December 1, 2025. The United States is actively trying to dissuade Beijing from implementing these restrictions. The question is—why, and what could this mean for the rest of the world?

China controls, by various estimates, up to 90% of global rare earth metals production. These resources are critical in sectors including automotive manufacturing, electronics, defense systems, and aerospace. While China has not announced a full export embargo, its rhetoric on the issue has already put many countries on edge. As of now, special government approval will be required to purchase these metals from China. It remains unclear who will be granted access and under which conditions. One thing is certain—not everyone will be able to buy what they need anymore.

Most economists believe China introduced these measures in retaliation to tariff threats from Donald Trump and that the restrictions may not apply broadly to all nations. Still, nothing is confirmed. If Beijing's aim is, in fact, to retaliate against Trump, the move is understandable. A literal trade war is underway between the two industrial giants. What did Trump expect—that China would not fight back?

Rare earth metals are used, among other things, in the production of Tomahawk missiles and F-35 fighter jets. This means China can—at least in theory—disrupt the manufacturing of certain advanced weapons systems abroad. Economists warn that tighter export restrictions could impact a wide range of industries and contribute to rising prices for electronics and automobiles, affecting everyday consumers.

Many tech firms are reportedly already seeking alternative rare earth suppliers, though replacing all Chinese imports in the short term is virtually impossible. The best hope is that Beijing and Washington will reach an agreement in November to prevent a new wave of global economic shocks and price instability.

Based on the above, this new phase of trade war escalation represents a serious global risk. The world has become increasingly fragmented in recent years, a trend sharply accelerated in 2025 by Donald Trump. Trump has been dictating who pays what for access to the U.S. market—and who may trade with whom and in what currencies. As such, many of the price tags now seen on global goods are a direct result of the American president's policies.

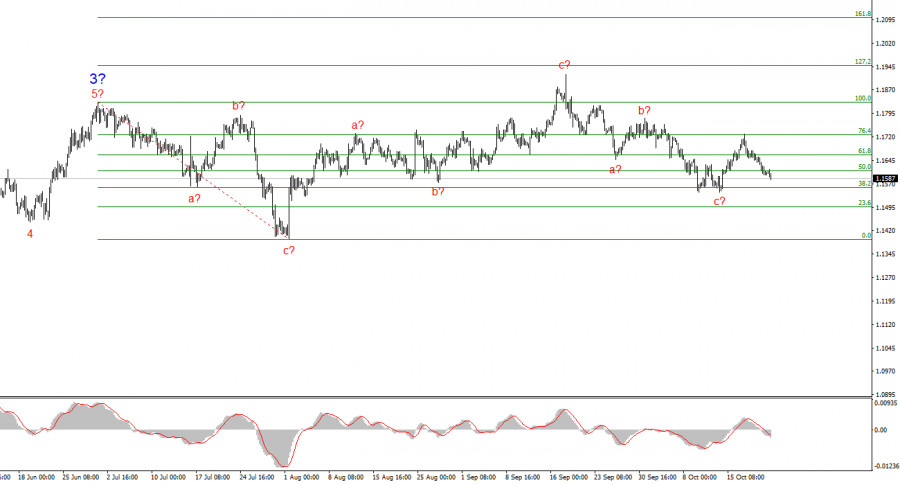

Based on the current wave analysis of EUR/USD, the pair continues to build an upward segment of the trend. The wave structure remains heavily dependent on news related to President Trump's decisions, as well as the foreign and domestic policy direction of the new U.S. administration. The current upward trend may extend up to the 1.25 area. At this moment, we are likely observing the formation of corrective wave 4, which is nearing completion and appears to be complex and extended. Therefore, I remain focused on buying opportunities. By year-end, I expect the euro to rise toward the 1.2245 level—approximately the 200.0% Fibonacci.

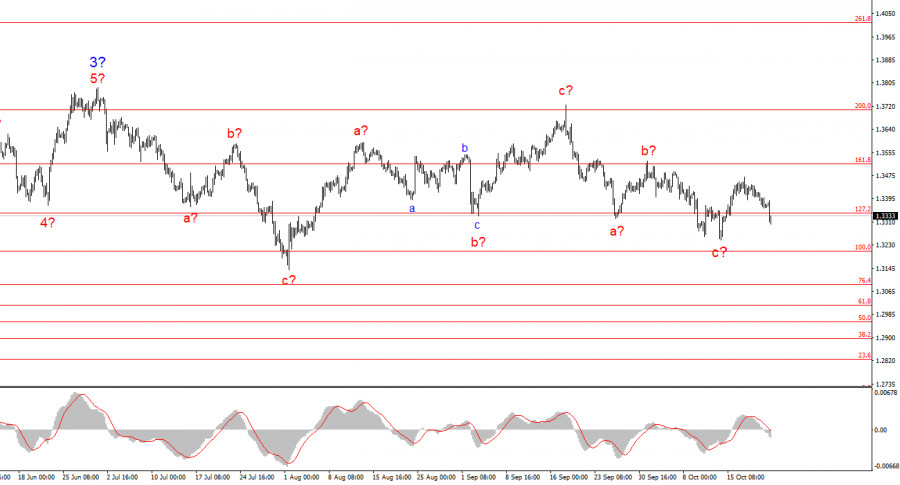

The wave pattern in GBP/USD has evolved. We are still within an upward, impulsive segment of the trend, but the internal structure has become more complex. Wave 4 is taking the form of a three-wave correction and is proving substantially more drawn out than wave 2. The most recent three-wave bearish correction appears to be completed. If this assessment is correct, the upward movement within the broader wave structure may resume, with initial targets near the 1.38 and 1.40 figures.

QUICK LINKS