At the beginning of the new quarter, most assets may start showing positive momentum. However, the euro will hardly follow these colleagues due to its weakness. Although on Friday, the single currency managed to rise, it looks like a short-lived phenomenon. Let us clear up the situation.

At the end of the fiscal year, US officials almost in the last minutes managed to extend the government's public financing program until December 3. Jerome Powell emphasized the importance of a higher debt ceiling. Otherwise, the country's economy might have faced serious problems. That is why now, the timing and magnitude of the QE tapering is the key issue.

Markets have almost accepted that in the near future the money inflow will be reduced. As a result, the yield of the 10-year government bonds jumped, thus boosting the US dollar. The US dollar index broke an important level and consolidated at the levels last seen in 2020. At the end of the previous week, the greenback slowed down. However, it does not mean a trend reversal. It is highly possible that traders were locking in their long positions.

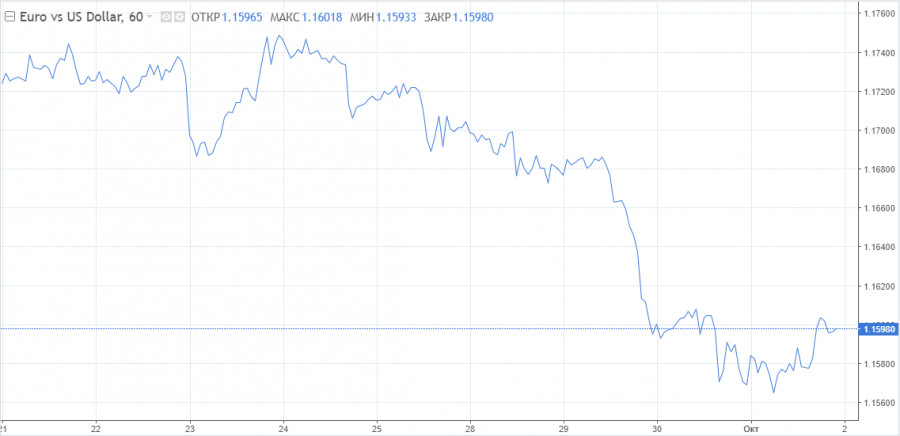

If the US dollar grows, the euro will not have a change to gain in value. The question is how deep the euro may fall. The pair has already broken an important support level and it will hardly rebound. Sellers are benefiting from the situation, whereas buyers have to accept their losses.

The current monetary policy is also supporting the US dollar. Comparing the ECB's and Fed's policies, we can see that the ECB's stance is really dovish, whereas the US Fed has almost launched the tightening of its policy. Until Christine Lagarde changes its approach, bears will keep control over the market.

What may affect Christine Lagarde's rhetoric? In fact, this should be a really strong reason such as a further rise in inflation above the targeted level. The regulator may decide to reduce its asset-purchasing program, but we cannot say for sure. Judging by the eurozone consumer price index data, the ongoing growth in prices is obvious. In September, inflation advanced by 3.4% on a yearly basis. Thus, high gas prices, and climbing prices of other types of energy are likely to be reflected in the price of goods and services. Of course, the CPI will remain above the target.

The current state of affairs adds to the euro's depreciation. The ECB is not ready to switch to a hawkish policy, whereas the US Fed may tighten its monetary policy earlier than expected. This fact is likely to continue boosting the greenback.

Support levels are located at 1.1560, 1.1510, 1.1450.

Resistance levels are located at 1.1610, 1.1660, 1.1680.