Společnost Walmart se drží své roční prognózy růstu tržeb a provozních příjmů, uvedl maloobchodní řetězec před svým středečním dnem pro investory.

Maloobchodní řetězec v únoru předpověděl, že roční tržby vzrostou o 3 až 4 % a očištěné provozní příjmy o 3,5 až 5,5 %.

Nezměněné prognózy přicházejí uprostřed nejistoty ohledně dopadu Trumpovy série cel především na asijské země, které Walmartu (NYSE:WMT) dodávají vše od oblečení po hračky.

The Euro Held Its Ground Despite Rising Demand for the Dollar and U.S. Trade Threats, While the Pound Continued to Fall

The euro managed to hold its position even amid a noticeable increase in demand for the U.S. dollar and ongoing trade threats from the United States. In contrast, the British pound continued to decline against the dollar, even in the absence of any fundamental data, once again confirming the weakness it has been displaying recently.

Yesterday's lack of major macroeconomic data from the U.S. helped keep the EUR/USD pair within a sideways channel, but it did little to support GBP/USD. This brief pause has not dispelled the overall uncertainty hovering over the market. Traders are eagerly awaiting new signals that could clarify the next direction for currency pairs.

In the first half of the day, attention will turn to the German ZEW Economic Sentiment Index, Current Conditions Index, the ZEW Economic Sentiment Index for the Eurozone, and Eurozone industrial production figures. These are key indicators of the region's economic health and can significantly influence the euro's exchange rate. The ZEW index, in particular, is a leading indicator reflecting analyst and investor expectations about future economic activity. Positive readings suggest optimism, while negative values indicate pessimism.

Meanwhile, the industrial production figure offers insight into the actual state of the manufacturing sector, a vital driver of the economy.

Additionally, a meeting of the EU Council of Finance Ministers will take place. This summit will provide a platform to discuss key issues related to financial stability and economic development in the region, especially in light of the 30% tariffs recently announced by Trump, which are set to take effect from August 1.

As for the United Kingdom, today features a speech by Bank of England Governor Andrew Bailey, from whom valuable insights can be expected regarding the central bank's future policy stance. This event is of critical importance for understanding the monetary policy trajectory of the UK and the GBP/USD pair. Markets will scrutinize every word from Bailey, looking for hints of the Bank of England's readiness to ease policy further. His remarks on inflation, economic growth, and the labor market will be particularly important. Any signs of concern about economic slowdown or continued disinflation could strengthen expectations of an imminent rate cut.

If the actual data meets economists' expectations, it is better to rely on the Mean Reversion strategy. If the data is significantly above or below expectations, the Momentum strategy would be more effective.

Buying on a breakout above 1.1690 may lead to euro rising toward 1.1715 and 1.1747

Selling on a breakout below 1.1666 may lead to euro falling toward 1.1624 and 1.1590

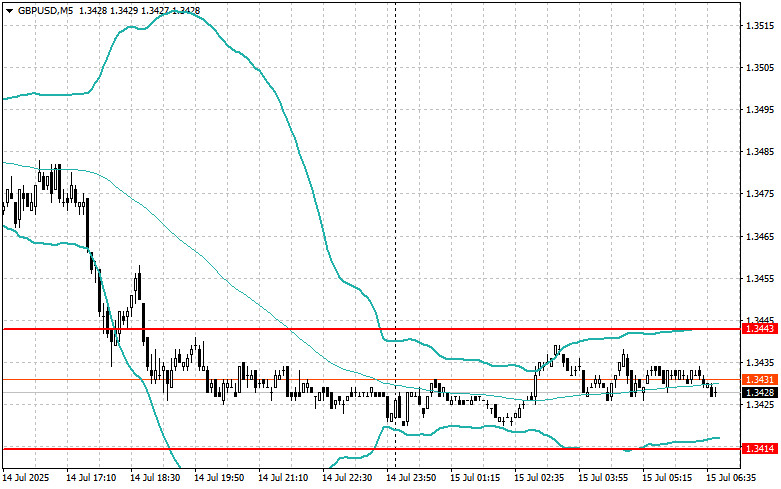

Buying on a breakout above 1.3445 may lead to pound rising toward 1.3480 and 1.3510

Selling on a breakout below 1.3414 may lead to pound falling toward 1.3375 and 1.3335

Buying on a breakout above 147.80 may lead to dollar rising toward 148.90 and 149.20

Selling on a breakout below 147.50 may lead to dollar dropping toward 147.18 and 146.75

I will look for selling opportunities after a failed breakout above 1.1684 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.1658 followed by a return above this level

I will look for selling opportunities after a failed breakout above 1.3443 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.3414 followed by a return above this level

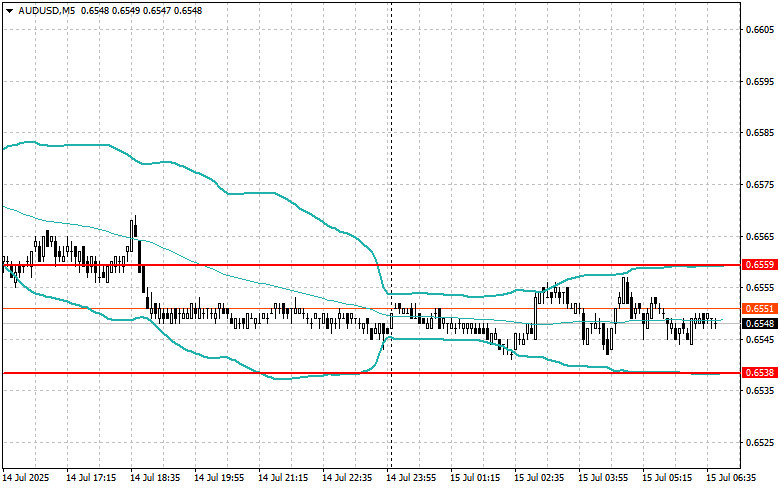

I will look for selling opportunities after a failed breakout above 0.6559 followed by a return below this level

I will look for buying opportunities after a failed breakout below 0.6538 followed by a return above this level

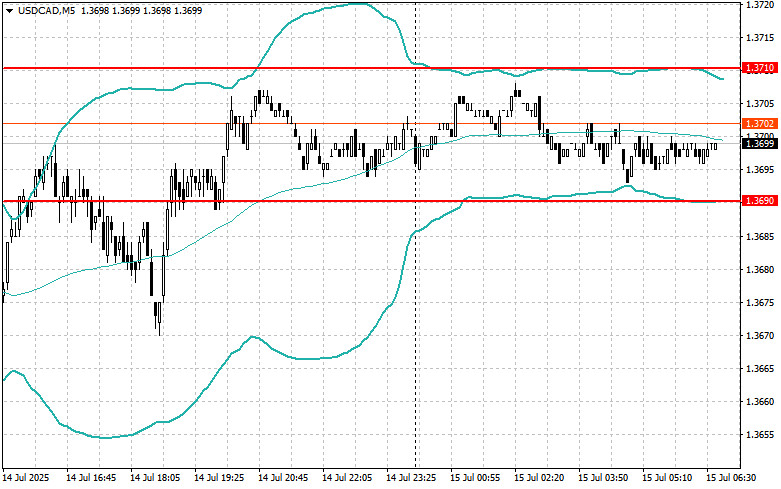

I will look for selling opportunities after a failed breakout above 1.3710 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.3690 followed by a return above this level

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-07-16 09:39:15 IP: 216.73.216.117