The EUR/USD currency pair continued its movement on Thursday, following the trend started the day before. In the second half of the day, the U.S. dollar appreciated again. The word "again" carries significant implications. In the first half of the year, when the American currency was plunging, we often said "the dollar has fallen again." But what justifies the dollar's rise for the second month in a row now?

The only somewhat significant event on Wednesday was the FOMC minutes. This document is generally considered formal, and it rarely provokes a market reaction. Why? Because it is published three weeks after the actual FOMC meeting. At this time, a substantial amount of important macroeconomic information is released, undoubtedly influencing the central bank's mood. Moreover, the minutes do not contain any "secret" information; they merely reflect the sentiment of the monetary committee representatives, giving a snapshot of each official's views and expectations. However, the market had a million opportunities to familiarize itself with those views and expectations over the last three weeks. Speeches by committee members are not rare or surprising; their viewpoints are transparent, and that's normal.

As a result, this document provided no new information to traders. Moreover, many experts reported that the dollar strengthened on Wednesday evening based on the "hawkish" minutes. It is important to note that the dollar began to appreciate at the opening of the U.S. session, and by the time the minutes were published in the evening, the strengthening of the dollar had already ceased (this is clearly visible on lower timeframes). So how could an unpublished protocol, whose content was unknown to anyone, lead to a dollar rise six hours earlier?

This situation exemplifies what we've been discussing in recent weeks. The market found another formal factor supporting the American currency, and there was no consistency between the news and the movements on Wednesday. But why does the market need to move prices in certain directions that defy common sense? It is worth remembering that the market is influenced by market makers, who are not obligated to follow macroeconomic or fundamental indicators. This is why there are times when market movements do not align with either global factors or local macroeconomic data. We clearly state that movements right now are illogical, so traders should not harbor illusions or question something difficult to answer.

Additionally, the daily timeframe continues to exhibit a flat. A flat always entails randomness, making movements within it illogical. The flat is not over; its lower boundary remains untested, so the dollar could very well experience another rise toward the 1.1400 level. We would like to say that everything is logical and the FOMC minutes were "hawkish," but that is not the case. All relevant information has been available to the market over the past three weeks. As a result, the dollar correction continues.

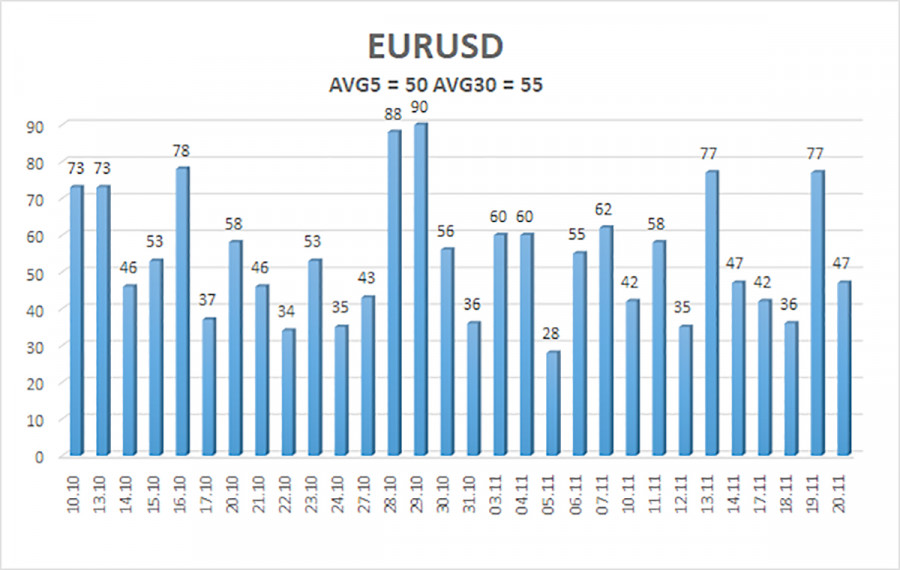

The average volatility for the EUR/USD pair over the last five trading days as of November 21 is 50 pips and is characterized as "low." We expect the pair to trade between 1.1487 and 1.1587 on Friday. The upper channel of the linear regression is directed downward, signaling a bearish trend, but in fact, the flat continues on the daily timeframe. The CCI indicator has entered the oversold area twice in October, which could provoke a new upward trend in 2025. The indicator may soon enter the oversold area for a third time.

The EUR/USD pair has once again settled below the moving average, but an upward trend remains on all higher timeframes, while a flat has persisted on the daily timeframe for several months. The U.S. dollar remains strongly influenced by the global fundamental backdrop. Recently, the dollar has been rising, but the reasons for such movements may be purely technical. If the price is below the moving average, small short positions can be considered targeting 1.1487 on technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

RYCHLÉ ODKAZY