Very few macroeconomic reports are scheduled for Friday. The only report worth noting is UK Retail Sales. This release could trigger a minor market reaction—but only if the actual figure deviates significantly from the forecast. Overall, the market may take a breather today after two very active days featuring two central bank meetings and a key inflation report out of the UK.

There is absolutely nothing notable on the fundamental calendar for Friday. The European Central Bank, Federal Reserve, and Bank of England meetings have all concluded, providing the market with all the necessary information for further trading. In our view, the outcome of the ECB meeting should be regarded as "neutral," the Fed meeting as "dovish," and the BoE meeting as "neutral." We believe this alignment supports the chances for further gains in the euro and the pound.

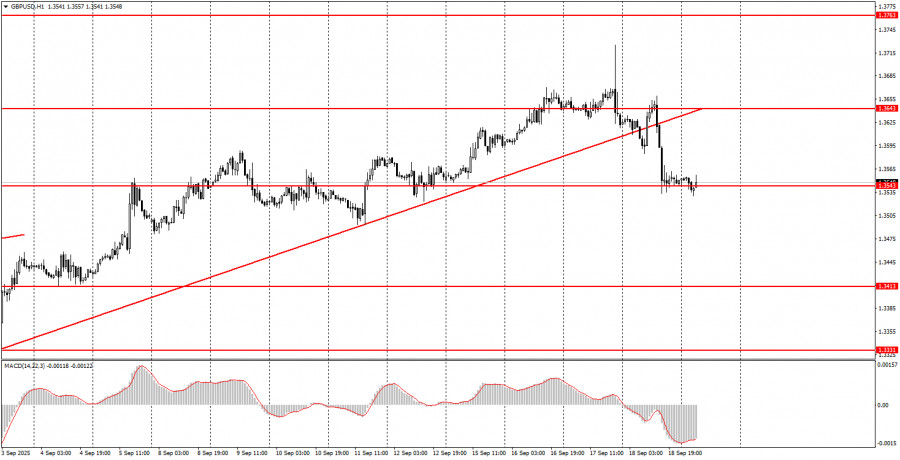

On the last trading day of the week, both currency pairs could resume their upward moves, provided new buy signals emerge. Today, the euro can be traded from the 1.1737–1.1745 area, and the pound sterling from the 1.3529–1.3543 area. A decline in either pair is not out of the question, so if sell signals appear, short positions may also be considered.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-09-19 03:59:25 IP: 216.73.216.179