The GBP/USD currency pair traded rather quietly on Tuesday but finally showed some gains. Similar to the EUR/USD pair. The ADP report played a significant role in the decline of the U.S. dollar, which is now published weekly instead of monthly. According to this report, the number of employees in the private sector decreased by 13,500 during the reporting week. In other words, we saw another disappointing report that doesn't mean much, as the market continues to focus on NonFarm Payrolls. As we warned, a certain market reaction was to follow, but essentially nothing has changed.

Meanwhile, the draft budget for 2026 is set to be published in the UK today. It seems that Chancellor Rachel Reeves has resigned herself to the fact that increasing taxes for households will not be possible (as the Labour Party previously promised not to raise taxes), so she decided to obtain funds for the "leaky" budget through other means. In particular, every parcel from abroad will be subject to tariffs. At present, all parcels costing less than £135 are not subject to duties. According to Reeves, such measures are expected to bring around £500 million to the budget annually.

Naturally, Reeves explained her initiative with a lofty goal—to support domestic retail networks. According to Reeves, many British shops pay tariffs on imported goods since they order them in large batches. Meanwhile, "bad" British consumers exploit legal loopholes and order goods directly from foreign online stores for amounts up to £135, without paying any tariffs. The Treasury chief aimed to rectify this injustice while promising not to raise taxes for households.

In my opinion, the UK has followed Donald Trump's path—namely, raising taxes without raising taxes. If taxes are increased, it will hit citizens' wallets and cause a wave of outrage. However, if tariffs on foreign goods are raised or if a million other fees are introduced, it's not as noticeable. But in any case, British consumers will contribute more funds to the budget, regardless of whether it's through tariffs or increased taxes.

Reeves also wants to raise several taxes for companies. Representatives of these companies have quickly stated that, in response to the UK government's actions, they will reduce investments in the country. I believe British consumers will act similarly. Who will benefit from this will be revealed in time. It is worth noting that this time the British pound did not respond with another collapse to Reeves's speech. Perhaps it is finally time to conclude the correction on the daily timeframe and begin the logical growth that has been overdue for several months.

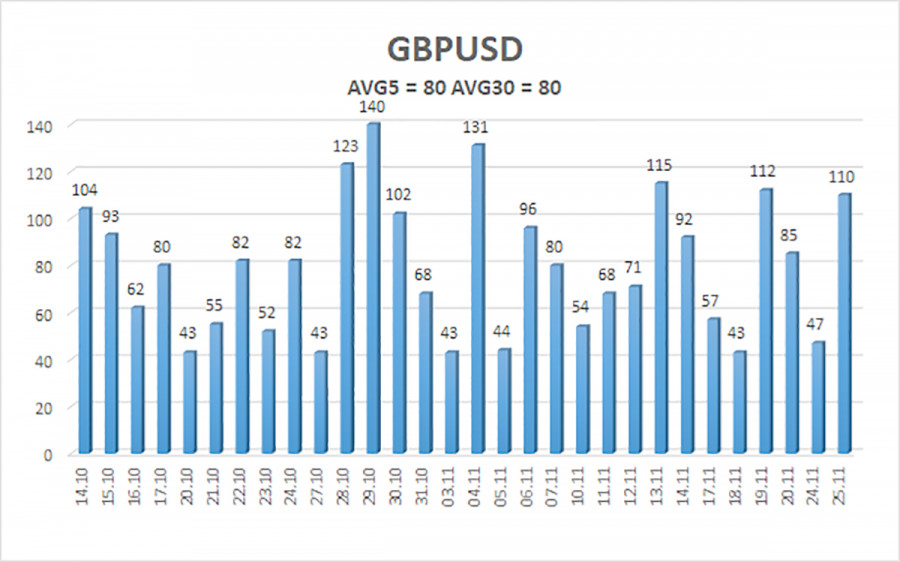

The average volatility of the GBP/USD pair over the last five trading days stands at 80 pips, which is considered "average" for this pair. Therefore, we expect movement within a range bounded by the levels of 1.3102 and 1.3262 on Wednesday. The upper channel of the linear regression is directed downwards, but this is only due to a technical correction on larger timeframes. The CCI indicator has entered the oversold area for the sixth time in recent months and has formed another "bullish" divergence.

The GBP/USD currency pair is attempting to resume the upward trend for 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not anticipate growth from the American currency. Therefore, long positions with targets at 1.3306 and 1.3428 remain relevant in the near future if the price is above the moving average. If the price is below the moving average line, small short positions targeting 1.3000 can be considered on technical grounds. From time to time, the U.S. dollar shows corrections on a global scale, but for a trend-based strengthening, it needs real signs of the end of the trade war or other global, positive factors.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-11-26 05:57:20 IP: 216.73.216.23