Trade Analysis and Recommendations for the Euro

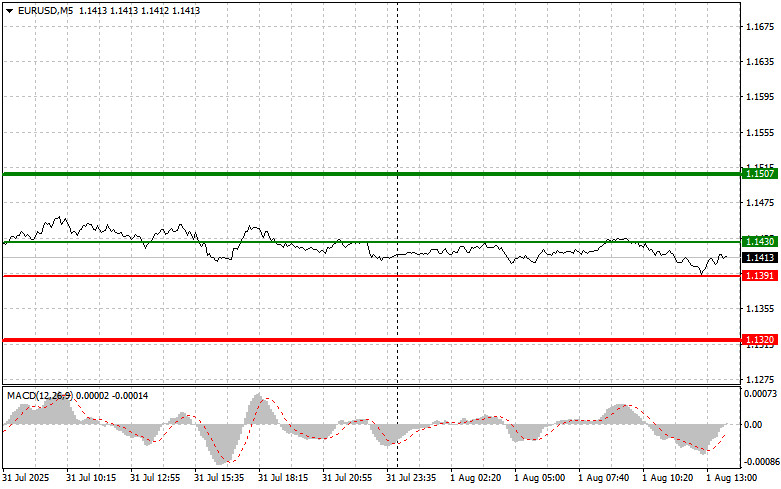

The test of the 1.1413 level occurred when the MACD indicator had already significantly declined below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

The downward revisions to the Eurozone's manufacturing PMI indices left the euro with no chance of strengthening. Disappointing European data raised concerns about a potential economic slowdown in the region, increasing market fears that the European Central Bank may resume its cycle of interest rate cuts.

In the second half of the day, data will be released on U.S. nonfarm payrolls, the unemployment rate, and changes in average hourly earnings. This data package typically has a significant impact on exchange rates. Particular attention will be paid to the employment change figure, as it reflects the pace of new job creation. A notable increase in employment may indicate a resilient economy and prompt the Fed to maintain interest rates at the current 4.50% level. Conversely, weak employment figures may raise concerns about slowing economic growth and force the Fed to soften its monetary policy, negatively affecting the dollar.

The unemployment rate is also a key indicator of overall labor market health. A decline in the unemployment rate is usually seen as a positive sign of rising employment. Lastly, the change in average hourly earnings is a significant indicator of inflationary pressure. Wage growth can stimulate consumer demand and lead to higher prices. If wage growth exceeds forecasts, it may push the Fed to take stronger action on rate hikes to contain inflation.

As for the intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, euro purchases can be considered upon reaching the 1.1430 level (green line on the chart), with a target of rising to 1.1507. At 1.1507, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 point move from the entry level. A strong euro rally today would require very weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1391 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1430 and 1.1507 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1391 (red line on the chart). The target will be the 1.1320 level, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point bounce). Downward pressure on the pair will increase if U.S. data is strong. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1430 level while the MACD is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1391 and 1.1320 can be expected.

Chart Key:

Important Note: Beginner Forex traders must be extremely cautious when entering the market. It is best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you could lose your entire deposit very quickly, especially if you don't practice money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on current market conditions is an inherently losing strategy for intraday traders.

RYCHLÉ ODKAZY