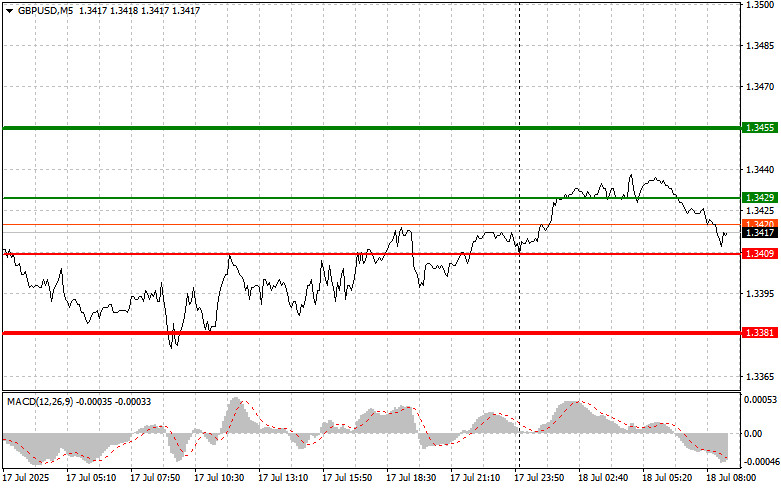

The test of the 1.3409 price level occurred when the MACD indicator had just begun moving up from the zero mark, confirming a valid entry point for buying the pound, which resulted in a 10-pip rise.

Yesterday, the British pound ignored weak labor market data and traded within a range. This sideways movement is likely due to general uncertainty regarding the Bank of England's next steps. On one hand, weak economic data, especially in employment, puts pressure on the central bank to ease monetary policy. On the other hand, persistent inflation and resilient consumer demand prevent the BoE from abandoning its current strategy too quickly. In this context, traders prefer to wait, resulting in the pair consolidating within a narrow range. A strong catalyst—such as unexpectedly positive economic data, a clear signal from the BoE, or a major shift in global risk appetite—will likely be needed for a breakout from the channel.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3429 (indicated by the green line on the chart), targeting a rise toward 1.3455 (represented by the thicker green line on the chart). Around 1.3455, I intend to exit the long position and open a short position in the opposite direction, aiming for a 30–35 pip pullback. Today's pound rally is expected to remain within the scope of a correction.

Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3409 twice in a row while the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger a market reversal upward. A rise toward the opposite levels of 1.3429 and 1.3455 can be expected.

Scenario #1: I plan to sell the pound after it breaks below 1.3409 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3381, where I plan to exit the short position and immediately open a long position in the opposite direction, aiming for a 20–25 pip rebound. Selling the pound on rallies would align with the ongoing bearish trend.

Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3429 twice in a row while the MACD indicator is in overbought territory. This will limit the pair's upside potential and trigger a downward market reversal. A decline toward the opposite levels of 1.3409 and 1.3381 can be expected.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-07-19 07:57:04 IP: 216.73.216.201