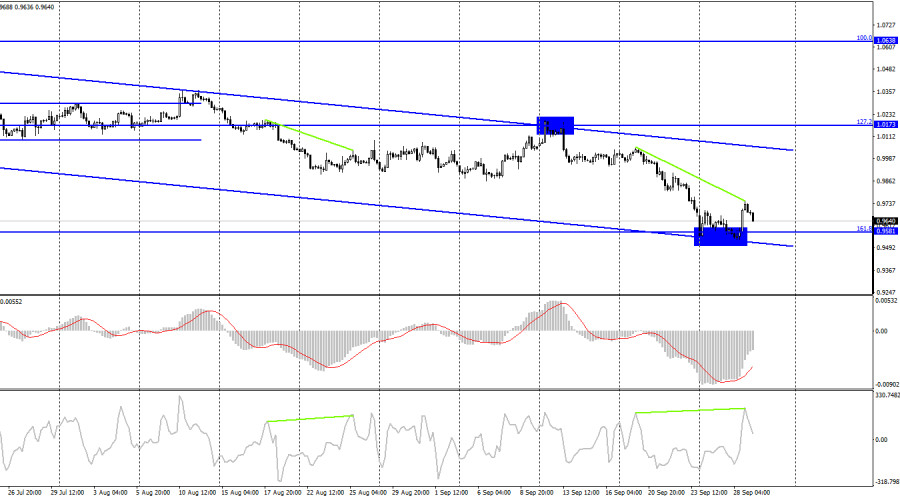

The EUR/USD pair reversed in favor of the European currency on Wednesday and began a fairly strong rise in the direction of the 0.9782 level. However, it could not reach this level. Today, a reversal was made in favor of the US currency, and a new fall began in the direction of the corrective level of 423.6% (0.9585). The downward trend corridor still characterizes the mood of traders as "bearish." Yesterday was quite boring in terms of background information. If we omit the news about the explosion of the Nord Stream in four places at once, which leaves no doubt that it was a diversion, there was practically no economic data. Jerome Powell's speech did not give traders any new food for thought. Christine Lagarde spoke for the third time this week. She assured the markets that the ECB would continue to raise the rate at the next meeting, which will undoubtedly lead to the cancellation of stimulus measures.

However, such measures are necessary for inflation to begin declining. Lagarde explained that the neutral rate for the EU zone is between 1% and 2%, so several increases are necessary for the economy to start slowing down (necessary to reduce inflation). Thus, Lagarde's rhetoric does not change over time, practically does not differ from Jerome Powell's rhetoric, and does not affect the position of the European currency in any way. I believe that yesterday's speeches by Powell and Lagarde, who did not provide any new information, were not the reason for the sharp rise in the euro. In any case, this growth does not give the euro hopes for stronger growth, and a 150-point increase near the low for 20 years is not the greatest consolation. Today, the pair could return to the Fibo level of 423.6% and consolidate under it. Meanwhile, traders will be waiting for the results of the investigation into the undermining of the Nord Stream and the speech of Russian President Vladimir Putin, which can greatly affect their mood.

On the 4-hour chart, the pair performed a new reversal in favor of the US dollar after forming a "bearish" divergence at the CCI indicator. In the near future, a closure under the Fibo level of 161.8% ( 0.9581) may be performed, allowing us to count on a further drop in quotations as low as possible. I recommend counting on the growth of the euro currency after fixing over the descending corridor.

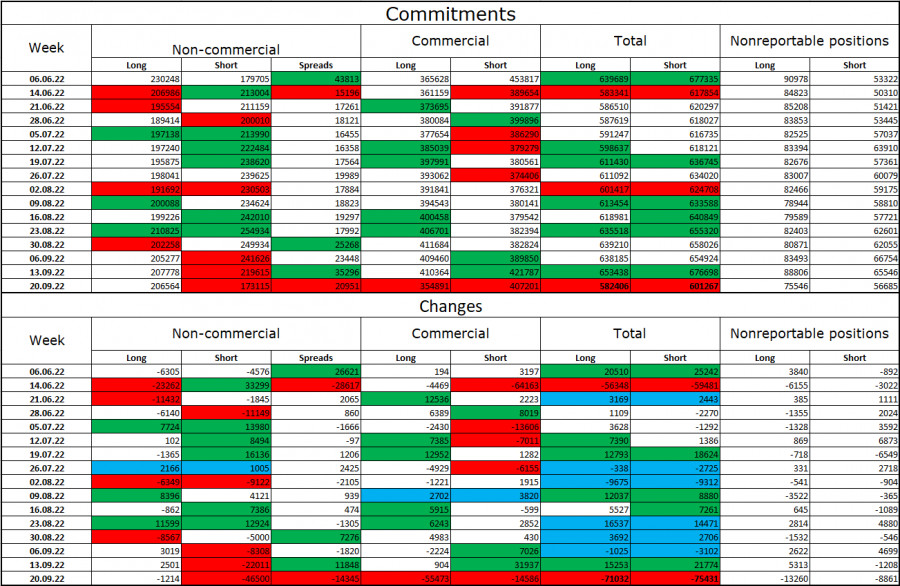

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 1,214 long contracts and 46,500 short contracts. This means that the "bearish" mood of the major players has weakened and ceased to be so. The total number of long contracts concentrated in the hands of speculators now amounts to 206 thousand, and the number of short contracts – 173 thousand. Thus, now the mood of the major players is "bullish," but do you see the euro currency showing growth? In the last few weeks, the chances of the growth of the euro currency have been gradually increasing, but traders are much more actively buying the dollar than the euro. The euro currency has not been able to show strong growth in the last few months. Therefore, I would now bet on important descending corridors on the hourly and 4-hour charts. I recommend expecting the European currency's growth after the quotes above the close.

News calendar for the USA and the European Union:

US – GDP report for the second quarter (15:30 UTC).

US - number of initial applications for unemployment benefits (15:30 UTC).

On September 29, the calendar of economic events of the European Union is empty. I cannot call the American reports important, so the influence of the information background on the mood of traders today may be very weak.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the level of 1.0173(1.0196) on a 4-hour chart with targets of 0.9900, 0.9782, and 0.9581. All these goals have already been worked out. New sales – at closing under 0.9585. I recommend buying the euro currency when fixing quotes above the level of 1.0173 on a 4-hour chart with a target of 1.0638.