Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

The bullish momentum is lifting spot prices toward the 1.0785 level, marking a new daily high. The upward movement is supported by a weakening U.S. dollar, which has pulled back from a three-week high, creating a more optimistic outlook for the euro.

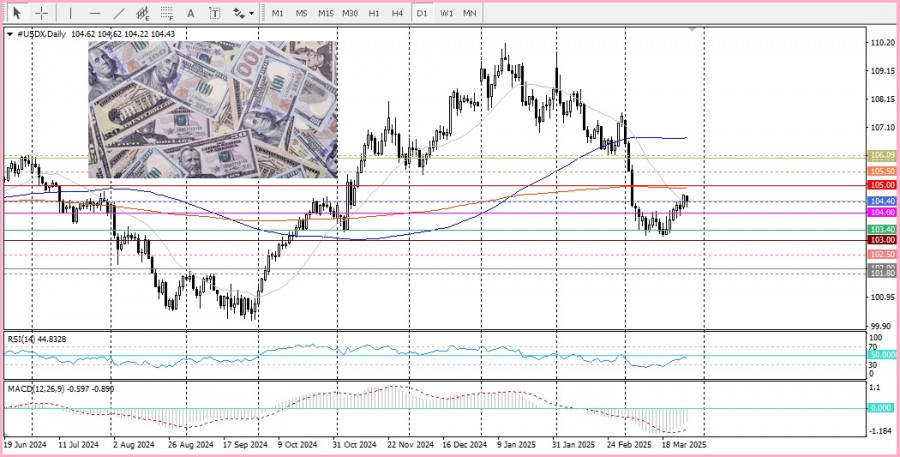

Recent actions by U.S. President Donald Trump—including the introduction of 25% tariffs on imported cars, light trucks, and all steel and aluminum, as well as upcoming reciprocal tariffs on April 2—are generating market uncertainty and contributing to the decline of the U.S. Dollar Index. This, in turn, is supporting the EUR/USD pair, particularly against the backdrop of the Federal Reserve's forecast for two 25 basis point rate cuts by the end of the year.

Additionally, the European Union is preparing retaliatory measures in response to U.S. tariffs, which could escalate trade tensions and increase the risk of a full-scale trade war between the EU and the U.S. This keeps traders cautious about taking aggressive long positions in the euro. Moreover, today's softer tone in the equity markets may lend support to the U.S. dollar as a safe haven, limiting the upward potential for EUR/USD.

To identify better trading opportunities, attention should be paid to the release of the U.S. Q4 GDP report, weekly initial jobless claims data, and pending home sales figures. Furthermore, speeches by key FOMC members may inject volatility into the U.S. dollar, providing some momentum to EUR/USD. However, the main focus remains on Friday's release of the U.S. Core Personal Consumption Expenditures (PCE) Price Index.

Technical Outlook: If the pair can hold above the 1.0780 level and break through the psychological barrier at 1.0800, this would pave the way for further gains. However, support at 1.0725—where the 200-day SMA currently lies—remains crucial. A break below that could trigger additional selling pressure. The next support is at the 1.0700 level, followed by the 100-day EMA near 1.0620. Still, as long as the oscillators on the daily chart remain in positive territory, the EUR/USD pair appears determined to hold its ground.

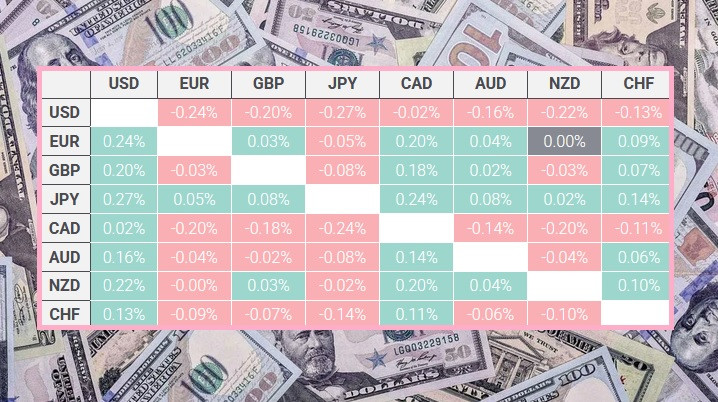

USD Performance Overview: The table below shows the percentage change of the U.S. dollar against the major listed currencies for today.

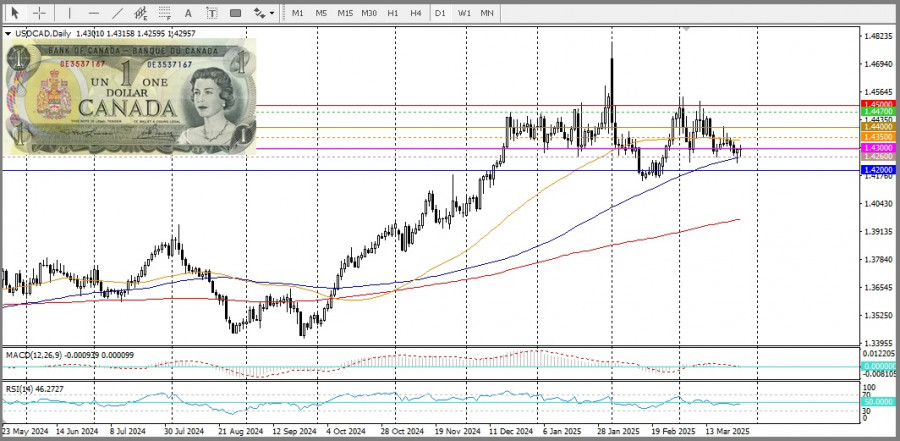

The U.S. dollar has been strongest against the Canadian dollar.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-07-16 01:56:03 IP: 216.73.216.117