Yesterday, stock indices closed mixed. The S&P 500 rose by 0.01%, while the Nasdaq 100 fell by 0.44%. The Dow Jones Industrial Average jumped by 0.55%.

The dollar strengthened alongside Treasury yields as traders prepared for the US jobs report and a possible Supreme Court ruling on tariffs imposed by President Donald Trump. Oil continued to climb.

The currency appreciated against all G10 peers, and the US dollar index was set to post its best weekly performance since November. Most Asian equity indices rose. Treasuries declined, with the yield on the benchmark 10?year note up one basis point to 4.18%.

Futures on stock indices point to a positive open for European markets, while contracts on US indices trade almost unchanged.

Traders are bracing for two consecutive risk events on Friday that could influence market sentiment in the short term — one of the most significant tests for global equity markets since their rebound after the April sell?off triggered by tariffs. US jobs data for December is especially important because it will inform the Federal Reserve's next steps on interest rates. Economists forecast that the US economy added 70,000 jobs in December, slightly more than the prior month, and the unemployment rate is expected to fall to 4.5%. The jobs market report will help clarify the likely path for US rate changes. Traders are currently pricing in at least two quarter?point Fed rate cuts in 2026.

The Supreme Court is also set to rule on the fate of many of Trump's tariffs. Hundreds of companies are already lining up to seek refunds of the billions paid in duties. A key factor in the Court's decision will be whether there is a clear mechanism to preserve past and future tariff revenues in unchanged form, an outcome that would be positive for the US dollar.

In other market segments, oil continued to gain ground as investors tracked developments in Venezuela and Iran. Silver and gold slipped slightly.

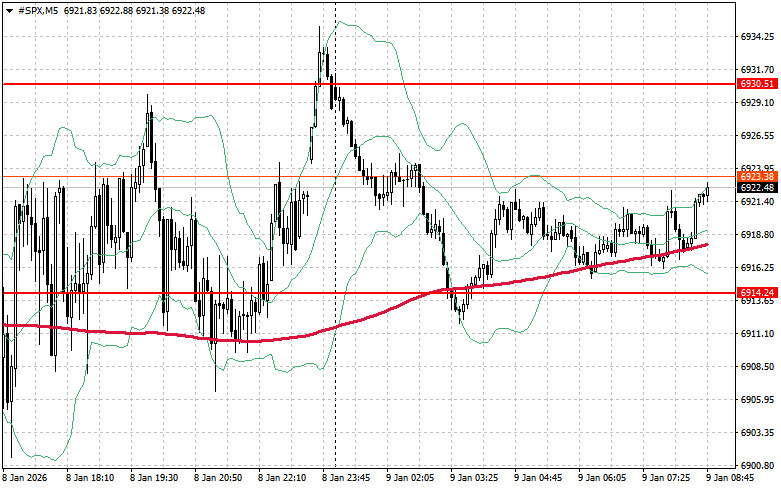

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,930. Overcoming this level would signal further upside and open the path to $6,946. An equally important objective for bulls is to secure control above the $6,961 mark, which would strengthen buyers' positions. In case of a downside move amid falling risk appetite, buyers must assert themselves around $6,914. A break below this level could quickly push the instrument back to $6,896 and open the way to $6,883.

RÁPIDOS ENLACES