There is a fuss in the foreign exchange market, large currency pairs with the dollar attract attention, as they have reached the next important levels. At the same time, the dollar has not exhausted its potential to rise. The question arises: what will happen next with the euro, yen, Australian dollar and other reputable currencies?

So, the dollar index in recent days has shown the sharpest growth in the last two years. If we compare with the previous similar jump, it can be noted that the reasons were absolutely opposite. Earlier, explosive growth was observed amid the collapse of stock markets combined with a powerful flight into short-term US government bonds. Now we are seeing a recovery in the stock market. The indices are trading in the black for the second consecutive day, investors have found support near last year's lows. This means that there is not a traditional flight into protective assets, which, among other things, is the dollar. The reason is different. The interest of the markets is directly caused by the dollar's strength.

What is its strength? There are several reasons, the most important are: first, investors are fully confident in a sharp increase in the Federal Reserve rate in the coming months. It is difficult to argue with these forecasts. Secondly, America demonstrates impressive macroeconomic indicators. The second hypothesis, of course, requires some evidence. They should appear in the coming weeks.

Today's GDP data could not disrupt the plans of dollar bulls. The rally, of course, slowed down, but it did not affect the overall picture. The gross domestic product of the United States unexpectedly decreased by 1.4% in the first quarter against the expected 1.1%.

It is unlikely to be possible to restrain dollar bulls in the coming days. Only the Fed can do this, and the central bank has gone into a week-long silence before the next meeting. Markets will find out how the FOMC committee treats the high dollar exchange rate next Wednesday.

The dollar index is expected to remain bullish not only in the future for several days, but also for weeks. To begin with, bulls will test the 104.00 level ahead of the Fed meeting. This will be a kind of liberation of the road to subsequent highs. In the prospect of several weeks, there is a great potential to reach the 107.00 mark. It was last active in 2002.

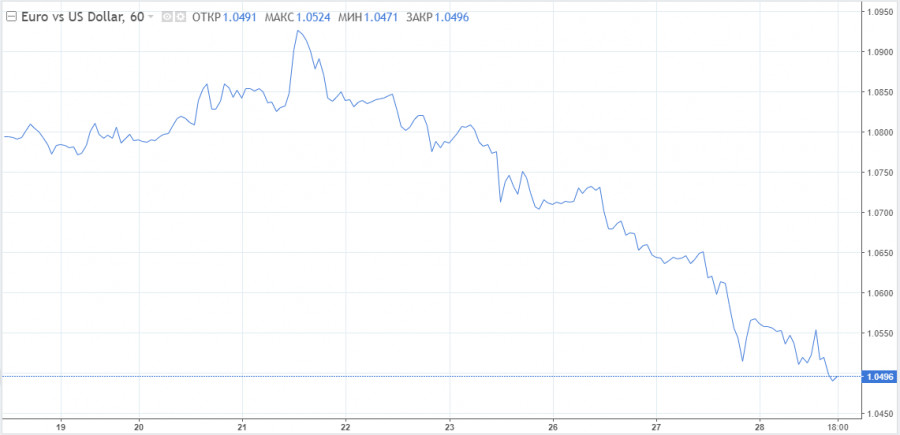

As for the euro, today it fell under the 1.0500 mark, which is the last intermediate round level before the parity, which is already being actively discussed in the markets. The most important moment from a historical perspective occurred on Wednesday - we are talking about taking the 1.0600 mark for the EUR/USD pair. Now it is after the fact, that is, there is a final capitulation of euro bulls.

After falling below 1.0500, EUR/USD bears will have the opportunity to push the quote to the lows of 2017 at around 1.0340, but not everything is so clear. The fifth figure resists, today there is a rebound above 1.0500. The break below did not really happen, and oversold conditions could stop the euro from falling further. The EUR/USD bulls are already waiting for the correction of the pair.

After briefly hitting 1.0565, the 1.0600 area acts as resistance, followed by 1.0625 and 1.0650.

The strongest volatility is observed in the USD/JPY pair on Thursday. The dollar stormed another round figure, breaking the 130.00 mark, and then 131.00. The last time the Japanese currency was priced so cheaply was in April 2002. Intraday strengthening of USD/JPY was more than 2%

The verbal interventions of the Japanese Ministry of Finance contributed to the strong movements in the pair. Representatives of the department called the current currency movements "extremely alarming." "If necessary, the authorities will take appropriate actions," they said.

According to the forecasts of Westpac economists, the test of the 135.00 level looks quite realistic, as the Fed seeks to implement a series of rate hikes by 50 basis points and launch an aggressive QT program next week. However, this is not a fact. Trading above 130.00 may continue for a certain time, while resistance and comments from the Ministry of Finance may contribute to slowing down the pace of such growth.

The Australian dollar's sell-off continues for the sixth consecutive session. During this time, the AUD/USD pair has lost about 350 points. Today's intraday losses alone amounted to about 1%.

Will the aussie be able to catch up? After all, important factors have appeared on the horizon in the form of a peremptory rate hike by the Reserve Bank of Australia next week. However, market players ignored yesterday's report on the consumer price index. The figure is high, statistics indicate a high possibility of a rate hike next week for the first time since 2010.

The aussie can be supported not only by the prospect of tightening monetary policy in the country, but also by signs of a slowdown in the spread of coronavirus in China, which is Australia's most important trading partner. In this regard, the initiative can go to the bulls on the AUD/USD pair at any time.

ลิงก์ด่วน