Yesterday, stock indices closed higher. The S&P 500 rose by 0.16%, while the Nasdaq 100 gained 0.26%. The Dow Jones Industrial Average jumped by 0.17%.

The US equity rally spilled over into Asia, where lower valuations and stronger growth prospects attracted investors who broadened their focus beyond US markets. The MSCI All Country World Index, one of the broadest market gauges, rose by 0.1% as Asian equities hit record highs. Futures on stock indices point to the rally continuing in Europe, while US index futures indicate a softer start after the S&P 500 closed Monday at a record high.

Against the backdrop of positive equity market dynamics, Treasuries eased slightly, with the yield on the benchmark 10?year note rising just over one basis point to 4.19%. Gold and silver partially recouped earlier losses. Brent crude reached its highest level since November after comments by President Donald Trump about imposing tariffs on goods from countries doing business with Iran.

Most of the action took place in Japan, where stocks jumped and government bond yields surged amid speculation that Prime Minister Sanae Takaichi might call an early election. The yen fell to its weakest level versus the dollar since July 2024.

Further equity gains may run into key risks related to US inflation data and a potential Supreme Court ruling on Trump's tariffs. Core CPI in the US, which excludes volatile food and energy prices, is expected to rise 2.7% year?on?year in December.

Market dynamics also indicate that investors are looking beyond the US, where renewed attacks by the Trump administration on the Federal Reserve have stoked concerns over the central bank's independence. RBC Capital Markets LLC said that investors had become more open to geographically diversifying their equity holdings and that, with the start of the new year, they had new reasons to do so.

Meanwhile, the fourth?quarter 2025 earnings season kicks off later this week and is expected to show solid results.

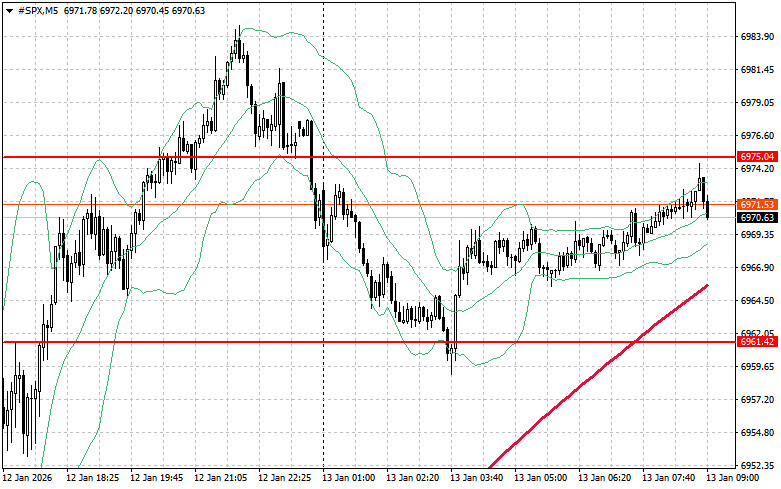

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,975. Overcoming this level would signal upside and open the path to $6,993. An equally important objective for bulls is to secure control above the $7,013 mark, which would strengthen buyers' positions. In case of a downside move amid waning risk appetite, buyers must assert themselves around $6,961. A break below this level could quickly push the instrument back to $6,946 and open the way to $6,930.

RÁPIDOS ENLACES