The EUR/USD pair has been in a downward movement over the past two weeks. From a fundamental and macroeconomic perspective, we continue to view this decline as completely illogical. We won't repeat the long list of dollar-negative factors that were ignored by the market during this period. Instead, let's focus on what lies ahead.

It's important to note that from a technical standpoint, the current decline doesn't raise any questions. On the daily timeframe, we observe a clear flat pattern. Within a flat, the price can move in either direction without the need for strong catalysts.

The market has ignored a slew of negative U.S. news in recent weeks, so we believe that at some point these factors will be priced in. For now, we are seeing another round of technical correction. The political crisis in France certainly did not trigger the fall of the euro—such a reaction would only be possible if it were the sole influencing factor. But the news stream has been persistent and varied, with the most recent development—Trump's new tariffs—not yet fully priced into the market.

The trade war between the U.S. and China is intensifying once again, although many traders had concluded that it was either resolved or had transitioned into a subdued phase. We warned earlier that a figure like Trump—a businessman to the core—would squeeze every last drop out of his trade partners. Signed trade agreements carry little weight; a deal today, tariffs tomorrow.

For example, Trump could at any moment accuse the European Union of "funding the war in Ukraine" by purchasing Russian oil and gas—and use that as grounds to impose new tariffs. Any excuse will do.

Currently, the U.S. has imposed a 100% tariff on all Chinese imports. We are quite certain this is only the first in a new wave of sanctions from Trump. He will squeeze not just other countries but also his own citizens, as they will ultimately pay these tariffs.

At the same time, Trump is attempting to force other nations to buy as many goods, resources, and services from the U.S. as possible—or to hand over money under vague pretenses. Recall that Japan and the European Union signed extremely one-sided deals requiring them to invest hundreds of billions of dollars into the U.S. economy and purchase U.S. energy on a massive scale.

Thus, the purpose of Trump's tariffs is to force trade partners to buy American under a respectable pretext while simultaneously burdening the U.S. population through higher import duties—all while slashing social and medical programs. Publicly, however, Trump will continue touting lower taxes and the "miraculous" growth of U.S. GDP.

Therefore, we expect the U.S. dollar to continue weakening regardless of technical bounces.

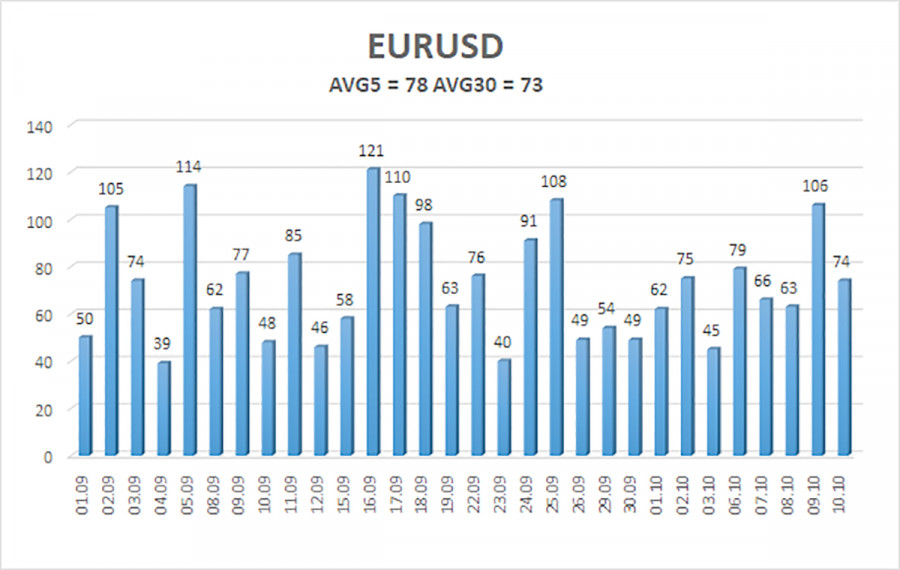

The average volatility of EUR/USD over the past five trading days, as of October 11, is 73 pips, which is classified as "average." We expect the pair to move between the levels of 1.1544 and 1.1700 on Monday.

The higher linear regression channel is sloping upward, which still indicates a long-term bullish trend. Meanwhile, the CCI indicator has entered oversold territory, which may trigger the next wave of upward movement.

The EUR/USD pair continues its correction, though the overall uptrend remains intact, as seen on higher timeframes. The U.S. dollar continues to be pressured by Donald Trump's economic agenda, and he shows no signs of stopping.

The dollar has seen some gains recently, but the reasons for them are ambiguous. Either way, the ongoing flat pattern on the daily chart explains the recent moves.

If the price is positioned below the moving average, short positions can be considered with targets at 1.1544 and 1.1536 on purely technical grounds. If the pair moves above the moving average, long positions remain relevant, with targets at 1.1841 and 1.1902 in continuation of the broader uptrend.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-10-13 07:10:50 IP: 216.73.216.208