On Monday, the EUR/USD pair continued to move higher within the trend that has developed over recent weeks. The upward move is still modest but entirely consistent with the general character and pace of the market. The question of why the dollar is falling again, even though there were no reasons for it on Monday, should not even arise. On Wednesday evening, the Federal Reserve will almost certainly decide to cut the key rate, and for the market, this factor is like a red rag to a bull.

The factor of Fed monetary policy easing has been priced in by the markets for a long time, back when U.S. inflation first began to slow. For a while, we believed this factor had been priced in "in advance," and even excessively so. However, conditions and circumstances in 2025 have changed dramatically. Now the dollar requires only fairly formal reasons to decline. A Fed rate cut is not merely a formal reason but a very real one.

The market also does not currently understand what the outlook for monetary policy will be through the end of 2025 and into next year. The fact that the Fed is prepared to cut rates twice is as clear as day. But what happens next? It's not only about the weakness of the U.S. labor market anymore. The key issue is that Donald Trump is pressuring the Fed almost daily. For example, over the weekend, he once again demanded a rate cut, and not by "a meager 0.25%." If Trump were only making demands, perhaps this wouldn't be such a troubling factor for the dollar. But Trump is not just demanding; he is trying to remove all FOMC members who refuse to vote for a cut.

Adriana Kugler left her post under strange circumstances at the end of the summer. Trump has already "fired" Jerome Powell about five times. Recently, the U.S. president dismissed Lisa Cook without any authority or legitimate reason to do so—a move quickly overturned by the U.S. Supreme Court, which reinstated Cook in her position.

But it doesn't matter who Trump has managed or failed to dismiss. What matters is that he is applying pressure on the Fed, and the market simply doesn't know how many more "players on the field" will be replaced. Powell will, in any case, step down in May 2026, leaving at least four "doves" on the FOMC. This means Trump only needs to replace a few more officials to secure control.

Whether Trump succeeds in doing so will determine how the market trades the dollar in the coming year. If traders sense that Trump is close to victory over the U.S. central bank, dollar quotes will collapse at lightning speed, since the market will understand that rates will no longer depend on the Fed's dual mandate but on Trump's will, allowing him to shift them in any direction. For the first time, the Fed would become the "personal bank" of a U.S. president, and the very purpose of its existence would be lost, as it would no longer make independent decisions.

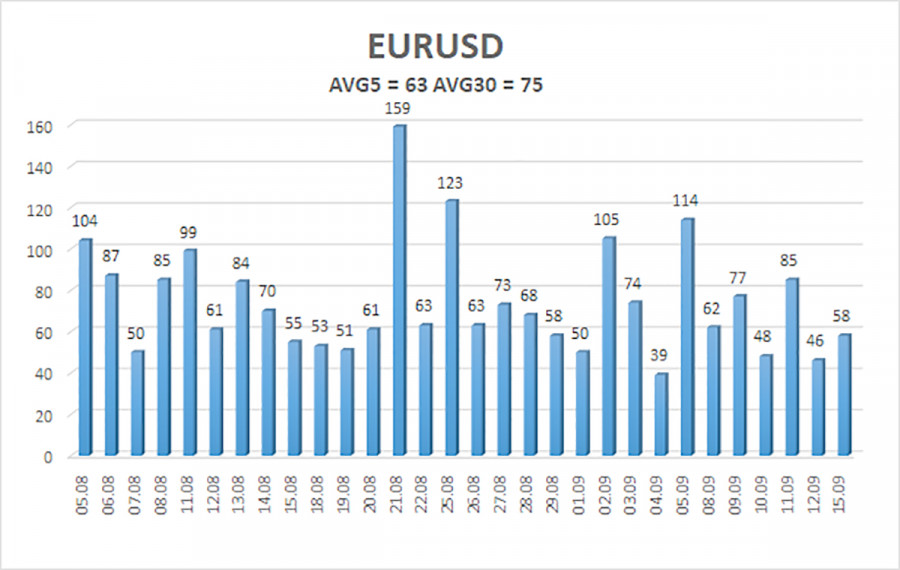

Average volatility of the EUR/USD pair over the last five trading days as of September 16 is 63 pips, classified as "average." We expect the pair to move between 1.1706 and 1.1832 on Tuesday. The linear regression channel's upper band points upward, still indicating an uptrend. The CCI indicator entered the oversold zone three times, warning of a trend resumption. A "bullish" divergence was also formed, signaling growth.

S1 – 1.1719

S2 – 1.1658

S3 – 1.1597

R1 – 1.1780

R2 – 1.1841

The EUR/USD pair may resume its upward trend. U.S. currency remains under strong pressure from Trump's policies, and he has no intention of "stopping here." The dollar rose as much as it could (not for long, though), but now it seems time for another round of prolonged decline. If the price is below the moving average, small shorts with a target of 1.1658 can be considered on purely corrective grounds. Above the moving average line, long positions with targets of 1.1780 and 1.1832 remain relevant in continuation of the trend.