The cryptocurrency market crash is at full swing, showcasing the collapse of a substantial bubble in terms of volume. Just last month, I expressed concerns that the overvaluation and inflated market prices in the crypto industry had reached their peak. I suggested that the likelihood of a series of rate cuts in the US and growing demand for stocks—which, unlike cryptocurrencies, generate interest income—could lead to serious sell-offs and, in turn, a decline in demand for these assets.

Such a stunning rally could not last indefinitely, despite the active involvement of US President Donald Trump, who effectively stimulated demand for tokens, including his own. It is likely that profit-taking has begun in the market, which could result not just in a corrective decline followed by increased demand but in a crash that leads to a plateau at price levels significantly lower than those seen at the end of October.

The accelerating collapse is also occurring because there is growing uncertainty among Federal Reserve policymakers regarding further rate cuts, including the upcoming policy meeting in December. The lack of comprehensive statistical data on the national economy is frightening investors, compelling them to exercise caution and thereby reduce the number of open positions in the crypto market.

There are also reports from the market indicating that some US hedge funds are exiting the crypto market amid fading demand for risk.

What can we expect in the crypto market in the near future? I believe there is a high likelihood that sell-offs will continue into next week. As long as uncertainty regarding rate cuts in the US looms over the market without comprehensive economic statistics, investors will shy away from risky operations, including trades in the cryptocurrency market.

Forecast of the day

Bitcoin Bitcoin is trading below the resistance level of 85,730.00, which further strengthens the bearish momentum from a technical standpoint. In this wave, a decline to 74,420.00 can be expected. The level for selling on a pullback may be around 83,160.00.

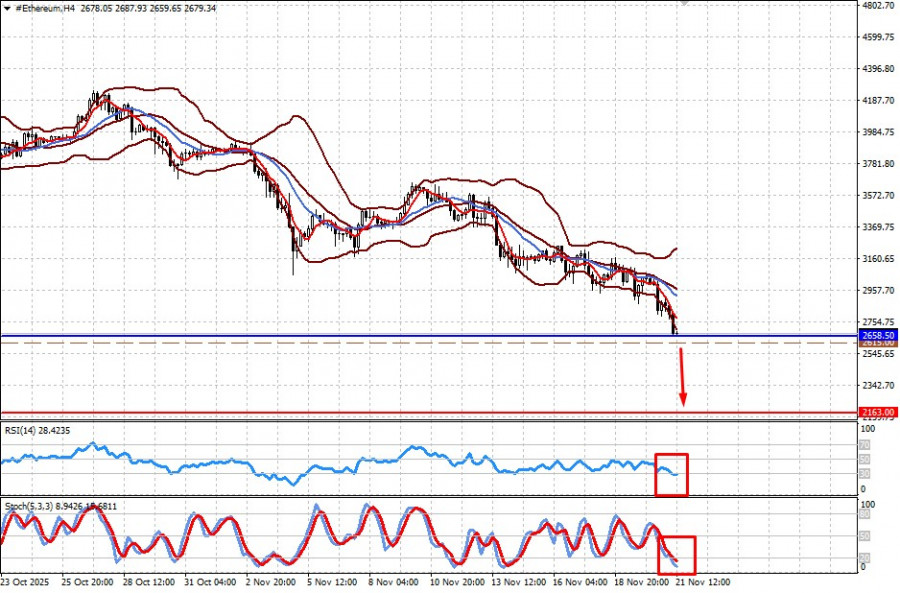

Ethereum The token is trading above the support level of 2,658.50, and breaching this level could enhance the bearish momentum. In this wave, a decline to 2,163.00 can be expected. The level for selling on a pullback may be around 2,615.00.

RÁPIDOS ENLACES