Společnost Tyson Foods, Inc. v pondělí oznámila smíšené výsledky za druhé čtvrtletí. Zisk sice překonal očekávání, ale tržby zaostaly za odhady analytiků.

Zpracovatelský gigant oznámil upravený zisk na akcii ve výši 0,92 dolaru, čímž překonal konsenzus analytiků, který činil 0,84 dolaru. Tržby dosáhly 13,07 miliardy dolarů, zatímco analytici očekávali 13,16 miliardy dolarů.

Tržby byly meziročně stabilní, ovlivněné tvorbou rezerv na právní spory ve výši 343 milionů dolarů, což snížilo tržby o 2,6 %. Upravený provozní zisk vzrostl o 27 % na 515 milionů dolarů, přičemž upravená provozní marže se zvýšila na 3,8 % z loňských 3,1 %.

„Dosáhli jsme dalšího solidního čtvrtletí s růstem jak v tržbách, tak v upraveném provozním zisku, a to díky silné realizaci napříč celou firmou,“ uvedl Donnie King, prezident a generální ředitel Tyson Foods (NYSE:TSN).

Pro fiskální rok 2025 očekává Tyson celkový upravený provozní zisk v rozmezí 1,9 až 2,3 miliardy dolarů. Společnost předpokládá, že tržby budou v porovnání s rokem 2024 stabilní až mírně rostoucí o 1 %.

Ve své divizi hovězího masa uvedla společnost, že USDA očekává v roce 2025 přibližně stejnou domácí produkci jako v roce 2024. V důsledku toho očekává Tyson upravenou provozní ztrátu tohoto segmentu mezi 0,4 a 0,2 miliardy dolarů.

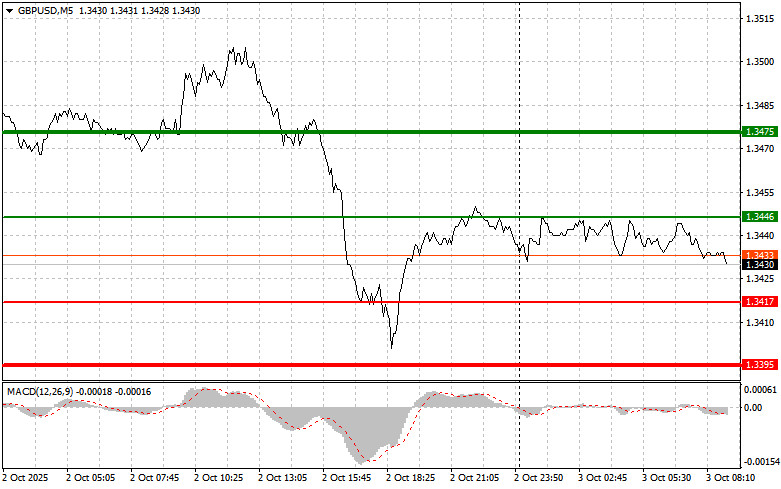

The test of the 1.3490 price level occurred just as the MACD indicator began moving downward from the zero line, confirming a valid entry point for selling the pound, which resulted in a drop of over 40 pips.

Strong U.S. data, supported by hawkish rhetoric from the Federal Reserve, restored confidence in a more cautious approach by the Fed regarding interest rate cuts. This, in turn, makes the U.S. dollar more attractive to yield-seeking investors. The pound, however, came under pressure. The situation is further complicated by the fact that the Bank of England is facing a greater challenge than the Fed. The UK central bank must contain inflation without collapsing an already fragile economy, teetering on the edge of recession.

Later this morning, we'll see the release of the UK's Services PMI and the Composite PMI. Additionally, a public speech is scheduled by Bank of England Governor Andrew Bailey. These events will undoubtedly have a significant impact on the pricing trajectory of the British currency and, more broadly, on the assessment of economic risks tied to the United Kingdom.

Historically, the services PMI is a key indicator of economic well-being due to the dominant role of the service sector in the UK's GDP structure. A reading above 50 signals growth, while a reading below 50 indicates a contraction in activity. The Composite PMI combines data from both the services and manufacturing sectors, offering a more holistic view of the economic climate. Weak PMI figures could signal a slowdown in economic momentum, thereby increasing pressure on the Bank of England to take more aggressive monetary policy action.

Nevertheless, the central highlight will be Andrew Bailey's speech. Market participants will closely examine his remarks for any hints about the BoE's future interest rate strategy.

As for the intraday strategy, I will focus mainly on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3446 (the green line on the chart), with a target of moving toward 1.3475 (the thicker green line on the chart). At 1.3475, I plan to exit long positions and open sell trades in the opposite direction, expecting a pullback of 30–35 pips from that level. Bullish pound positions are only justified if strong economic data is released. Important: Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound if the price tests the 1.3417 level twice while the MACD indicator is in the oversold zone. This would limit the downside potential of the pair and lead to a market reversal to the upside. A rise to the opposite levels of 1.3446 and 1.3475 can be expected.

Scenario #1: I plan to sell the pound today after a breakout below 1.3417 (red line on the chart), which could trigger a sharp decline in the pair. The key target level for sellers will be 1.3395, where I plan to exit the short position and immediately open a buy position on the rebound—expecting a recovery of 20–25 pips from that level. Pound sellers may look to strengthen their advantage at any opportunity. Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3446 level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and lead to a reversal to the downside. A drop toward the opposite levels of 1.3417 and 1.3395 is expected.

Beginner traders should exercise extreme caution when deciding to enter the market. It is best to avoid trading during important economic data releases to prevent being caught in sharp price movements.

If you choose to trade during news events, always use stop-loss orders to minimize potential losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management and trade with large volume sizes.

And remember: to succeed in trading, you need to have a clear trading plan—just like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-10-03 11:21:57 IP: 216.73.216.169