Norské akcie byly po uzavření čtvrtečního obchodování na vyšší úrovni, když k růstu vedly zisky v sektorech zdravotnických zařízení a služeb, farmaceutických biotechnologií a věd o živé přírodě a veřejných služeb.

V závěru obchodování v Oslu přidal index Oslo OBX 0,85 %.

Nejlépe si v rámci seance na burze Oslo OBX vedla společnost Yara International ASA (OL:YAR), která vzrostla o 4,66 %, tj. o 14,50 bodu, a v závěru obchodování se obchodovala na úrovni 325,90 bodu. Mezitím společnost Nordic Semiconductor ASA (OL:NOD) přidala 4,55 %, tj. 6,05 bodu, a skončila na 138,95 bodu a společnost Norsk Hydro ASA (OL:NHY) v závěru obchodování vzrostla o 3,47 %, tj. 2,10 bodu, na 62,70 bodu.

Nejhůře si během seance vedla společnost Telenor ASA (OL:TEL), která klesla o 1,99 %, tj. 2,70 bodu, a v závěru se obchodovala na 132,80 bodu. Equinor ASA (OL:EQNR) klesl o 1,39 % neboli 3,70 bodu a uzavřel na 262,00 bodech a Orkla ASA (OL:ORK) se propadla o 1,18 % neboli 1,15 bodu na 96,60 bodech.

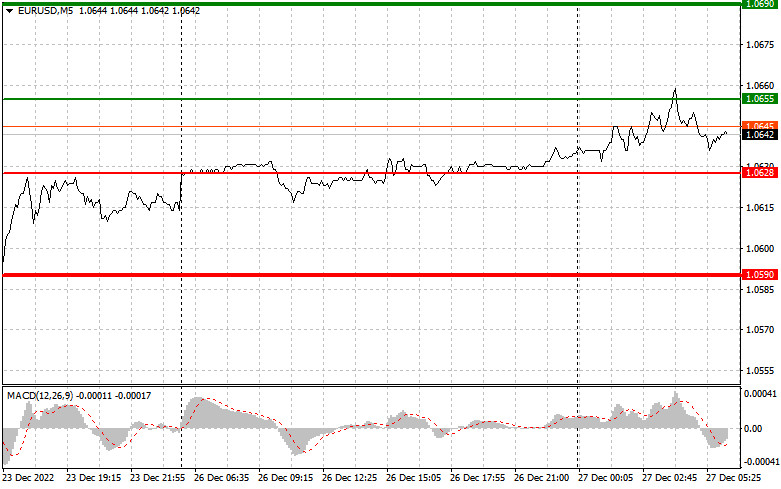

Analysis of transactions in the EUR / USD pair

There were no market signals on Monday because the pair failed to test any of the presumed levels.

The same situation could occur today, but volatility will return after the Christmas holidays are over. By then, large movements will be seen in EUR/USD.

For today, the pair is unlikely to move up, especially since there are no statistics due out in the Euro area. The upcoming US reports on the foreign trade balance, inventories in wholesale warehouses and housing price index are also of little interest, but given the low trading volume, figures that are better than expected could lead EUR/USD lower.

For long positions:

Buy euro when the quote reaches 1.0655 (green line on the chart) and take profit at the price of 1.0690. Although there is a chance for growth today, it is unlikely to be last long. Also, buy only when the MACD line is above zero or starting to rise from it. Euro can also be bought at 1.0628, however, the MACD line should be in the oversold area as only by that will the market reverse to 1.0655 and 1.0690.

For short positions:

Sell euro when the quote reaches 1.0628 (red line on the chart) and take profit at the price of 1.0590. Pressure will return if the US reports strong statistics. But take note that when selling, the MACD line should be below zero or is starting to move down from it. Euro can also be sold at 1.0655, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.0628 and 1.0590.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-08-02 02:47:54 IP: 216.73.216.130