The GBP/USD currency pair spent most of Thursday moving sideways, but there is no reason to think the uptrend has ended. The pound sterling has been steadily rising since completing a month-long correction (visible on the daily timeframe) and, logically, should now form a new phase of the trend that began in January 2025. Therefore, in any scenario, we expect further movement to the upside.

If the fundamental background were neutral or occasionally supportive for the dollar, we could allow for periods of U.S. currency growth not solely due to the technical need for occasional corrections. However, at present, even with a vivid imagination, it is tough to identify a factor the dollar could use to strengthen. In essence, for the U.S. currency to start rising, the factors that caused its collapse must be eliminated. This would ideally require Donald Trump leaving the U.S. presidency, the trade war either ending or at least shifting into a more peaceful phase, and the Federal Reserve abandoning any thoughts of cutting the key rate. None of these scenarios is realistic in the foreseeable future.

It is worth recalling that Trump has no intention of "stopping where he is." The U.S. president wants every country to contribute to the American budget in one way or another for access to its rich and generous market. Thus, there is no end in sight — not just to the trade war, but to new escalations. Naturally, Trump will not voluntarily step down, and all impeachment attempts have failed spectacularly. A few months ago, the media were abuzz with news about Elon Musk's party becoming the third major political force in the U.S., but recently, there has been no further word on the matter. And of course, there is the Fed's monetary policy. After the labor market setback and low inflation, even ordinary Americans will now be asking why Jerome Powell is not cutting the key rate.

As a reminder, the lower the rate, the easier it is for the economy to grow. Loans become cheaper, investment increases, the construction sector expands, and retail sales and business activity rise. However, for the dollar, this factor is not positive. Monetary policy easing is a bearish factor for a currency. If the dollar fell during the first half of the year with the Fed's rate still high, what will it do when the Fed eases policy?

On top of that, the Bank of England may pause its rate cuts for a long time. Inflation in the UK is approaching 4%, the economy is growing slowly but still growing, and the labor market is not experiencing serious problems. Thus, the BoE must once again focus primarily on price stability. At the last meeting, the Monetary Policy Committee voted "on the edge," with only five out of nine policymakers supporting a rate cut. Therefore, the next stage of easing may be a long way off — another factor unfavorable for the dollar.

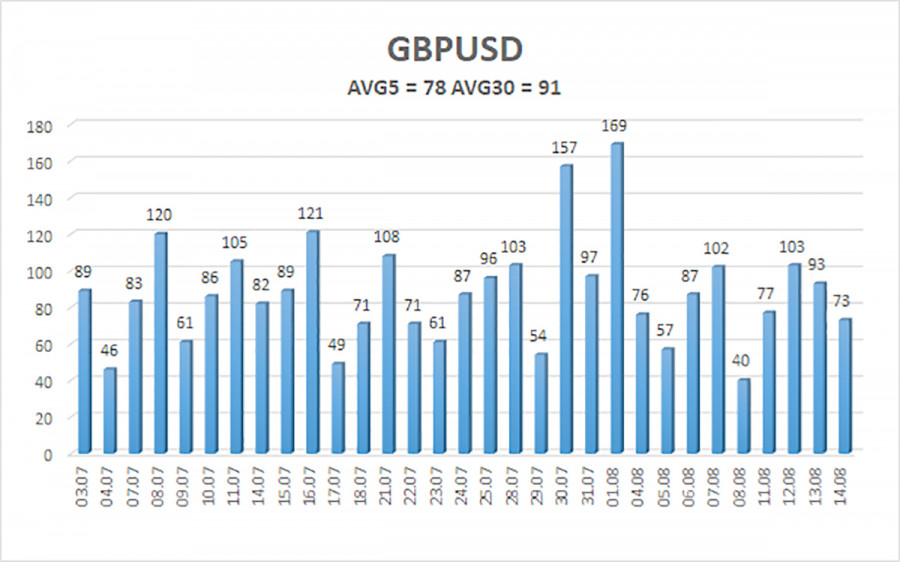

The average volatility of the GBP/USD pair over the last five trading days is 78 pips, which is considered "moderate" for this currency pair. On Friday, August 15, we expect movement within the range bounded by 1.3449 and 1.3605. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered the oversold zone twice, signaling the resumption of the upward trend. Several bullish divergences were also formed before the start of the rise.

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

The GBP/USD currency pair has completed another cycle of downward correction. In the medium term, Trump's policies will likely continue to put pressure on the dollar. Therefore, long positions with targets at 1.3611 and 1.3672 remain much more relevant when the price is above the moving average. If the price is below the moving average, small short positions can be considered with targets at 1.3367 and 1.3306 on purely technical grounds. From time to time, the U.S. currency shows corrections, but for a trend reversal and sustained strengthening, it needs clear signs of the end of the global trade war.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

QUICK LINKS