Trade analysis and recommendations for trading the British pound

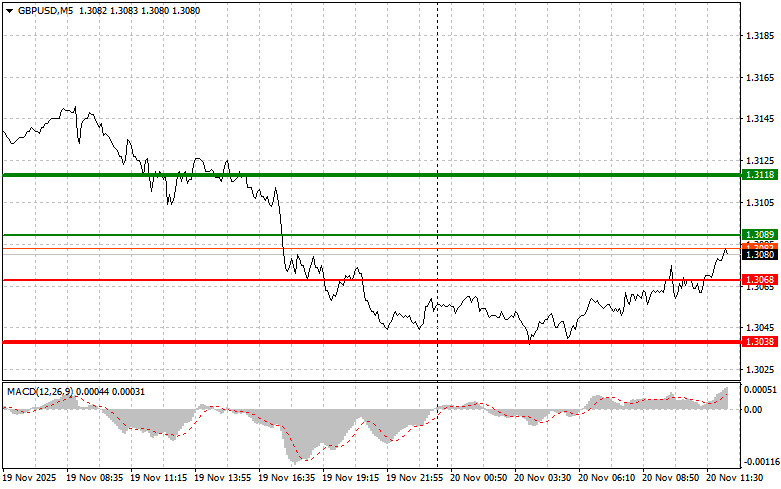

The test of the 1.3063 price level occurred when the MACD indicator had already risen significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the pound. The second test of 1.3063 happened when the MACD was in the overbought area, which triggered scenario No. 2 for selling the pound, but the pair never actually moved into a decline.

In the absence of important U.K. statistics, the pound managed to partially recover its positions. The lack of macroeconomic guidance from the U.K. left traders with little opportunity for fundamental analysis, which increased the speculative nature of the pair's fluctuations. However, the pound's recovery remains fragile and depends largely on upcoming U.S. data.

Ahead of us are figures on U.S. non-farm payrolls, unemployment rate, average hourly earnings, and private sector employment. The U.S. labor market has recently shown signs of weakening, and each new report is viewed by market participants as a potential catalyst for changes in the Federal Reserve's monetary policy. If job creation exceeds expectations and unemployment declines, this will strengthen the argument for a more hawkish Fed. In that scenario, the dollar will receive a strong upward impulse. However, one should not forget that the market is always capable of surprises—especially after the largest shutdown in U.S. history. If the data disappoints—for example, if job numbers fall far below forecasts or unemployment rises—the dollar may weaken sharply.

As for the intraday strategy, I will rely primarily on scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today upon reaching the entry point near 1.3089 (green line on the chart), with a target of rising to 1.3118 (thicker green line on the chart). Around 1.3118, I will exit buy positions and open sell positions in the opposite direction (expecting a 30–35 point move from the level). Pound growth today is possible only if the data is weak. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound if the price twice tests the 1.3068 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. Growth toward the opposite levels of 1.3089 and 1.3118 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price breaks below 1.3068 (red line on the chart), which should lead to a quick decline. The key target for sellers will be 1.3038, where I will exit sales and immediately open buy positions in the opposite direction (expecting a 20–25 point rebound from the level). Pressure on the pound will return if the data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound if the price twice tests 1.3089 when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.3068 and 1.3038 can be expected.

What the chart shows:

Important

Beginner Forex traders must be extremely careful when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you may quickly lose your entire deposit—especially if you ignore money management and trade large volumes.

And remember: to trade successfully, you must have a clear trading plan, like the one I provided above. Spontaneous decision-making based on the current market situation is inherently a losing strategy for an intraday trader.

RYCHLÉ ODKAZY