The dollar is trading differently with the index showing some multidirectional moves. The drop to a 2-week low has not been redeemed. However, the dollar tends to rise and the bullish trend is strong. The dollar correction is unlikely to last long as defensive assets will continue to be in high demand in the market.

The only question is which asset investors will prefer to purchase. The dollar sentiment has been undermined. Market makers express deep concern over a potential recession. Therefore, incoming economic statistics will be analyzed thoroughly in terms of slowing economic growth. Weekly labor market data released on Thursdays showed gains. Therefore, investors became worried and the dollar also declined significantly.

Recessionary risks were the major reason for the dollar to stop its rapid rise in response to the Fed's increased hawkish sentiment. Traders began to focus on other protective assets.

The Swiss franc is in a favorable position as it has been correcting from its 3-year lows since the start of the week. It has almost fully recouped its losses to the dollar incurred in early May.

Moreover, the Japanese yen has gained considerably. Its exchange rate returned to April levels. However, it still remains near 20-year lows.

The USD/JPY pair has been trapped around 128.00. On Friday, the dollar managed to attract buyers at 127.50 due to a combination of favorable factors. China's central bank cut its five-year lending rate by 15 basis points to increase economic growth. Consequently, the stock markets recovered slightly. Nevertheless, the yen's defensive function was undermined.

US Treasury bond yields will continue to play a key role in the dollar's performance except other major factors (releases, events). Traders will further focus on signals and estimate risks for trading the USD/JPY pair.

Support is located at 126.95, 126.05, and 125.10. Resistance is at 128.85, 129.85, 130.80.

Gold gained considerably, though it had traded at its year's low earlier this week. Its prices reached intermediate resistance around $1,850 an ounce. If gold breaks through this mark, it will hit $1,900. In case traders continue to liquidate long positions in the next sessions, it will be easy to reach this level.

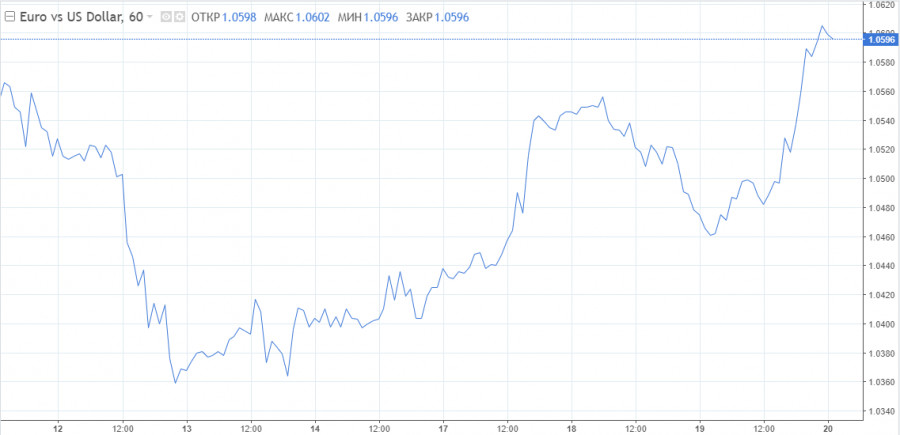

The euro is likely to rebound. Moreover, it also started consolidating in a wide range following the dollar. On Friday, the EUR/USD pair made some losses near 1.0580. However, then the bears increased their pressure on the pair. The bullish scenario is unlikely as the quotes touched below 1.0550 leading to the pair's decline.

Support is located at 1.0495, 1.0410, and 1.0350. Resistance is at 1.0635, 1.0690, 1.0780.

The markets fuel further speculations about the possible parity and its terms. The EUR/USD pair may fall below 1 during the first half of the year and only due to the difference in the Fed and ECB's monetary policies. The second half of 2022 will definitely be more favorable to the euro.

The current situation is the following: the Fed has started to tighten its monetary policy, while the ECB is still considering it. Consequently, the dollar may further increase against the euro. Meanwhile, the differential between the US and German short-term rates is declining amid slowing their growth in the US and continuing increase in Germany. Macroeconomic pressures in the EU are likely to persist.

Economists expect the euro to recover in the second half of the year. Consequently, the EUR/USD pair will gradually return to 1.1 amid a tighter ECB policy and slowing US inflation.

RYCHLÉ ODKAZY